黃金交易技巧,黃金技術分析,黃金走勢分析,黃金白銀交易平台評選

Investment shortcut articles: How to look at the ranking of the top ten gold trading platforms?

In the current international environment where risk aversion is rapidly heating up, gold has become an important financial management tool for people to hedge and invest. However, different gold platforms provide different investment services and profitability. So what should we look at when referring to the ranking of the top ten gold trading platforms? Below I will tell you about:

1. Platform qualification

How do you see the ranking of the top ten gold trading platforms? Generally speaking, at present domestic gold speculation, only the platform in Hong Kong can provide a legal trading environment and fully guarantee the security of investors' accounts during trading. Therefore, when we refer to the platform ranking data, the qualification factors such as the platform's qualifications, registration place, etc. , investors often need to understand in detail, in order to ensure that they can safely buy and sell gold in a stable investment environment, and avoid many unnecessary investment risks.

2. Spread charges

How do you see the ranking of the top ten gold trading platforms? At present, in the international market, we often need to pay a spread fee of US$0.5 per ounce for each lot of gold traded. Although it does not seem to be much, if investors conduct short-term operations for many times, it is often easy to accumulate a sum that cannot be ignored. the costing payment.

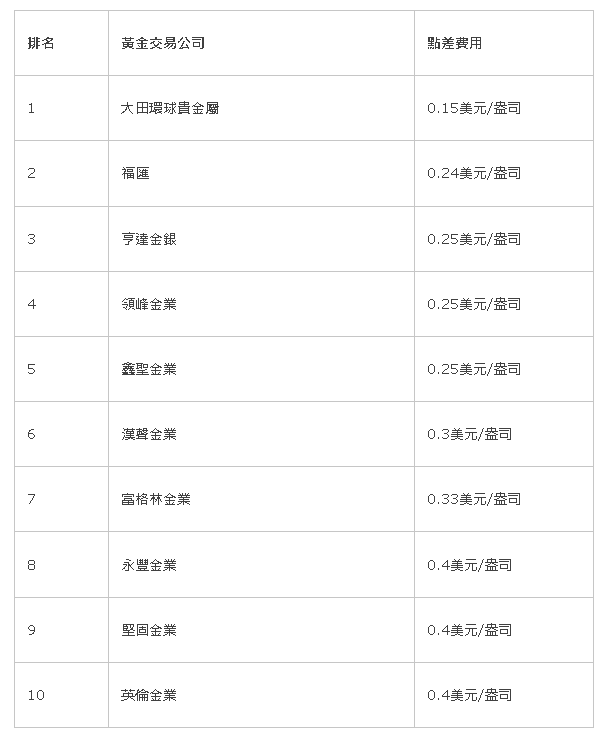

However, the mainstream high-quality platforms in the industry often provide investors with enough preferential spread charges when trading, so that we can make better profits in trading and improve the overall rate of return. According to the current spread charges of the top ten platforms in the industry, the editor has compiled the following table for you:

It is not difficult to find from the above table that in the current ranking of the top ten gold trading platforms, their spread charges are all below the standards of the international market, which can save costs for investors to varying degrees and allocate them more efficiently in financial management. funds. Among them, Datian Global's special micro-spread account has an average spread fee as low as 15 US dollars per lot, which can reduce the cost of transactions compared with other platforms. It is an ideal channel for public investors to enter the gold market!

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…