This the place I wrote something interesting.

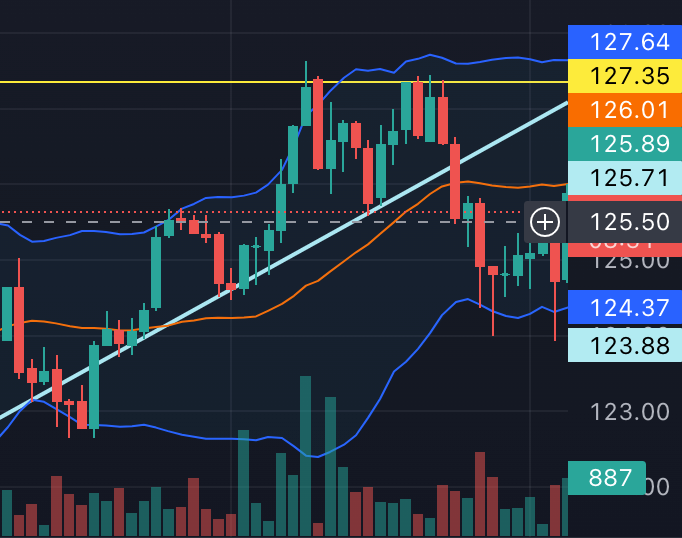

Tony Cryptocurrency Exchange-Contract Novice Village opens the three most important lines of the contract

Before you start drawing lines, you can take a look at the following references.

Pull out trend lines to find buy and sell points

How to look at pressure and support

Step 1: Connect the relative lows of the wave front and find the trend line.

Step 2: Find the Pressure Line

Step 3: Find the Relative Support Line

Operation reminder: (Any pressure line will become a support line if it is broken, on the contrary, if the support line is broken, it will become a pressure line)

- Between the support line and the pressure line, do not open an order to avoid back and forth shocks, or losses caused by the wrong direction, do not open an order to avoid back and forth shocks, or losses caused by the wrong direction.

- The suggestion for a long order is to establish a long order after the price breaks above the pressure line, and if there is a step back to support the next one, this is the safest way. Usually it is the second or third root after the breakthrough.

- The suggestion for an empty order is that after breaking below the support line, if the next one has a pullback test, if it does not break through, you can enter the second or third line to establish an empty order.

- When opening an order, try to focus on the planned order. When opening, be sure to set the stop loss price or ratio. Usually, the stop loss price will refer to the previous price, which will be set near the support or pressure line. The upper and lower positions depend on your risk tolerance, so there is no absolute position).

- Risk and reward ratio, when opening a plan, you must have an idea, high risk and high reward, any plan, with a reasonable risk-reward ratio, can bring you profits). For example: if you set a stop loss of 10%, but set the take profit at 100%, then the risk of capital withdrawal in this order is extremely high, which often turns your profit into a loss.

- The trading psychology of opening orders, it is better to do more analysis before opening each order, don’t ignore the risk because of the market situation, rather let it go, and don’t chase the price, chase the high and kill the low, which is often the problem that the novice will lose.

Here are a few tips and tricks to share with you. Hope you all have a smooth billing.

Article sharing, reprint please indicate the source, thank you.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…