大家好~我們是防詐達人🙌投資詐騙、交友詐騙、各式各樣的釣魚連結,防詐達人提供最新的詐騙快訊與手法破解。當看到任何無法確定的訊息,也都可用防詐達人來查詢和回報唷~

If the wrong card number is entered and the account is frozen, it is necessary to pay tens of thousands of yuan as a guaranteed release fee to get a loan? The most common loan scams at a glance

Common loan scams

Common loan fraud methods 1. Charge fees in various names

A normal loan application does require some start-up fees, handling fees, processing fees, etc. . . . Execution fees, but usually only when the insurance and appropriation are finally determined .

However, loan fraud often collects fees under the guise of bank fees, insurance fees, lawyer fees, etc., but it is often collected before the appropriation, and finally when you have paid all the fees, the other party will run away.

Common loan fraud tactics 2. The card number is incorrectly entered, and the account is frozen

Fraud prevention experts have recently had many readers who said that their account number was frozen when they entered the wrong card number when taking a loan, and the other party asked to submit tens of thousands of yuan in unfreezing money before they could withdraw the loan. And asked Xiaobian should I pay? The editor's answer is of course: " No! This is a scam! "

In fact, it's not that your card number is wrong at all. No matter how many times you check it and confirm it is correct, the other party will tell you that your card number is wrong.

The other party will even threaten the victim that if you do not pay the thawing fee, the legal department will deal with it and sue you for " fraudulent loan ". But in fact, paying it will not allow you to get the loan money, and even the other party will collect money from you in other names until you find out that it is a fraud.

Common loan fraud tactics 3. Request to send private documents

This is a common loan fraud method for book loans . It advertises that the originals of double documents, seals, and passbooks can be handed over to help you easily get a loan.

Think about it, how many job scams use the same method, requiring job seekers to hand over their identity documents, bankbooks and seals, and finally become the head of a fraud group, so don't give your personal documents to others, as long as others have With these three things, you can do a lot of things in your name, and even get involved in criminal cases.

These materials are usually required to provide documents to verify the identity of the person when the guarantee is issued. It is absolutely not necessary to verify the documents before the loan is verified.

And whether it is a bank loan or a private loan, you only need to provide a "photocopy" of two documents , and it is recommended to note "only for XX loans" on the photocopy.

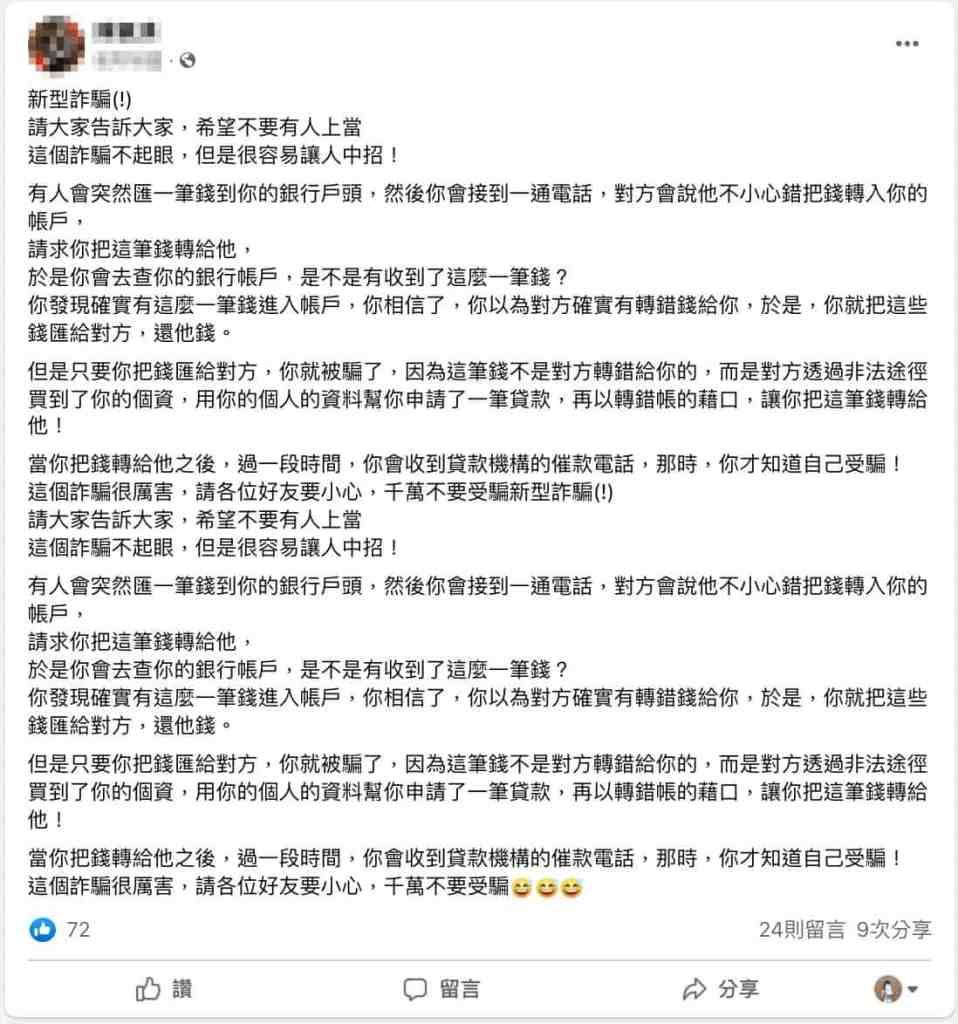

Common loan fraud tactics 4. Loan transfer wrong account

Many people on social media are sharing this new type of loan fraud, your account will first receive an unknown remittance, and then you will receive a call saying that he accidentally transferred the money to your account, I hope you will pay it back , when but you want to say that the money is really not yours anyway, just transfer it to him like this

You will start to receive calls from the lending institution. In fact, your personal information was stolen by the fraudulent group to borrow money. The borrowed money was eventually taken away by the fraudulent group, and you are responsible for paying off the loan.

In fact, if it is really wrong to remit money, it should be contacted by the bank. It is impossible for the bank to hand over personal information to others and let him contact you.

Common Characteristics of Loan Fraud

The anti-fraud expert has sorted out the common characteristics of loan fraud for you. If the company you want to borrow from meets one of the following points, be very careful.

Loan Fraud Features 1. Ultra-low interest rates and ultra-high quotas that exceed the general market

The starting method of any fraud is to give you the conditions of "too good to be true". Fraud with exaggerated and untrue gimmicks. For shopping fraud, it is a big discount, and the price is so low that you feel that it is a pity not to buy it; loan fraud It is to use ultra-low interest rates or ultra-high limits to make you feel that the most cost-effective loan here

Characteristics of loan fraud 2. Opaque contact information

Some fraudulent groups will pretend to be banks to advertise loans, but only leave personal contact information such as mobile phone numbers or lines in the advertisements, but do not clearly indicate the company's contact number or address.

Legal loan companies registered by the government will have a unified number for inquiry and a clear company address.

Loan fraud characteristics 3. The processing conditions are too simple

There are many loan advertisements that appeal to the public with the simplicity of the loan process, such as unrealistic phrases such as "guaranteed", "no review required" or "no collateral required".

When you encounter this kind of advertisement, it is likely to be in two situations: 1. Fraud (actually to attract you and deceive you into the above-mentioned scams) 2. Loan sharks/underground banks

Loan Fraud Features 4. Limited quota/limited time activities

Many scammers will use this method to tell the public that this is a time-limited event, or that the number of places is limited, and they want everyone to be quick. People don't have much time to think and make mistakes impulsively!

How to Prevent Loan Fraud - Trend Micro Fraud Experts

If you are still not sure if this is a scam, you can use Trend Micro fraud prevention experts to help you confirm, as long as you send the link of the loan website to the fraud prevention experts, you can know in a second whether the website is safe or whether there are people Report to 165 as a scam

What if the remittance/documents have been given

1. Lost report passbook/ATM card

Before the account is listed as a warning account, report the loss of passbooks and ATM cards first, in order to avoid suspicious funds flowing in or being withdrawn by fraudulent groups, and also to avoid being involved in criminal cases.

In an emergency, it is recommended to call the bank directly, and be sure to call the bank's loss reporting line or customer service center to ensure that the call is recorded.

2. Reporting

If you have provided personal data or documents:

Even if you haven't been taken as a head account, or you haven't found out that your identity has been stolen, you can still go to the police station to file a record and inform yourself of your situation, so as to avoid the fraud group pretending to be your identity to do bad things in the future and make you take the blame

If you have already sent money:

Provide the collection account of the police fraud syndicate for the police to recover or freeze the account

Be sure to leave a report:

If legal problems do arise in the future, some judges will judge whether the parties’ accounts are used by fraudulent groups based on whether the parties have reported the case.

- When reporting a crime at the police station, be sure to get the "Triple Report Form" (it will be changed to " Certificate of Incident " in the future) and keep a report record for yourself.

- Call 110 or 165 for anti-fraud calls, there will be a recording record

- Online report / 165 anti-fraud website report, there will be network records

3. Search for evidence by yourself

In addition to the loss report and report records, you can also record in detail the content of every call with the fraudulent group, leave a record of the contact, or if you contacted by message, you can also save the conversation.

The more and more detailed fraud process and evidence you keep, the better it is for you!

"The Distance Between Us and Being Deceived" Essay Challenge in Progress

Fraud Experts and Binance Co-host "The Distance Between Us and Being Defrauded"

- From now until 7/2 23:59

- Leave your opinion or experience about scams in the currency circle

- No less than 300 words

- Have the opportunity to get 50 USDT cash coupons and thousands of yuan Quanlian gift coupons and many other gifts

For details on how to participate, please see: [Fraud Master X Binance] Investing in virtual currency but encountering fraud? Essay challenge to win prizes

Comprehensive Fraud Prevention Toolkit:

- Learn More Fraud Prevention Tips: Fraud Expert Blog

- Get to know Fraud Master: Fraud Master Official Website

- Identify fraudulent websites in one second: anti-fraud expert chatbot

- Discuss fraud with everyone: fraud prevention experts - National Anti-Fraud Notification Center

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…