整個人都fomo了

Does it not fall every time the package is released? ! Really can not SOL!

"Ethereum killer, Lamborghini in the public chain, the only chain that can actually be used in business"

Don't doubt, these are the reputations that Solana's public chain has received, and it is really difficult for Solana to connect with these praises.

Most of Solana's impressions now are:

There are frequent DDoS attacks, block generation is occasionally stopped, and it is impossible to just transfer funds. It takes more than two hours to complete a transaction. Even recently, more than 9,000 wallet mnemonics were leaked, leading to hacking incidents (I am the bitter master). one)

Solana has gone through so much hardship, and I believe everyone who pays attention to the currency circle has found a phenomenon:

Why doesn't the price of Solana drop every time the package is released?

This article mainly discusses the authenticity of this rumor. First, I will briefly introduce Solana, and then I will discuss whether the rumor that Solana will not fall is Impressionism or is it true? If the competition does not fall, what is the reason? Is it profitable?

Let's GO!!!!!!!

— — — — — — — — — — — — — — —

What is Solana?

An emerging public chain founded in 2017, but it will not become popular until 2021, and the highest increase in the currency price last year was as much as 160 times (1.5 to 250)

Solana is a blockchain known for its high speed and low transaction fees. The PoH verification mechanism used is more trendy. Unlike the blockchains using PoW or PoS mechanisms, it can only process about 14~45 transactions per second. Solana, a PoH mechanism, claims to be able to process 65,000 transactions per second, and even Visa can only process about 1,700 transactions per second. Therefore, solana also has the reputation of Lamborghini of the public chain and the killer of Ethereum.

Looking at the above, although I'm not a mathematician, this sounds great right.....?

Ideal is full, the reality is very skinny. Solana, known as Lamborghini, often suffers from all kinds of hardships.

From DDoS attacks, the block chain stopped producing blocks, the user wallet mnemonic was stolen, and a series of fancy outgoing packages also made everyone question the stability of Solana.

However, there is such an urban legend in the currency circle: Solana sells the package, and the currency price does not fall.

Are such rumors true? Or is it the Impressionists who are attached to it?

Inventory of Solana's delivery time and currency price performance (5 times, calculated after 12 hours)

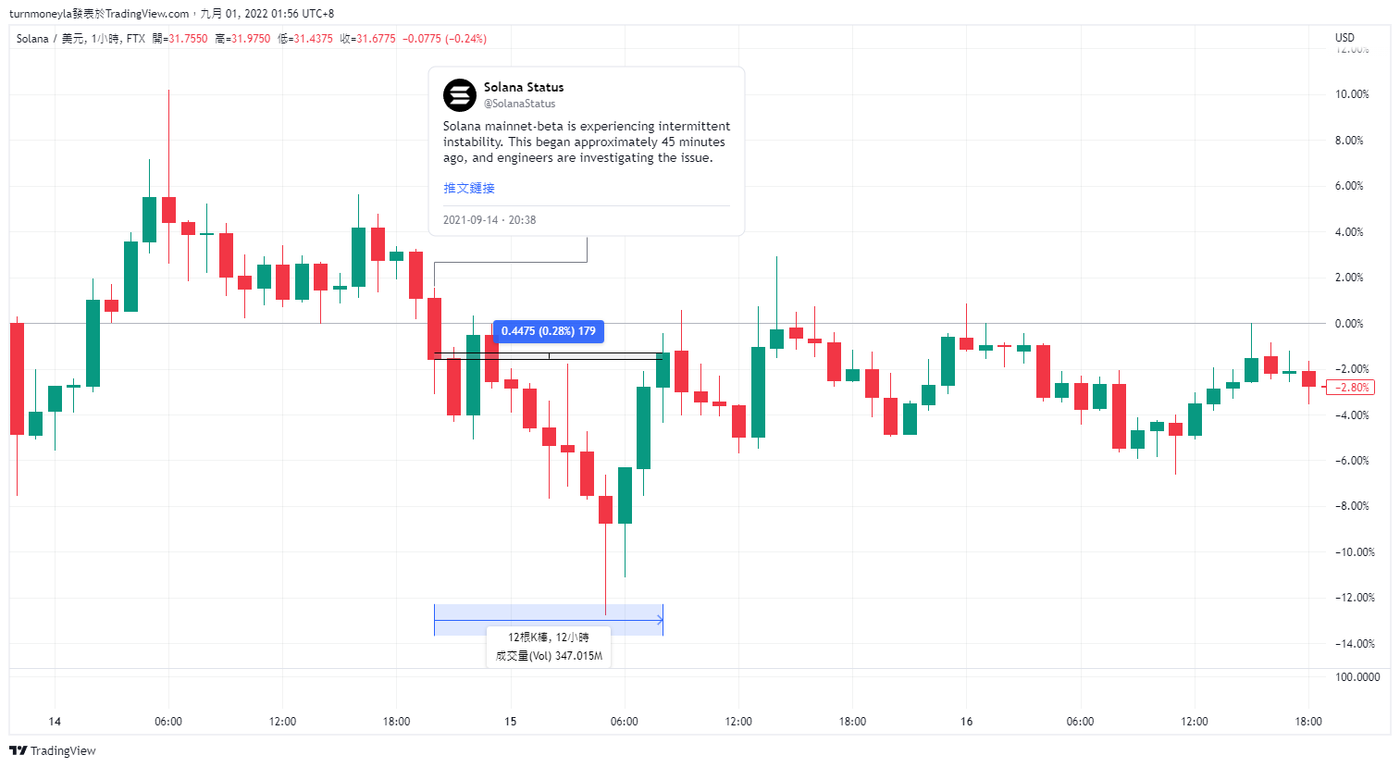

1. 2021/9/14 8:38 pm : DDoS attack, 17 hours of downtime.

At that time, the currency price was about 157 US dollars, and the maximum fell to 142 US dollars, with a maximum decline of about 13%, but 12 hours after the incident (still downtime) the currency price has rebounded and stabilized.

The currency price fell first and then rebounded.

Is it possible that the volatility of Bitcoin itself on the day affected the trend of Solana?

Switch to the SOL/BTC trading pair and see:

The two trend charts are very similar, which also proves that the price fluctuation of Solana is only an independent market, and the correlation with the broader market is low.

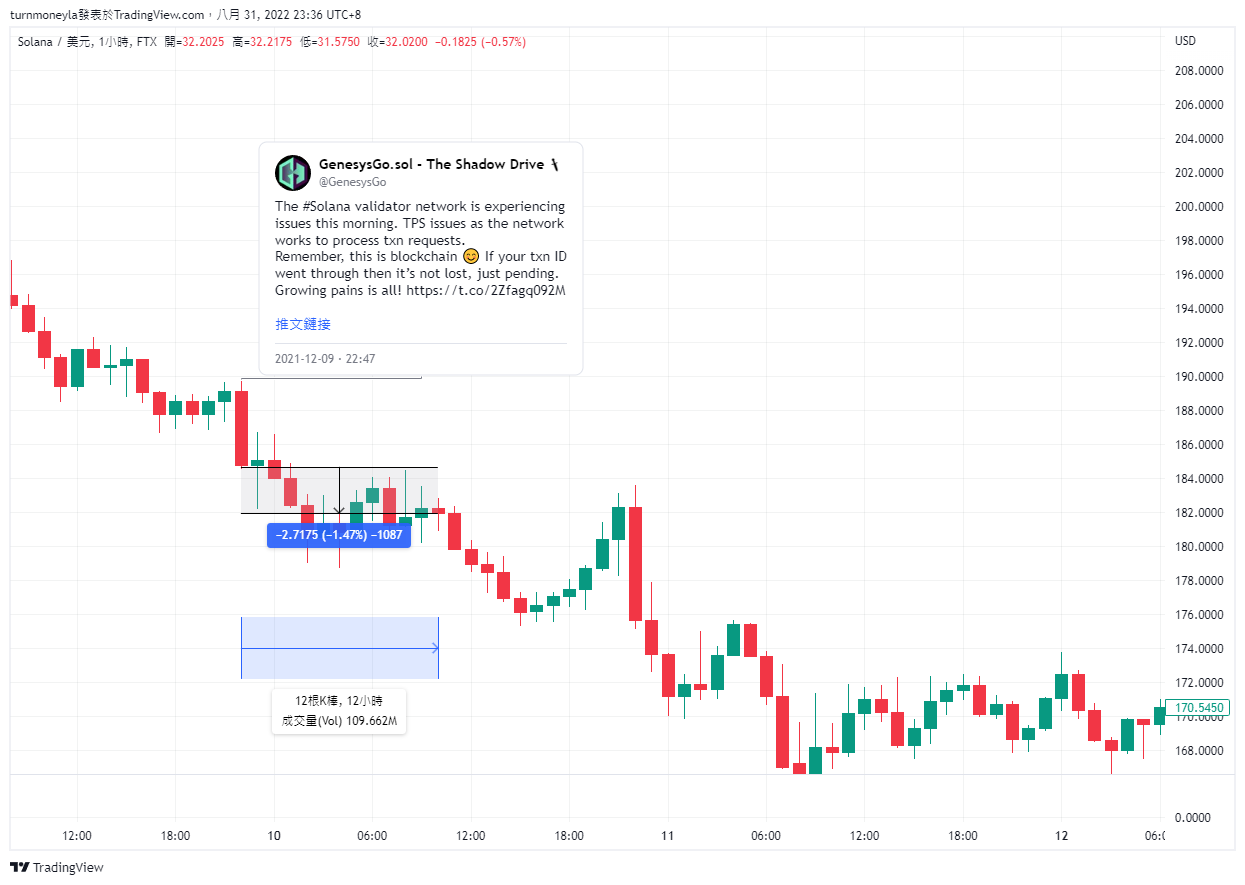

2. 22:47 pm 2021/12/9 : Due to DDoS attack, TPS (transactions per second) was reduced to 19, and the card chain exploded. Currency prices were not affected.

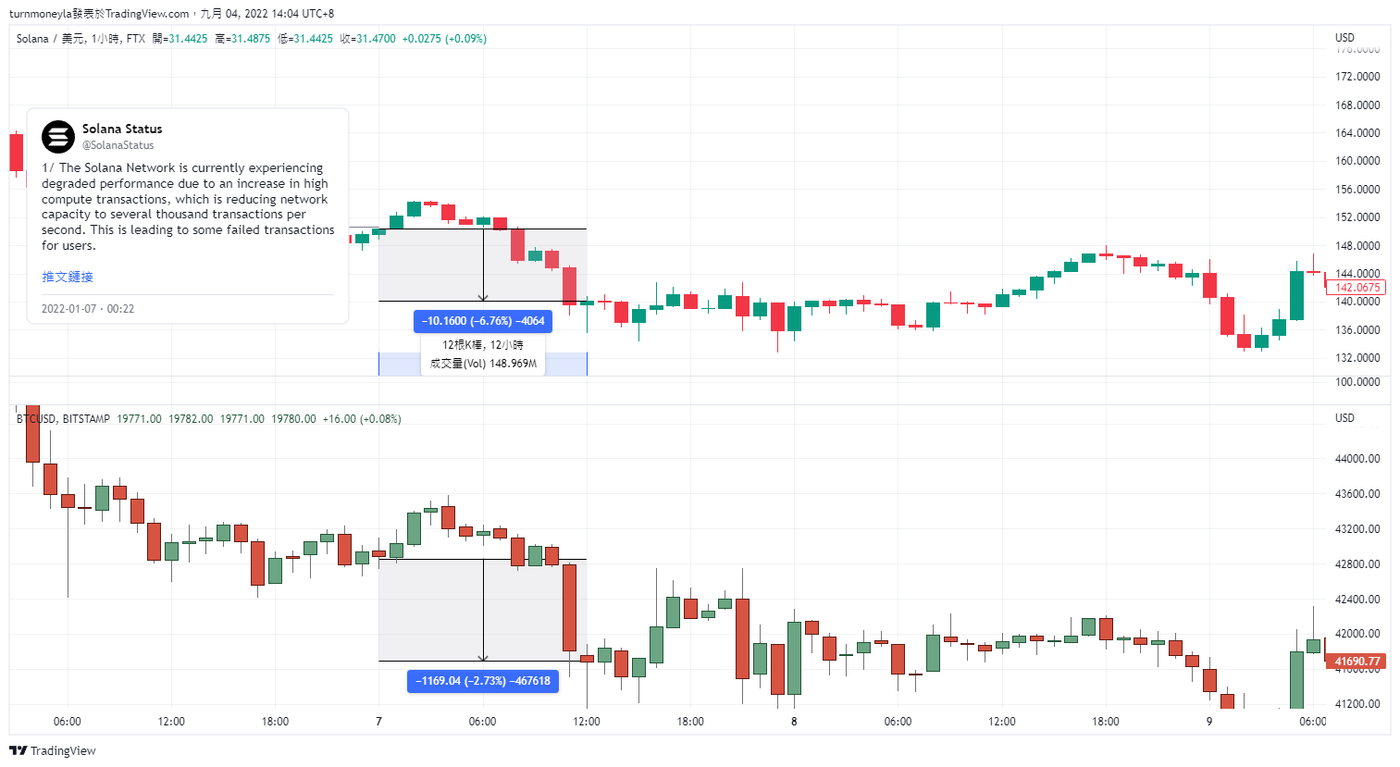

3. 2022/1/7 12:22 a.m .: Solana network traffic jams due to high computing transactions, the TPS remaining is less than 4%, and the chain is still stuck.

This time, the currency price has finally dropped significantly, but the market has also retraced to a certain extent, so the attribution of Solana's decline cannot be completely accommodated to the card chain.

4. 2022/5/1/ 5:01 a.m .: The main network is down again, and the nodes are required to be restarted.

It shows a trend of first down and then up, which is similar to the trend of the first out of the package .

5. 2022/8/3/ 8:32 am : The mnemonic phrase was leaked, and more than 9,000 wallets were hacked.

Although Pantom tweeted at 8:32 am, I was stolen at 23:07 the day before, and it was ultimately the time of the tweet.

The currency price did not fluctuate much.

In fact, the number of Solana packages is far more than these five times, but due to space problems, only five events are listed first.

From these five events we can draw a simple conclusion:

After the package is released, the price of the currency is really unlikely to fall. Even if it falls, it will first go down and then go up, as if nothing is wrong.

So why is it that the short-term major bears have not fallen over and over again? Maybe we can find the answer from the token distribution.

Solana Token Distribution

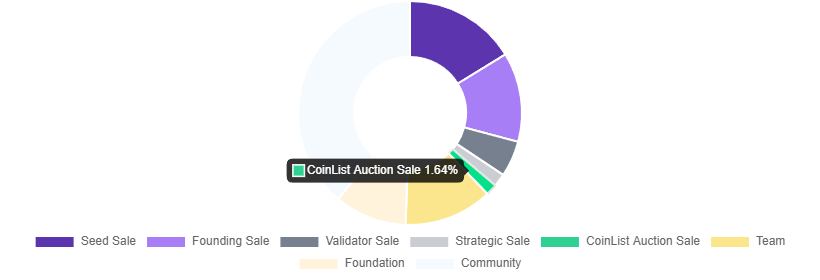

It can be seen from the above figure that Solana's token distribution, public sales only account for 1.6% , which is the token share that retail investors can get.

Most tokens are in the hands of institutions (31%) and the Solana Foundation, community, development team (63%)

Therefore, when Solana is released, the first panic selling must be retail investors. However, the 1.6% token share does not make much waves in the market, and most tokens are still held by institutions and foundations.

It is difficult to make short-term event-based trades in this currency because the dealer has a lot of chips. The market panic/bullish news is also difficult to show in the currency price in the short term.

On the other hand, as long as the dealer is willing to pull the market, the upward force will be very fierce, and you will be afraid of it.

Summarize:

After Solana is out of the package, there will only be two reactions in the short term: pull back after a sharp drop and stay still.

Investors who want to make a profit by shorting have a very high chance of losing money.

Excessive concentration of chips in the hands of institutions is not a sin. After all, the development of the public chain must also require capital injection.

When investing or speculating, pay more attention to the token allocation and economic model of each project. Although I dare not say that it will make you rich, it will at least make you lose money.

— — — — — — — — — — — — — — — — — — — — — — — —

You can find me in these places

Line Community:

IG is also available: https://www.instagram.com/nomoney.q_q/

Discord for information: https://discord.gg/622jKUchzt

FTX registration link (5% fee discount): https://ftx.com/#a=25073985

Binance registration link (5% discount on handling fee): https://accounts.binance.com/zh-TW/register?ref=YO1XON5W

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…