To Da Moon 律动BlockBeats首席动物员 https://www.theblockbeats.info/

84 million US dollars leveraged 40 billion financial empire, UST collapsed

Original author: 0x137 , rhythm BlockBeats

In 1997, the legendary financial killer Soros and his giant allies hunted the Southeast Asian bubble market, sold a large number of Thai baht and quickly exhausted the 30 billion US dollar foreign exchange reserves of the Bank of Thailand, and finally forced the Thai baht to implement a floating exchange rate system and pushed Southeast Asian countries further into the financial system. Crisis abyss.

In 2008, Wall Street investment banking giant Lehman Brothers was exposed to a large number of sub-credit bad debts, and its net debt far exceeded the company's market value several times. It was forced to file a bankruptcy application in the Federal District Court for the Southern District of New York, almost destroying the entire modern financial system.

These epic capital duel stories have spread all over the world in the past ten years, become iconic events in history, and have been studied repeatedly as textbooks by people. But who would have thought that the same story would be staged again in the crypto market with only 10 years of development history, and "live broadcast" in front of everyone through traces on the chain.

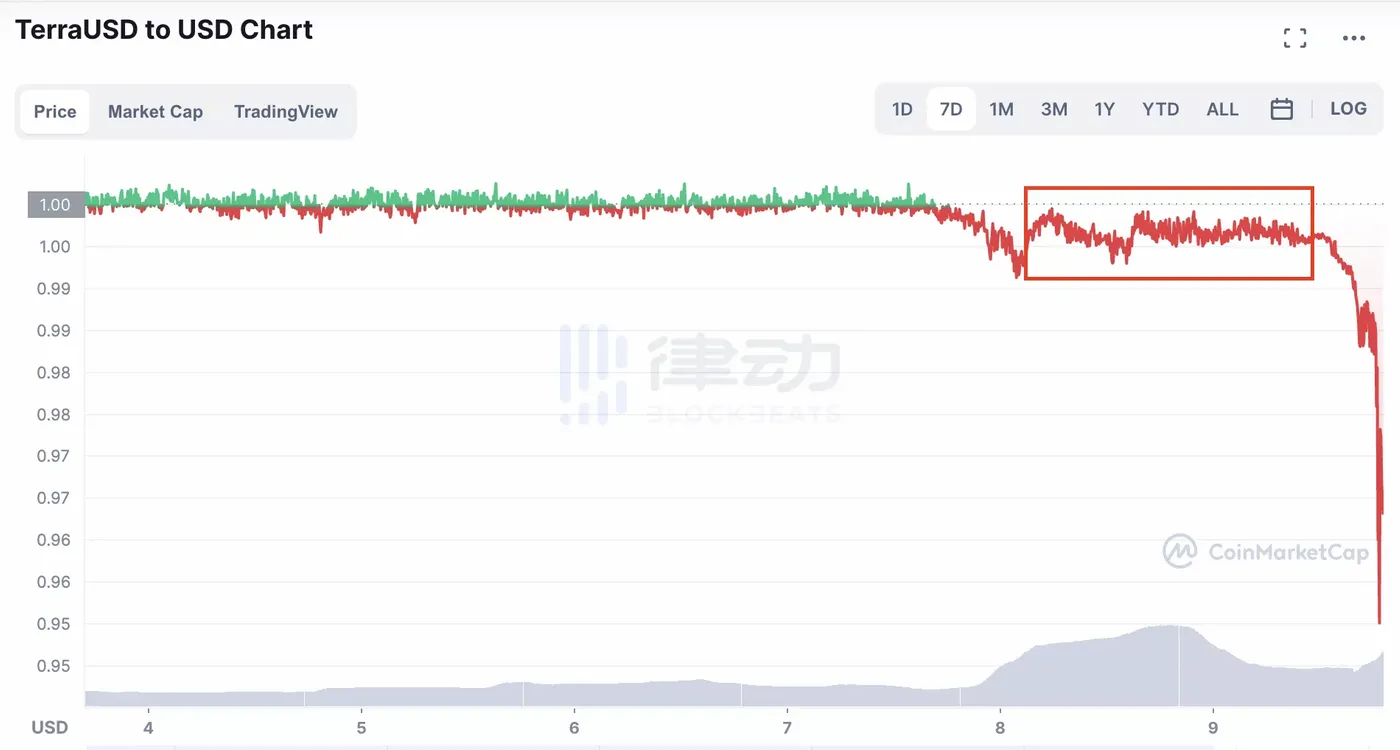

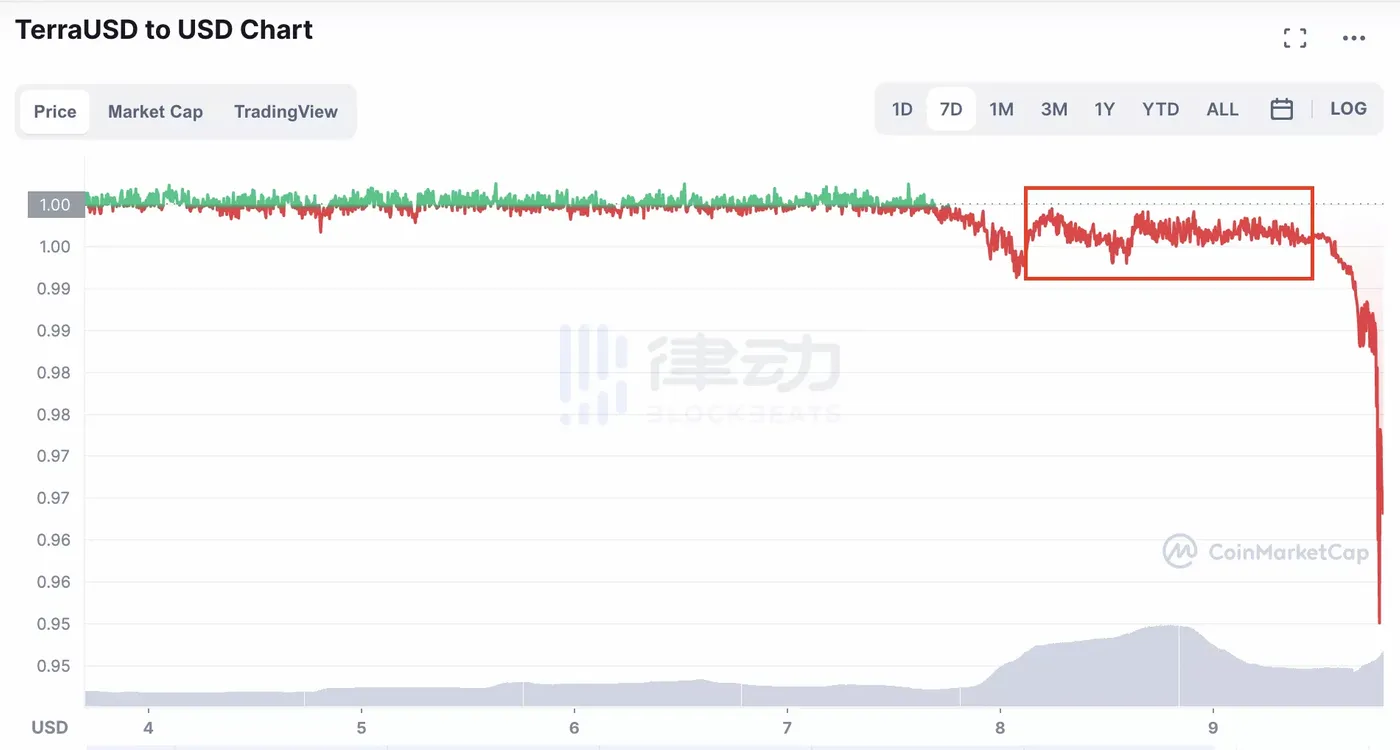

On May 10, Terra Eco's native algorithm stablecoin UST suffered a serious de-anchoring event due to capital hunting and debt crisis, and the minimum value fell to $0.6. The second-largest public chain ecosystem with a TVL of nearly 20 billion U.S. dollars, repeated the terrifying disasters of the Thai baht and Lehman in just 2 days.

Margin Call: UST crash life and death

Terra, as the second largest public chain ecosystem in the crypto market, has always been a subject of controversy. On the one hand, through the Luna-UST dual currency mechanism, Terra Ecosystem successfully promoted its own algorithmic stable currency UST to the entire crypto market, rapidly increasing the price and market value of Luna; on the other hand, its “publicity machine” Anchor Protocol used to promote UST It has been criticized as an unsustainable "Ponzi scheme". (Rhythm Note, for more information about the Luna-UST and Anchor mechanism, please refer to the Rhythm articles " Analysis of Terra Ecology: Understanding the Economics of LUNA, Mirror and Anchor Token " and "The long-term interest rate of stablecoins is as high as 20%, is Anchor also a Ponzi? ? ”)

Luna's supporters and skeptics have long been extreme. Supporters call themselves the army of "Lunatics" (meaning "madman" in Chinese), and every day on social media platforms such as Twitter, they attack and smash comments criticizing Luna's mechanism; doubters use "Ponzi" as an excuse to turn their fingers and look forward to it. The day when Luna collapsed. Such an extremely "tensile" ecology is difficult to be ignored by speculators. These capital killers always pay attention to the industry trend and wait for the best hunting moment.

The opportunity finally came after the Fed announced another 50 basis point rate hike. Since May, the Nasdaq index has continued to decline, the market's reaction to the macro situation has been extremely pessimistic, and the price of Bitcoin has also fallen by nearly 10% for several consecutive days, and panic has spread rapidly throughout the crypto market. The Terra ecological core team LFG (Luna Foundation Guard) announced that it will adjust the UST-3Crv liquidity pool (UST main chain trading venue) on May 8 to prepare for the formation of its own powerful 4Crv pool.

Various conditions created a perfect storm for capital hunting, so on the night of May 8, the crocodiles in the currency circle quietly launched their long-established "encirclement and suppression plan".

Phase 1: Use the UST-3Crv pool withdrawal gap to launch an offensive

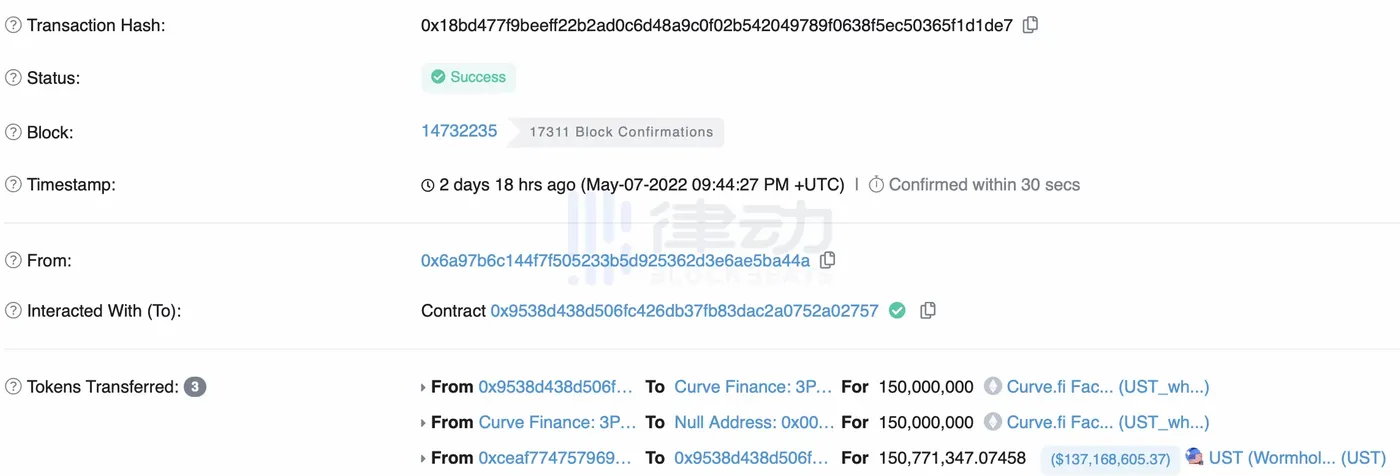

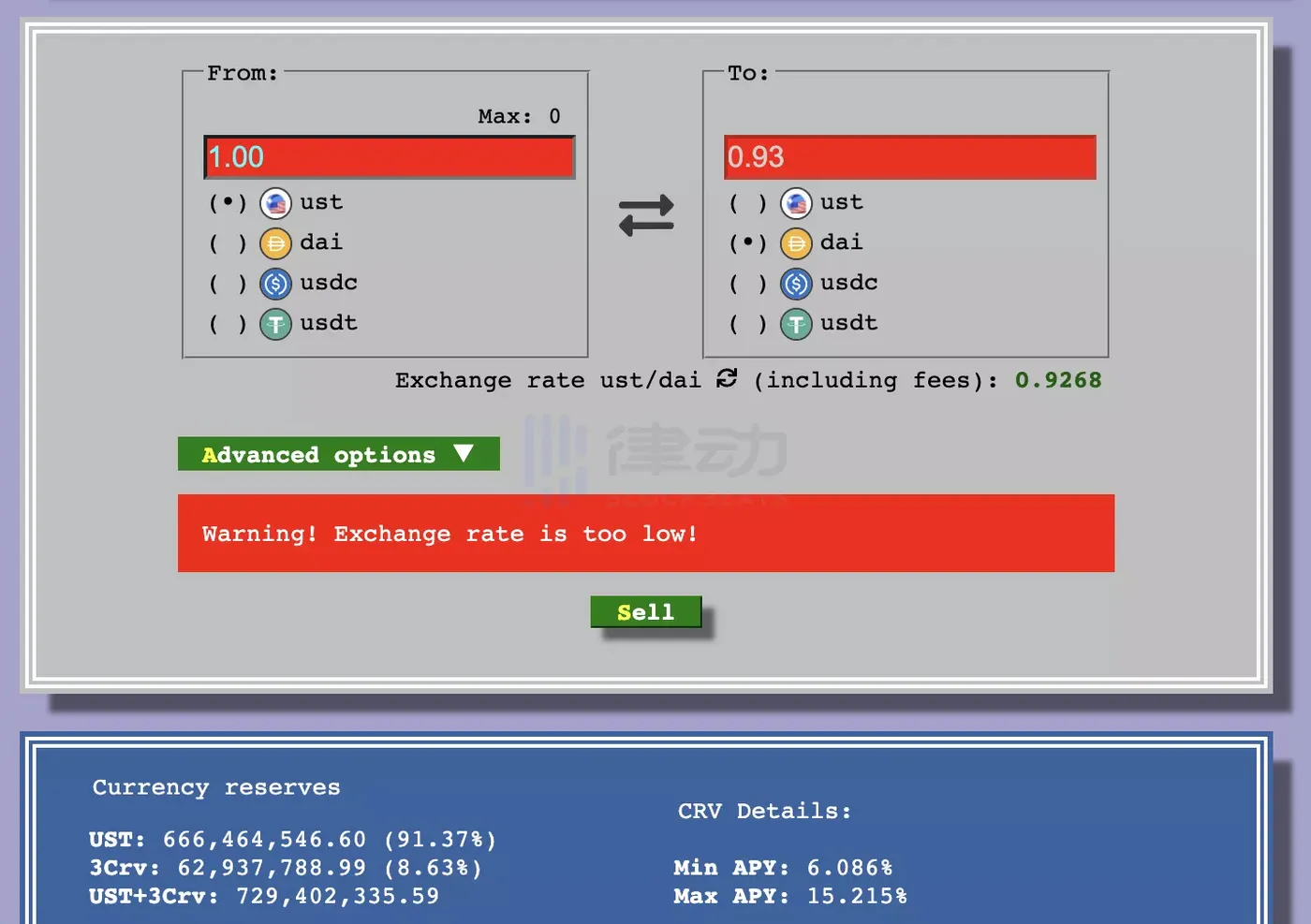

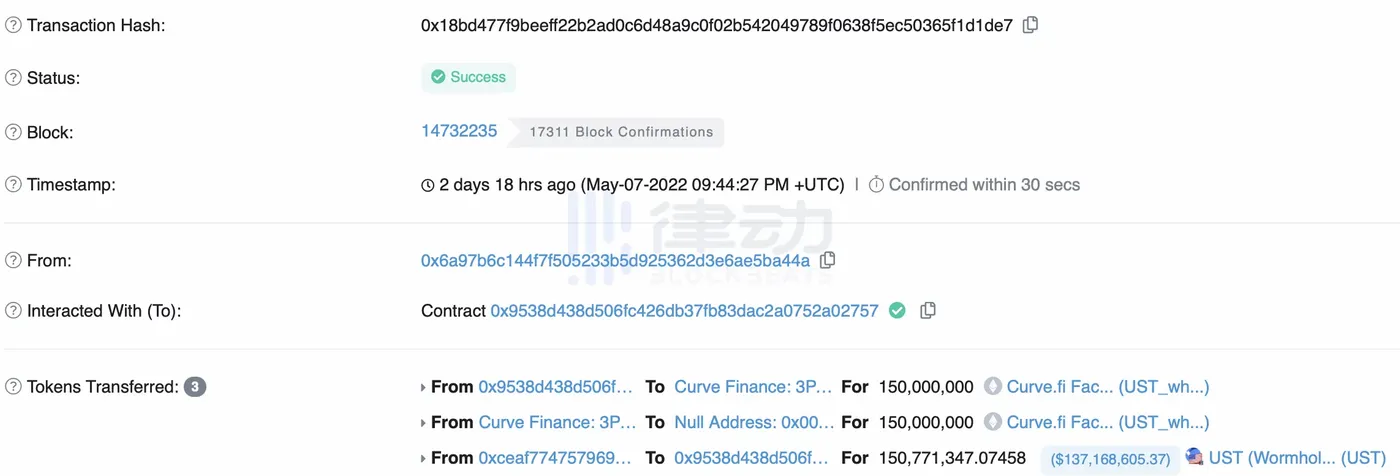

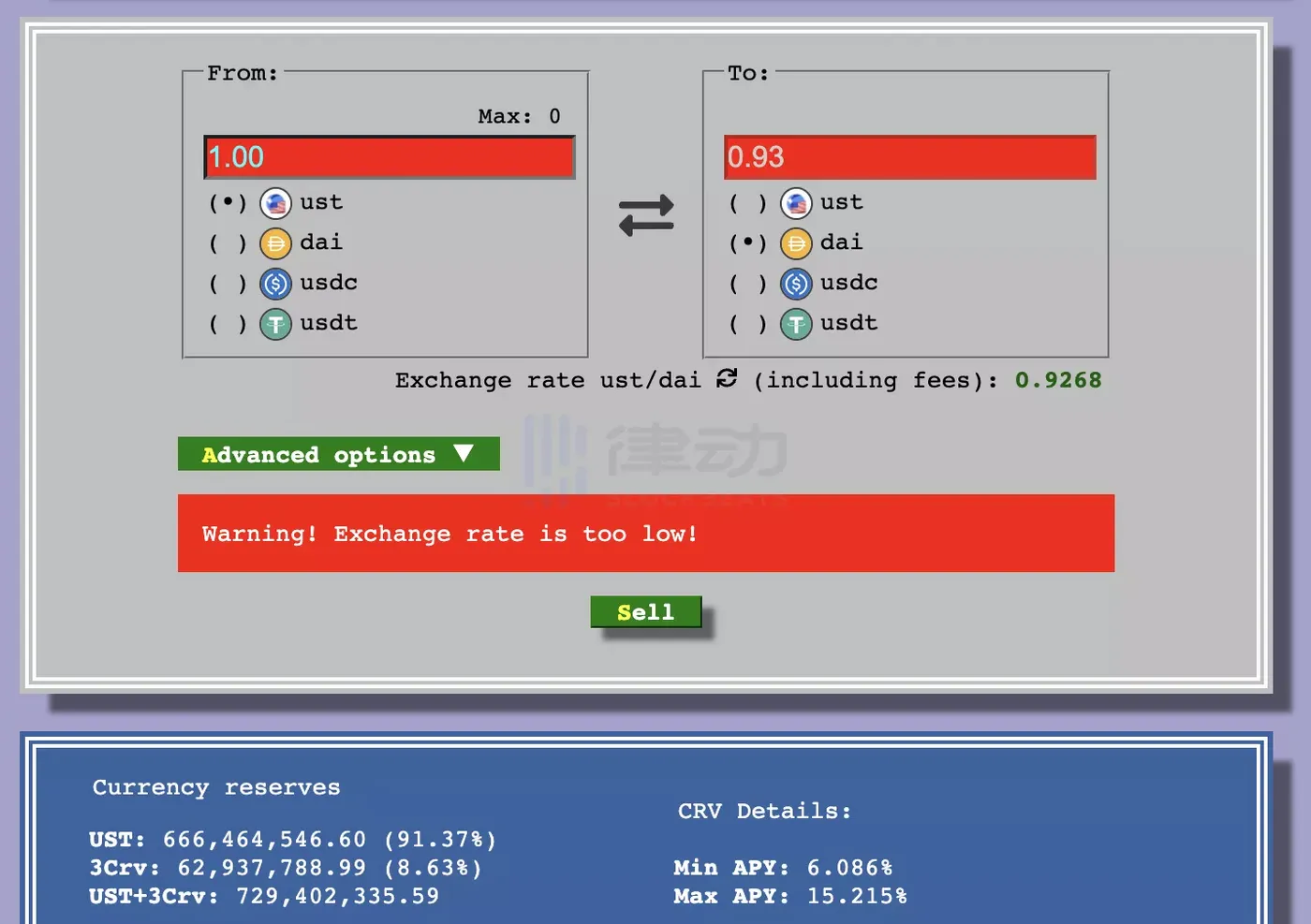

In the early morning of May 8th, LFG withdrew USD 150 million of UST liquidity from the UST-3Crv pool due to the need to prepare for the formation of the 4Crv pool. At this time, the TVL of the UST-3Crv pool was around USD 700 million, and it wanted to drain it. UST liquidity actually only needs about 300 million US dollars.

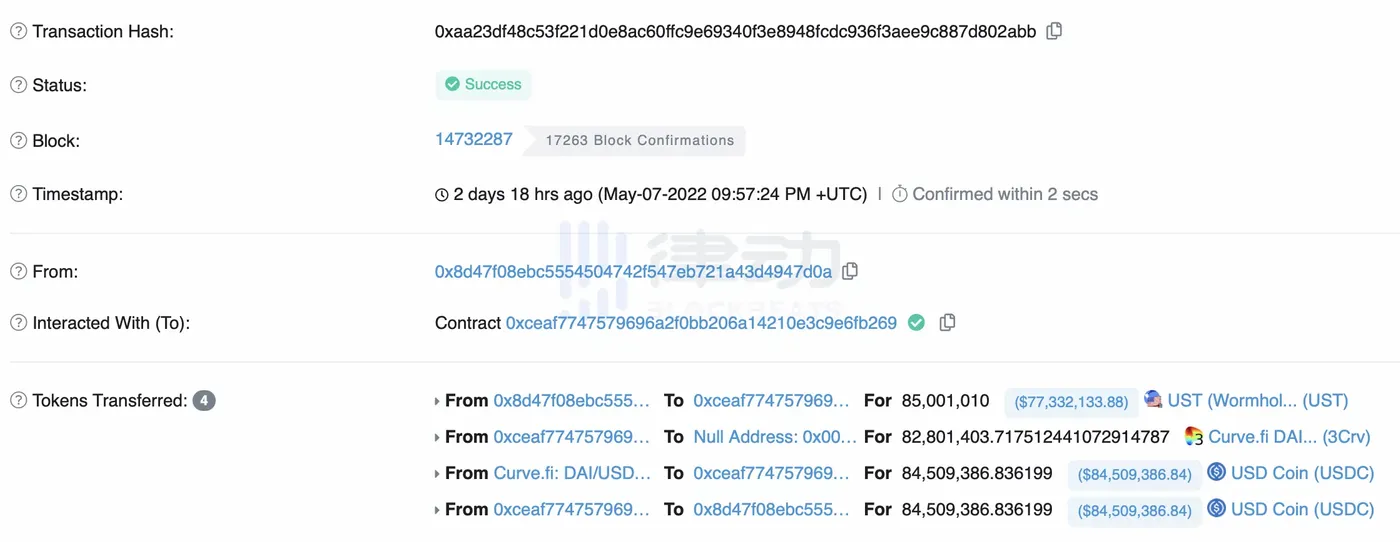

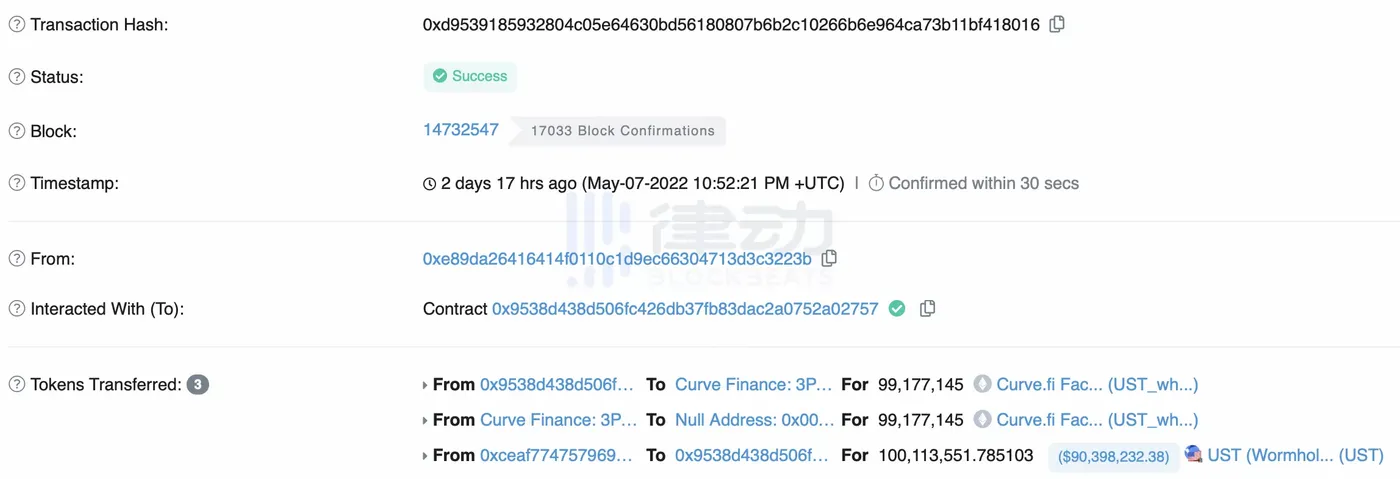

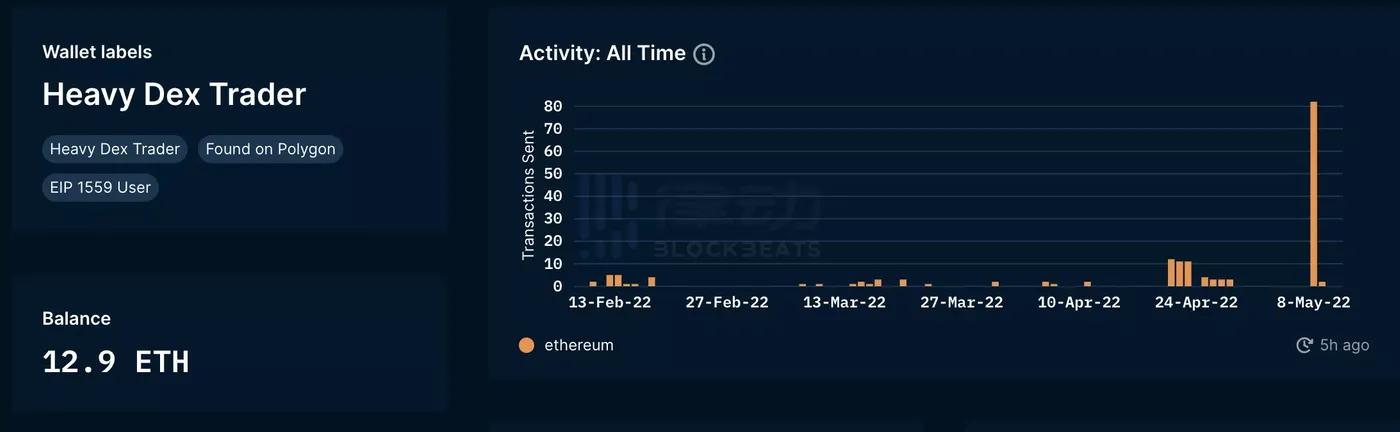

About 10 minutes later, a new address suddenly dumped $84 million in UST, seriously affecting the 3crv pool balance.

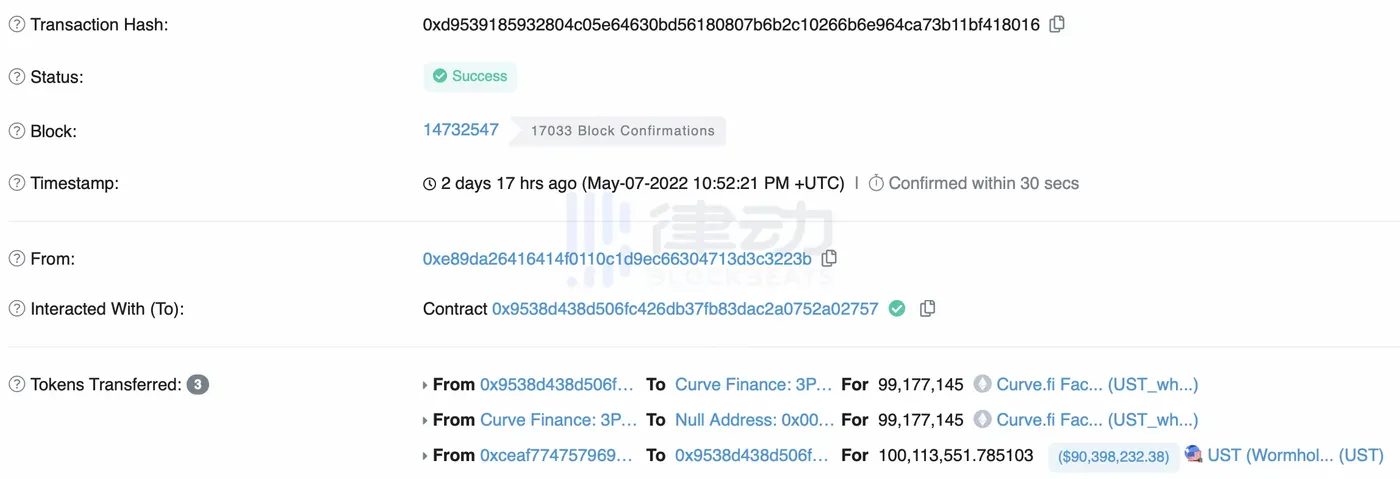

In order to maintain the balance of the liquidity of the UST-3Crv pool, LFG withdrew another $100 million of UST from the pool.

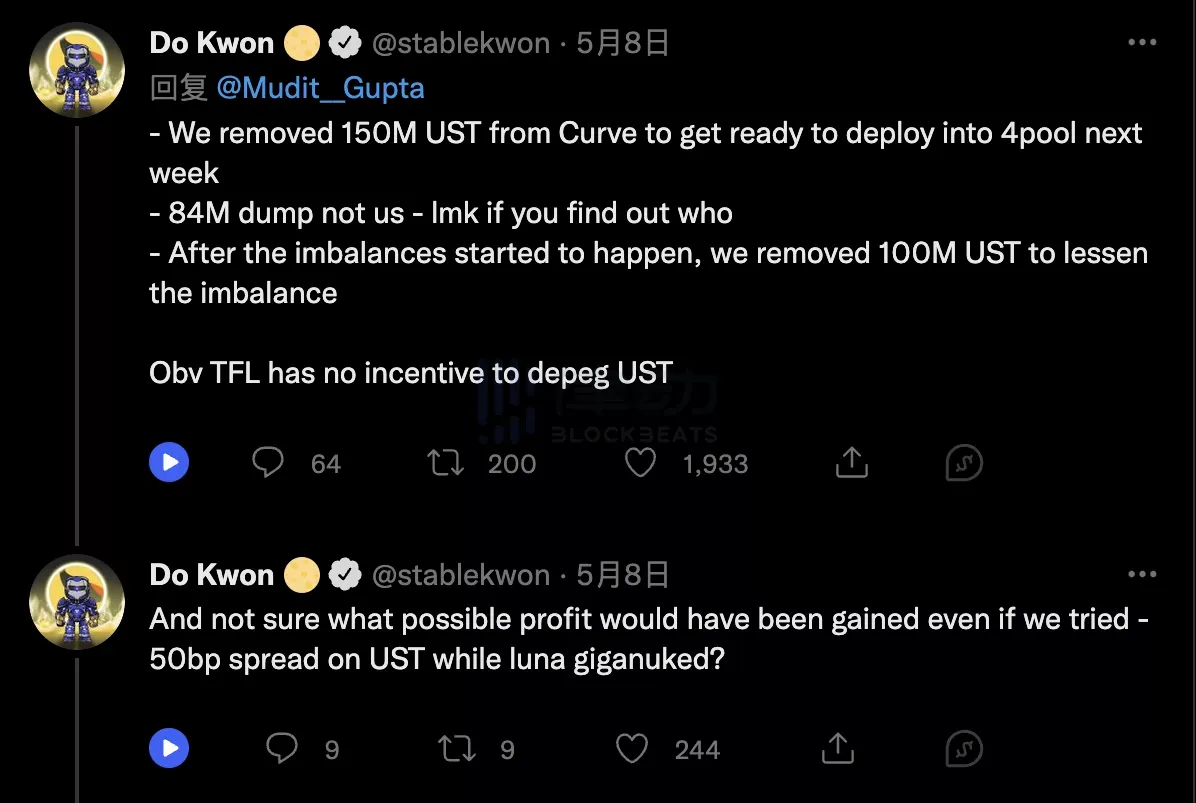

At this point, rumors began to surface on Twitter that the sell-off was being directed and performed by LFG, and Terra founder Do Kwon responded immediately on Twitter.

It didn’t take long for multiple whale accounts to start selling UST on Binance, with each transaction amounting to millions of dollars.

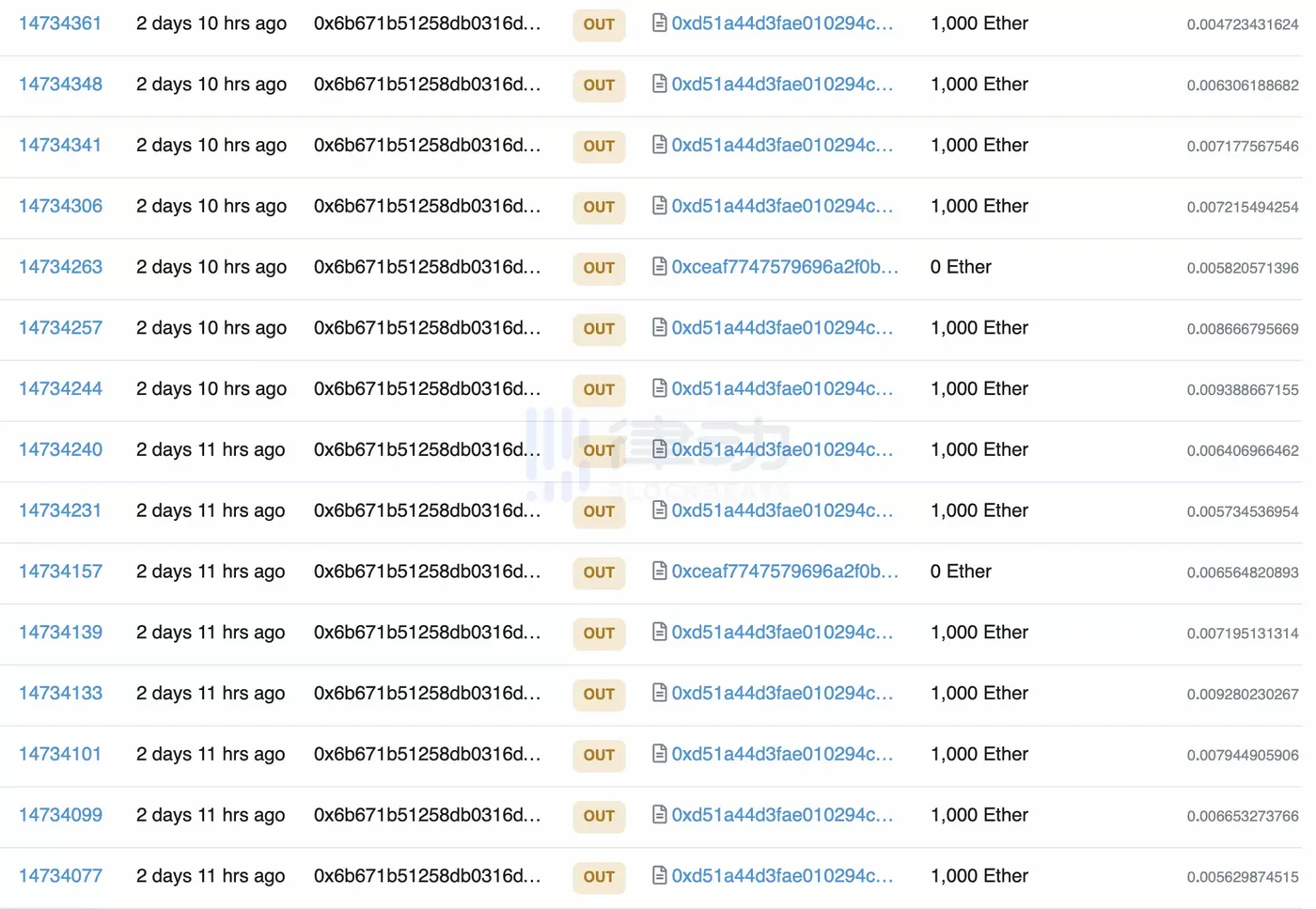

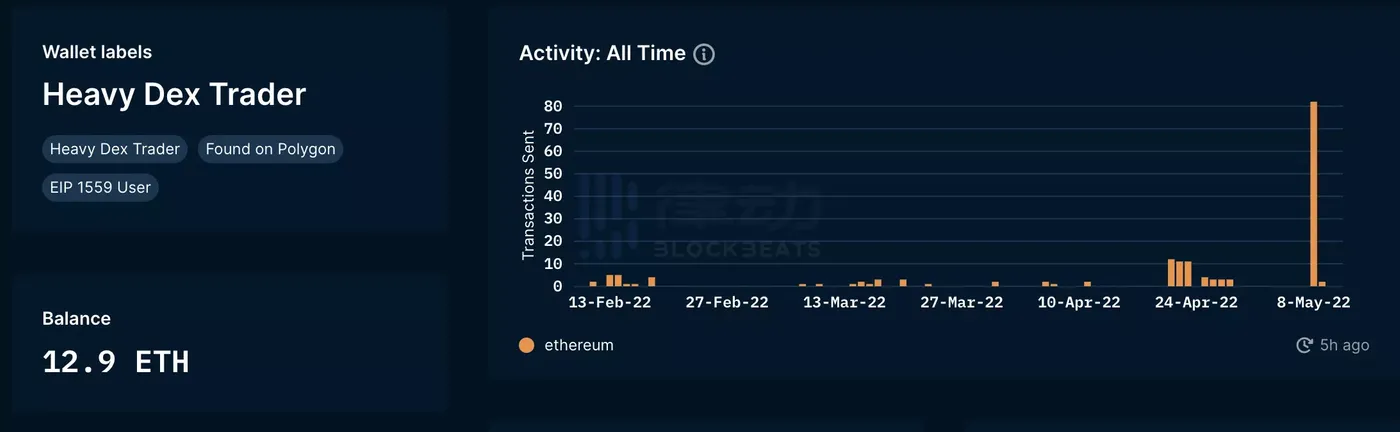

Affected by the sell-off, UST began to decouple. At this time, the address suspected of Jump Trading (UST market maker) sold a large amount of ETH to buy UST in an attempt to stabilize the anchor of UST.

Up to now, the address has sold more than 50,000 ETH to maintain the UST anchor, and there are currently less than 13 ETH left on the address.

Until this time, the attack was mainly completed through the UST-3Crv pool, involving an amount of about 300 million US dollars. If the LFG 4Crv pool of 4 billion US dollars was established before this attack, the above attack would not be effective.

Stage 2: Anchor funds flee in large numbers due to panic

Due to the small decoupling incident in the early morning of the 8th, panic spread rapidly among UST and Luna holders. From May 8th, a large number of UST locked in Anchor flowed into the market, further causing selling pressure on UST.

During this period, LFG announced that it "lent" its own $700 million in Bitcoin savings to maintain the stability of the UST.

But according to Do kwon, UST above $0.95 is not considered a decoupling, so Bitcoin will not be used above this threshold.

This also explains why UST has not returned to the $1 anchor after decoupling on the 8th.

However, LFG did not expect that the long-term inability of UST to return to the anchor has brought great negative sentiment to the market. UST that fled from the anchor began to sell on a large scale, and the UST anchor fell below the $0.95 threshold. When LFG was forced to start liquidating bitcoin savings, Do Kwon tweeted again: "More funds are being mobilized".

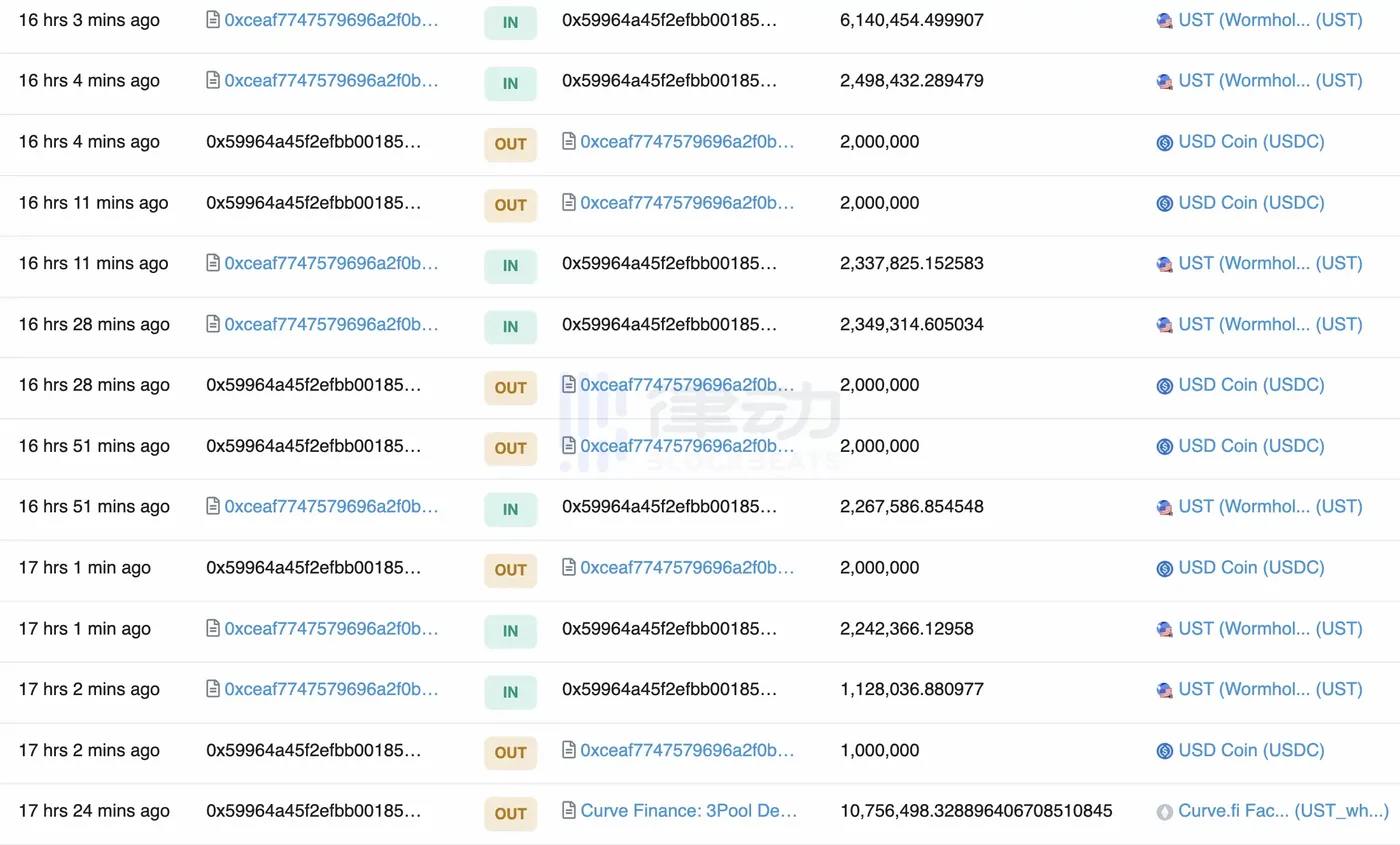

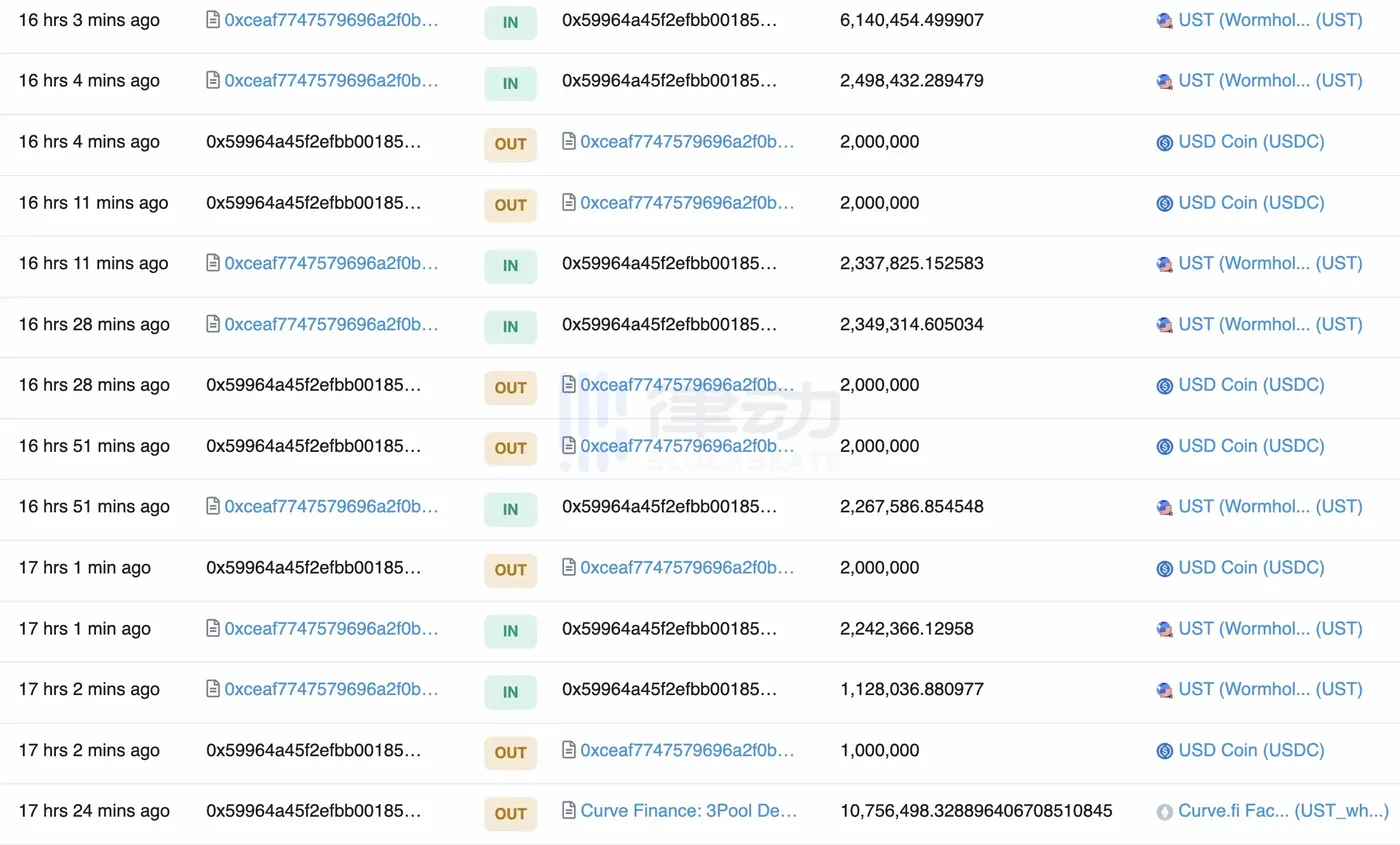

Subsequently, an address starting with "0x599" began to absorb UST circulating in the market on a large scale, with an amount exceeding $200 million.

This also quickly rebalanced the UST-3Crv pool, but the Bitcoin liquidation further drove its price down, and the market sentiment continued to deteriorate, resulting in a large-scale liquidation in Luna, further increase in UST selling pressure, and the UST-3Crv pool soon fell into out of balance.

On the morning of May 10th, Jump Trading and LFG may have realized that something was wrong and stopped selling their Bitcoin savings to protect the peg, and let things go bad and UST plummeted all the way to $0.6. Although the anchor price has rebounded later, the UST-3Crv pool ratio of the Curve platform is still heavily skewed, and the ratio was once 91.37%/8.63%.

The third stage: behind-the-scenes transactions, rumors of institutional rescues begin to spread

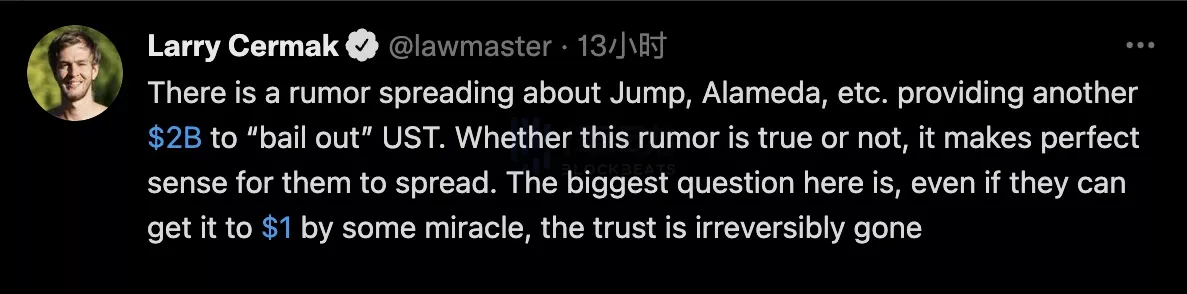

After UST triggered the "Thriller 2 Hours" of the death spiral, rumors began to circulate that Jump, Alameda and other institutions had reached some behind-the-scenes deals and were ready to invest $2 billion to start saving the scene. Subsequently, an address starting with "0x6c" did receive a transfer of $2 billion, but there was not much action, and the address has not yet been seen to be related to the UST incident.

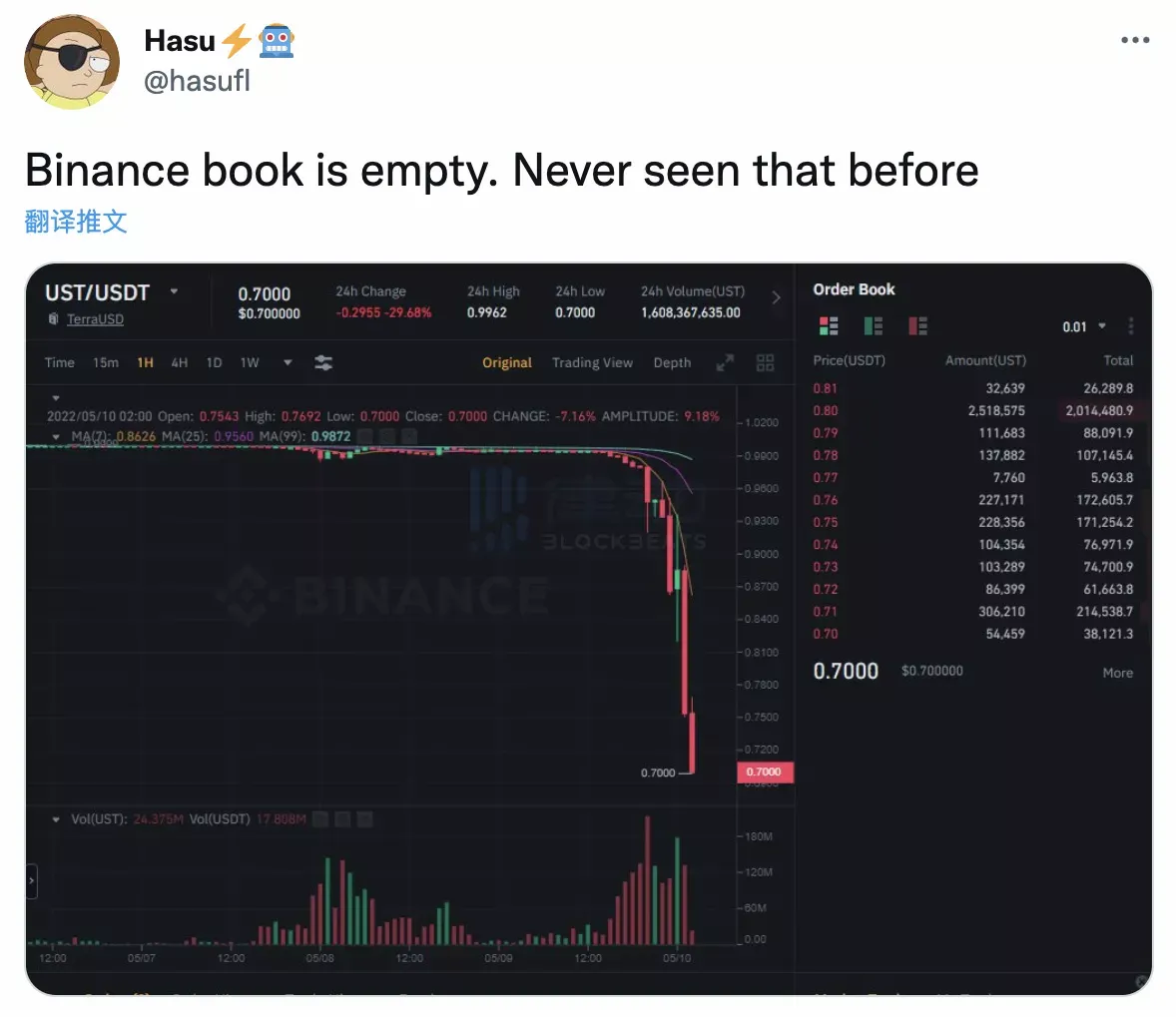

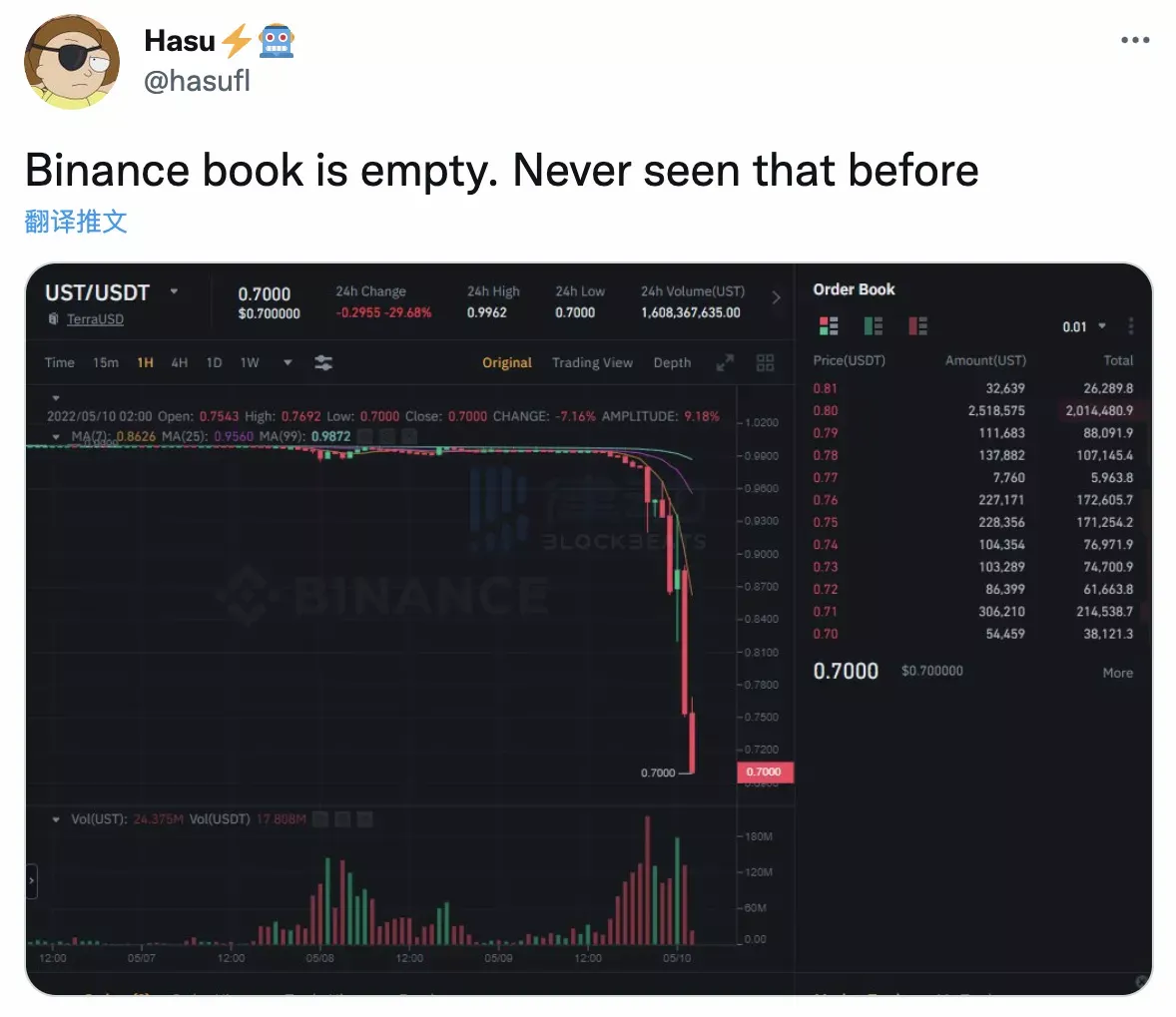

Also, Binance seems to be involved in the UST defense. According to Hasu, the director of "Uncommon Core", Binance forcibly set a floor price for the UST order book, and users were unable to submit orders under the $0.7 threshold for a long time.

This morning, news of LFG's financing resurfaced, with sources saying that LFG is reaching out to institutions to raise $1 billion to support UST. According to Larry, a researcher at The Block, the details of the financing currently known are: Jump Trading, Celsius, and Jane Street have agreed to this financing, with a commitment of about $700 million, but Alameda Research has not yet agreed. The condition of the institution is to get the LUNA spot at a 50% price discount, lock the position for one year, and unlock it linearly on a monthly basis after one year. But at the same time, Larry emphasized that the financing has not yet been confirmed, and everything may change.

Regulatory shadows: mantises catch cicadas, oriole behind

While the current rhetoric about the UST de-anchoring is speculation, we have found extremely reliable information on the market. On the morning of May 10, Raoul Pal, a well-known macro investor and founder of Real Vision, interviewed Do Kwon, founder of Terra, about the UST breakaway. Although the content of the conversation has not yet been broadcast, in the subsequent interview with Bankless, Raoul still revealed that Some details of this incident.

"It's very simple, UST decoupling, Jump Trading, as a UST market maker, was forced to sell its ETH to buy UST, and then LFG was also forced to liquidate its bitcoin positions." When talking about UST de-anchoring, Raoul briefly He explained the incident, and immediately added: "This is a typical Margin Call, it's like someone patted Luna on the shoulder and said 'give me back my collateral', similar things happen every day in traditional finance. staged".

Indeed, the amount that triggered the UST death spiral this time did not exceed US$300 million, and the scale caused by it is only billions. Compared with traditional finance, this is indeed insignificant. But the most incredible thing is that it happened in plain sight, which is extremely rare in the traditional financial world. Thanks to the blockchain, we are fortunate to witness the first large-scale "Thai Baht + Lehman" event in the history of encryption development.

In fact, Rhythm has explained UST and the entire algorithm in the previous two articles " The Lord of the Rings Dream of Algorithmic Stablecoins: After LUNA, There Will Be No Next UST " and " Dialogue with Luna Founder Do Kwon: UST's Bitcoin Gambling ". The endorsement dilemma of stabilizing the market, and UST's own coping strategies.

And this severe de-anchoring of UST is not the first time that Luna has triggered a death spiral. On 5.19 last year, UST also experienced a severe de-anchoring, and the price fell to $0.85. Finally, under the rescue of LFG, Luna and UST were able to survive and develop. . Since then, LFG has made a series of changes in order to prevent similar incidents from happening again, including the new endorsement mechanism of UST.

In fact, it is not a wrong choice to buy the native Token of Bitcoin and other L1 public chains as an endorsement, but it will take some time to realize the full delivery of this new mechanism. Had LFG's $4 billion 4Crv pool been formed, a crash like this might not have happened at all. But unfortunately, the market did not give Do Kown, a Luna madman, enough chances of redemption. Luna's collapse this time was lost to time.

Senior DeFi players should know that the impact of the UST de-anchoring this time may not stop at the Terra ecosystem. Just like the bankruptcy of Lehman Brothers, the collapse of the Luna ecosystem may affect the entire crypto market. But in the eyes of many people such as Raoul, the worst impact of this de-anchoring incident is actually at the regulatory level. This “mantis catching cicadas” by the crypto crocodiles is likely to attract the “regulatory oriole” behind it. .

We know that central banks of various countries have been vigorously popularizing their own digital currencies (CBDC) in recent years. The UST, which is a "stable leader", has come out of the circle in this way, which is undoubtedly a perfect excuse for regulators. Putting aside the question of whether the UST can regain confidence, the previous remarks about "the de-anchoring of the UST may lead to regulation" have begun to spread widely on Twitter, causing many people to worry.

Sure enough, the tuyere of supervision came on the night of the incident. According to rhythm news, at a meeting on Capitol Hill on May 10, U.S. Treasury Secretary Yellen talked about the regulation of USD Stablecoin in the crypto market. Brings huge risks, and as we all know, Terra UST went through a downtrend today.”

There is no doubt that the collapse of UST once again cast a regulatory shadow on the entire stablecoin market. Now we must think about whether the regulators of various countries will launch a "regulatory encirclement and suppression" of stablecoins in this regard? Will the future crypto market lose its "sovereign freedom"?

Luna's supporters and skeptics have long been extreme. Supporters call themselves the army of "Lunatics" (meaning "madman" in Chinese), and every day on social media platforms such as Twitter, they attack and smash comments criticizing Luna's mechanism; doubters use "Ponzi" as an excuse to turn their fingers and look forward to it. The day when Luna collapsed. Such an extremely "tensile" ecology is difficult to be ignored by speculators. These capital killers always pay attention to the industry trend and wait for the best hunting moment.

The opportunity finally came after the Fed announced another 50 basis point rate hike. Since May, the Nasdaq index has continued to decline, the market's reaction to the macro situation has been extremely pessimistic, and the price of Bitcoin has also fallen by nearly 10% for several consecutive days, and panic has spread rapidly throughout the crypto market. The Terra ecological core team LFG (Luna Foundation Guard) announced that it will adjust the UST-3Crv liquidity pool (UST main chain trading venue) on May 8 to prepare for the formation of its own powerful 4Crv pool.

Various conditions created a perfect storm for capital hunting, so on the night of May 8, the crocodiles in the currency circle quietly launched their long-established "encirclement and suppression plan".

Phase 1: Use the UST-3Crv pool withdrawal gap to launch an offensive

In the early morning of May 8th, LFG withdrew USD 150 million of UST liquidity from the UST-3Crv pool due to the need to prepare for the formation of the 4Crv pool. At this time, the TVL of the UST-3Crv pool was around USD 700 million, and it wanted to drain it. UST liquidity actually only needs about 300 million US dollars.

About 10 minutes later, a new address suddenly dumped $84 million in UST, seriously affecting the 3crv pool balance.

In order to maintain the balance of the liquidity of the UST-3Crv pool, LFG withdrew another $100 million of UST from the pool.

At this point, rumors began to surface on Twitter that the sell-off was being directed and performed by LFG, and Terra founder Do Kwon responded immediately on Twitter.

It didn’t take long for multiple whale accounts to start selling UST on Binance, with each transaction amounting to millions of dollars.

Affected by the sell-off, UST began to decouple. At this time, the address suspected of Jump Trading (UST market maker) sold a large amount of ETH to buy UST in an attempt to stabilize the anchor of UST.

Up to now, the address has sold more than 50,000 ETH to maintain the UST anchor, and there are currently less than 13 ETH left on the address.

Until this time, the attack was mainly completed through the UST-3Crv pool, involving an amount of about 300 million US dollars. If the LFG 4Crv pool of 4 billion US dollars was established before this attack, the above attack would not be effective.

Stage 2: Anchor funds flee in large numbers due to panic

Due to the small decoupling incident in the early morning of the 8th, panic spread rapidly among UST and Luna holders. From May 8th, a large number of UST locked in Anchor flowed into the market, further causing selling pressure on UST.

During this period, LFG announced that it "lent" its own $700 million in Bitcoin savings to maintain the stability of the UST.

But according to Do kwon, UST above $0.95 is not considered a decoupling, so Bitcoin will not be used above this threshold.

This also explains why UST has not returned to the $1 anchor after decoupling on the 8th.

However, LFG did not expect that the long-term inability of UST to return to the anchor has brought great negative sentiment to the market. UST that fled from the anchor began to sell on a large scale, and the UST anchor fell below the $0.95 threshold. When LFG was forced to start liquidating bitcoin savings, Do Kwon tweeted again: "More funds are being mobilized".

Subsequently, an address starting with "0x599" began to absorb UST circulating in the market on a large scale, with an amount exceeding $200 million.

This also quickly rebalanced the UST-3Crv pool, but the Bitcoin liquidation further drove its price down, and the market sentiment continued to deteriorate, resulting in a large-scale liquidation in Luna, further increase in UST selling pressure, and the UST-3Crv pool soon fell into out of balance.

On the morning of May 10th, Jump Trading and LFG may have realized that something was wrong and stopped selling their Bitcoin savings to protect the peg, and let things go bad and UST plummeted all the way to $0.6. Although the anchor price has rebounded later, the UST-3Crv pool ratio of the Curve platform is still heavily skewed, and the ratio was once 91.37%/8.63%.

The third stage: behind-the-scenes transactions, rumors of institutional rescues begin to spread

After UST triggered the "Thriller 2 Hours" of the death spiral, rumors began to circulate that Jump, Alameda and other institutions had reached some behind-the-scenes deals and were ready to invest $2 billion to start saving the scene. Subsequently, an address starting with "0x6c" did receive a transfer of $2 billion, but there was not much action, and the address has not yet been seen to be related to the UST incident.

Also, Binance seems to be involved in the UST defense. According to Hasu, the director of "Uncommon Core", Binance forcibly set a floor price for the UST order book, and users were unable to submit orders under the $0.7 threshold for a long time.

This morning, news of LFG's financing resurfaced, with sources saying that LFG is reaching out to institutions to raise $1 billion to support UST. According to Larry, a researcher at The Block, the details of the financing currently known are: Jump Trading, Celsius, and Jane Street have agreed to this financing, with a commitment of about $700 million, but Alameda Research has not yet agreed. The condition of the institution is to get the LUNA spot at a 50% price discount, lock the position for one year, and unlock it linearly on a monthly basis after one year. But at the same time, Larry emphasized that the financing has not yet been confirmed, and everything may change.

Regulatory shadows: mantises catch cicadas, oriole behind

While the current rhetoric about the UST de-anchoring is speculation, we have found extremely reliable information on the market. On the morning of May 10, Raoul Pal, a well-known macro investor and founder of Real Vision, interviewed Do Kwon, founder of Terra, about the UST breakaway. Although the content of the conversation has not yet been broadcast, in the subsequent interview with Bankless, Raoul still revealed that Some details of this incident.

"It's very simple, UST decoupling, Jump Trading, as a UST market maker, was forced to sell its ETH to buy UST, and then LFG was also forced to liquidate its bitcoin positions." When talking about UST de-anchoring, Raoul briefly He explained the incident, and immediately added: "This is a typical Margin Call, it's like someone patted Luna on the shoulder and said 'give me back my collateral', similar things happen every day in traditional finance. staged".

Indeed, the amount that triggered the UST death spiral this time did not exceed US$300 million, and the scale caused by it is only billions. Compared with traditional finance, this is indeed insignificant. But the most incredible thing is that it happened in plain sight, which is extremely rare in the traditional financial world. Thanks to the blockchain, we are fortunate to witness the first large-scale "Thai Baht + Lehman" event in the history of encryption development.

In fact, Rhythm has explained UST and the entire algorithm in the previous two articles " The Lord of the Rings Dream of Algorithmic Stablecoins: After LUNA, There Will Be No Next UST " and " Dialogue with Luna Founder Do Kwon: UST's Bitcoin Gambling ". The endorsement dilemma of stabilizing the market, and UST's own coping strategies.

And this severe de-anchoring of UST is not the first time that Luna has triggered a death spiral. On 5.19 last year, UST also experienced a severe de-anchoring, and the price fell to $0.85. Finally, under the rescue of LFG, Luna and UST were able to survive and develop. . Since then, LFG has made a series of changes in order to prevent similar incidents from happening again, including the new endorsement mechanism of UST.

In fact, it is not a wrong choice to buy the native Token of Bitcoin and other L1 public chains as an endorsement, but it will take some time to realize the full delivery of this new mechanism. Had LFG's $4 billion 4Crv pool been formed, a crash like this might not have happened at all. But unfortunately, the market did not give Do Kown, a Luna madman, enough chances of redemption. Luna's collapse this time was lost to time.

Senior DeFi players should know that the impact of the UST de-anchoring this time may not stop at the Terra ecosystem. Just like the bankruptcy of Lehman Brothers, the collapse of the Luna ecosystem may affect the entire crypto market. But in the eyes of many people such as Raoul, the worst impact of this de-anchoring incident is actually at the regulatory level. This “mantis catching cicadas” by the crypto crocodiles is likely to attract the “regulatory oriole” behind it. .

We know that central banks of various countries have been vigorously popularizing their own digital currencies (CBDC) in recent years. The UST, which is a "stable leader", has come out of the circle in this way, which is undoubtedly a perfect excuse for regulators. Putting aside the question of whether the UST can regain confidence, the previous remarks about "the de-anchoring of the UST may lead to regulation" have begun to spread widely on Twitter, causing many people to worry.

Sure enough, the tuyere of supervision came on the night of the incident. According to rhythm news, at a meeting on Capitol Hill on May 10, U.S. Treasury Secretary Yellen talked about the regulation of USD Stablecoin in the crypto market. Brings huge risks, and as we all know, Terra UST went through a downtrend today.”

There is no doubt that the collapse of UST once again cast a regulatory shadow on the entire stablecoin market. Now we must think about whether the regulators of various countries will launch a "regulatory encirclement and suppression" of stablecoins in this regard? Will the future crypto market lose its "sovereign freedom"?

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…