岀生及成長於香港,旅居加拿大25年後回流。兩地生活文化的差異與衝擊,一邊是多元文化,一邊是中西匯集,從一邊看過去另一邊,算是多重國際視野。

Immigrant Life: Banks and Money

Probably banking business has a lot to do with a country's political system. Every country has its own bank, and only a few have transnational services. For example, when I arrived in Canada at the beginning of the year, I only got to know the major banks: Royal Bank of Canada, Bank of Montreal, Canadian Imperial Bank of Commence, Toronto Dominion Bank and Scotiabank. I had never heard of them in Hong Kong before and I didn’t recognize them at all.

I bought a money order at that time. After arriving, according to a friend's introduction, I went to one of the banks to open an account and deposit the money order. At that time, there were savings and checking accounts. Since there were still many opportunities to use checks, checking accounts had no interest, so everyone transferred money to the checking account after writing a check. There was no telephone or online banking at that time, so you had to go to the bank to handle it. The bank business hours at that time were from Monday to Friday, from 10 am to 3 pm, and were only extended to 6 pm on Friday because that day was the pay day (Pay Day), people will want to deposit and withdraw money immediately and spend money on the weekend, so there will be long queues. Our school hours are from 9 am to 3:30 pm, so when we go to the bank, we have to go to class. This is what I have always questioned: shouldn’t banking services be customer-centric? Why does it always seem like it’s hard to keep customers? In the past, we worked from nine to five in Hong Kong, and it seemed like we were always busy.

By the 1990s, as the number of immigrants in Hong Kong increased, the demand for banking services increased, and many of the immigrants were former bank employees. Some areas where Chinese people inhabited also paid special attention to the Chinese market. Gradually, these banks had Chinese names, and the above five became Royal Bank, Bank of Montreal, Imperial Bank of Commerce, TD Bank and Banco Delta Asia. Moreover, the large number of Chinese employees are almost the same as in Hong Kong. Hong Kong's HSBC has also begun to develop business in Canada, but it is smaller than the other five major banks, but Hong Kong immigrants find it friendly and convenient. There are also some trust banks (Trust), which also provide retail and general savings services. One of them, Canada Trust, advertises its business hours as 8 a.m. to 8 a.m. This is a big breakthrough and has won many customers. Later, TD Bank acquired Canada Trust, and followed its usual business practices of operating from 8 to 8, and later expanded to seven days a week, which can be regarded as the first of its kind in banking business. At that time, the real estate market was booming, and many people went to open houses on weekends to get offers, but banks were only open on Mondays. So at that time, some banks were open for a few hours on weekend afternoons, mainly for mortgage applications, which was convenient. Go home.

However, now that online banking is common, everyone is withdrawing money at teller machines. It seems that in Hong Kong, there are almost always queues at teller machines in busy areas at any time. Everyone is too lazy to care about bank services, and in my experience of going to the bank several times, I always had to wait for about an hour, which was a bit daunting. But as the general trend goes, it seems that banks are also ignoring retail business, probably because it is too wet and meatless.

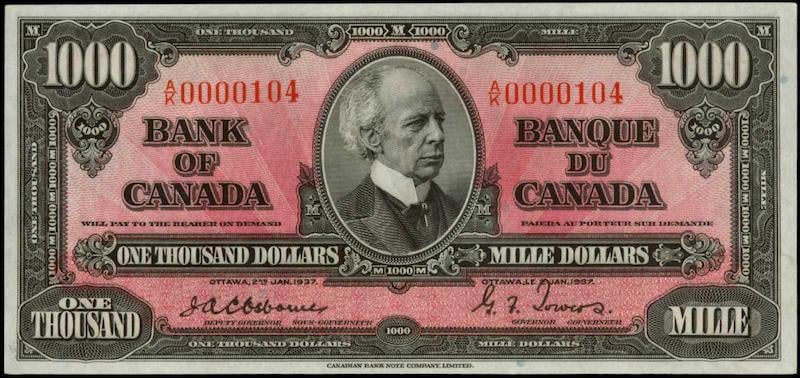

I didn't think much of it before, but it turns out that Canadian banknotes and Hong Kong banknotes are almost the same. Ten dollars, twenty dollars, fifty dollars, one hundred dollars and one thousand dollars. (In fact, it can be said that it is similar in many places. For example, the US dollar is the same, but there is no one thousand yuan, but there are still one yuan and two yuan banknotes). The only difference is that Canada has a five-dollar note but Hong Kong does not; while Hong Kong has a five-hundred-dollar note but Canada does not. In Canada, banknotes used to be mainly used for 20 dollars or less. Bank teller machines almost always use 20 dollar banknotes (only in recent years have 50 dollar banknotes started to appear). If you want to take other denominations, you have to go to the bank counter. . In Hong Kong, the denominations are mainly 100 yuan and 500 yuan. In theory, thousand yuan banknotes (known as gold bulls) should also be widely used. However, there have been too many fake gold bulls. Many retail industries have refused to accept them, and even banks have refused to accept them. Try to avoid it as much as possible. To this day, teller machines still won’t issue thousand-yuan notes. It’s really like “cutting off your toes to avoid sandworms”!

The Canadian dollar thousand dollar note is even more of a mystery, and most people may never see it once in their lives. And it is not usually seen in ordinary life. Who would take this kind of banknotes to buy things in the supermarket? Most people have never seen it, and it is difficult to tell whether it is genuine or not, so they will definitely reject it. The one time I saw it was when the boss at the time got one from nowhere, so he shared it with all the employees so that everyone could see it. Until 2018, the Canadian Finance Minister announced that some old banknotes would be removed from the general line, including four kinds of banknotes: one dollar, two dollars, twenty-five dollars (I only knew about them at that time) and one thousand dollars, and they would no longer be in the market. For circulation applications, holders can only go to the Bank of Canada (the note-issuing bank of Canada, not any Canadian bank) to exchange notes of equivalent value. Of course, no one is that stupid. As long as such banknotes are of good quality, they will definitely have a price and a market.

The weakness of paper money is that it is not durable, so there are plastic coins, such as Hong Kong's ten dollars, but there has been no other development, and Canada has already fully switched to plastic coins. In this regard, Hong Kong is lagging behind. Not to mention that Hong Kong is a small place with three note-issuing banks (actually four, as the $10 banknotes are separately issued by the government). In the eyes of others, it must be confusing enough.

Another point of my observation is that Hong Kong people generally love money (this statement must be an Understatement), but they generally don’t pay much attention to how to deal with it. How should I put it? In Canada, whether you are in a bank or withdrawing money from a teller machine, a stack of banknotes must be neat and aligned up and down. There will be no flipping of one and a half, or left or right, even in ordinary stores. The banknotes in the cash register are also neatly arranged. But almost no one in Hong Kong pays attention to it. Even the banks are in a mess. They have to reorganize it after each withdrawal. But the worst thing is that in some market stalls, there is almost only cash transaction, but it is always messy, some are folded in half, some are folded in quarters, and even old ones are buried and a little wet. Especially during the peak period of the epidemic, it is really depressing. Difficult!

There are also some people, mainly the elderly, who like to fold each piece of silver paper separately and put it in different places in the wallet, which is something I can't quite understand. Or, paper money will eventually decline. Will digital currency really completely replace paper money?

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…