黃金投資指南,產品包括現貨黃金、現貨白銀、貴金屬類衍生品投資資訊及交易技巧,敬請關注。

Which financial product is better? Invest in dark horses or precious metals in 2022!

Everyone needs financial management, because financial management is the scientific management of property, which can increase the value of the assets in hand. The selection of products is a necessary stage for every investor to enter the market for financial management, and choosing a financial product that suits them is a prerequisite for success. Which financial product is better? From this year's point of view, precious metal products may be the best choice for public financial management.

In terms of annual rate of return, precious metals have the largest appreciation

In 2021, which is full of crises, various assets and currencies in the financial market have depreciated to varying degrees. Even the stock market, which has recently rebounded, has fallen sharply in the first quarter, and the overall environment is extremely unstable. If you want to discuss which financial product is better this year, it is the hot precious metal investment product.

After entering 2022, under the influence of the epidemic, the global economy has fallen into a crisis, and the market has to re-enter a loose monetary environment, which has given a lot of boost to various products of precious metals. Among them, gold, which has the characteristics of hedging, has successfully refreshed its historical high by soaring into the sky, with an increase of more than 30% during the year. Silver has also seen a strong compensatory increase recently, achieving a doubled growth. In other words, if an investor chooses to invest in precious metals at the beginning of the year, it is likely to have achieved great appreciation.

In terms of transaction methods, spot precious metals are more flexible

In addition to the perspective of income, it is necessary to judge which wealth management product is better, and to compare whether its trading method is suitable for most investors. Stocks and precious metals are both high-return financial products, but the risks are high, and the rise and fall of stocks is affected by many factors, and there are also limitations in trading time; while stable products such as funds and bonds have little return.

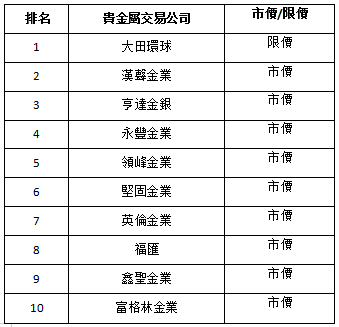

Therefore, for most investors, spot precious metals may be a more suitable investment method. Compared with stocks, the variety of spot precious metals is more simple, and there is no need to choose among many stocks; moreover, it adopts a 24-hour T+0 two-way trading mechanism on the opening day, with sufficient trading opportunities and extremely flexible access to the market. If you choose a price-limited and no-slippage precious metal trading platform with strong risk control capabilities to open an account for investment, you can achieve efficient profits very steadily.

Datian Global mini account has ultra-low investment threshold, and you can operate profitably at $30

In terms of transaction costs, spot precious metals are more cost-effective

For investors, another key factor in judging which wealth management product is better is the level of transaction costs. If wealth management products incur excessive costs during the transaction process, it will undoubtedly seriously affect investors' returns. Therefore, everyone should focus on investment methods with low cost expenditures.

Just like the spot precious metals mentioned above, it is also a more cost-effective way of financial management. Taking spot gold as an example, investing 1 lot (100 ounces, about 2835g) only requires a spread fee of $50. If you choose a micro-spread account with a large spread discount, you only need to pay $15 per lot. In contrast, It is a financial product with extremely low unit cost!

To sum up, whether in terms of yield, transaction rules, or transaction costs, spot precious metals are well-deserved to be the best financial products in 2022! Choosing to invest in spot precious metals can not only have better investment prospects, greater transaction flexibility, but also do not need to pay high costs. It is an excellent investment method to achieve future asset preservation and appreciation!

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…