CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx: What you need to know before starting contract trading

Since the beginning of 2022, the sharp dive in the price of cryptocurrencies has led to the continuous shrinking of the spot trading volume of the crypto market. According to the March 2022 market trading report released by CryptoCompare, the trading volume of the crypto derivatives market has increased by 4.58%, reaching 2.74 trillion US dollars. , accounting for 62.8% of the total trading volume, while the market share of spot trading volume is only 37.2%. It can be seen that when the spot market is sluggish, more and more investors are beginning to choose encrypted derivatives that can hedge and improve capital utilization, such as contract transactions.

Understand how contracts work

The biggest difference between contracts and spot transactions is that contracts can greatly improve the utilization rate of users' funds. The spot can only get the benefits brought by the price rise, and in the contract transaction, whether the price rises or falls, as long as the direction is right, the profit can be obtained.

Users can choose two directions in the contract: buy to open long and sell to open short.

Buy to open long: User A judges that the price will rise in the future. Assuming that the current BTC unit price is 40000U, he buys 0.1 BTC with 4000U to open a 10x leverage, and when the BTC price rises to 45000U, he sells the flat and earns it The difference, referred to as "buy first and then sell".

Selling to open short: User B judges that the price of the market will fall in the future. Assuming that the current BTC unit price is 40000U, he buys 0.1 BTC with 4000U and sells it with a leverage of 10x at the original price. When the BTC price falls to 35000U, he can buy to close the short position and earn a profit. Take the difference, referred to as "sell first and then buy".

Understand the basic concepts of contracts

Leverage multiple: Leverage large returns with small capital, which is one of the reasons why contract trading is gradually becoming popular among crypto investors. At present, the leverage provided by mainstream exchanges is generally up to 100x, but while amplifying the benefits, it also increases the risks.

Margin: When conducting contract transactions in the contract market, users need to pay a small amount of funds according to the current billing price as a guarantee for the performance of the contract. This part of the funds is called contract margin. The margin required to open a position is called the initial margin; in order to maintain the current position, a certain percentage of the position value is required to be held, which is called the maintenance margin.

Forced liquidation mechanism: When the user's available margin balance is not enough to support the maintenance margin, the system will forcibly liquidate the position, also known as liquidation.

Funding rate: There are two types of futures contracts in the crypto market: delivery contracts and perpetual contracts. In order to make the contract price and spot price converge for a long time, the delivery contract will be cleared monthly or quarterly, and the delivery will be made through regular clearing. The contract market price returns to the spot price. However, there is no delivery date for perpetual contracts. In order to maintain price stability, a funding rate mechanism is introduced to narrow the basis.

How to trade contracts on CoinEx?

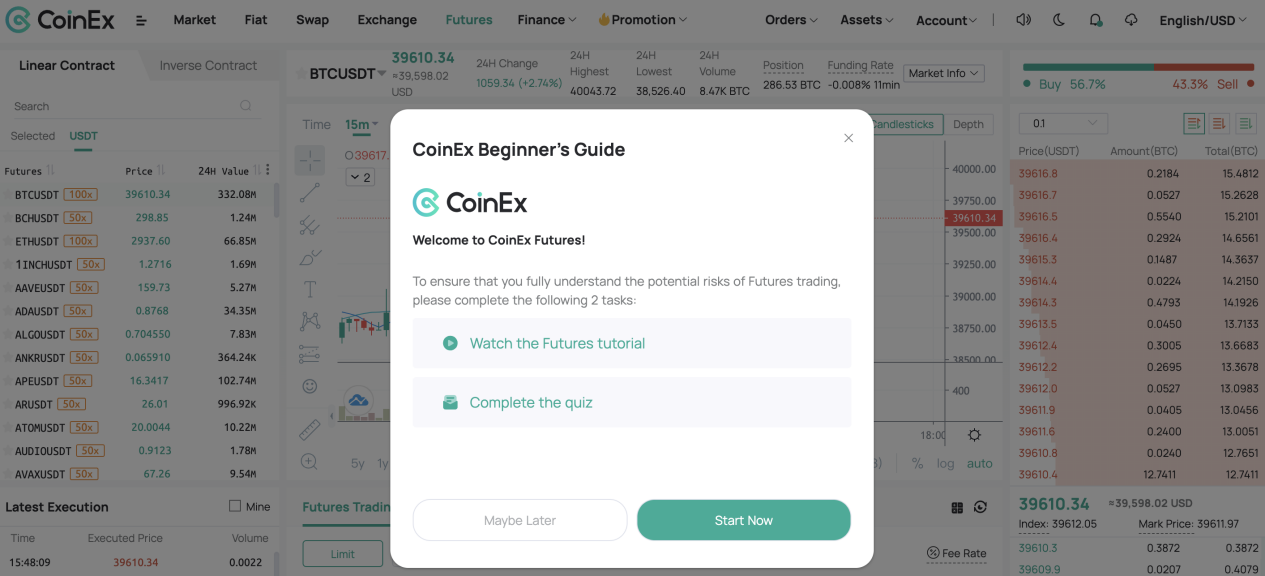

Step 1: Register a CoinEx account and enter the contract trading page. For novice users, before that, you can click to watch the contract tutorial video and complete the answer quiz;

Step 2: Transfer funds from other accounts to the contract account;

Step 3: Select the currency contract you want to open. CoinEx now supports more than 100 forward contract trading currencies and 2 reverse contract trading currencies;

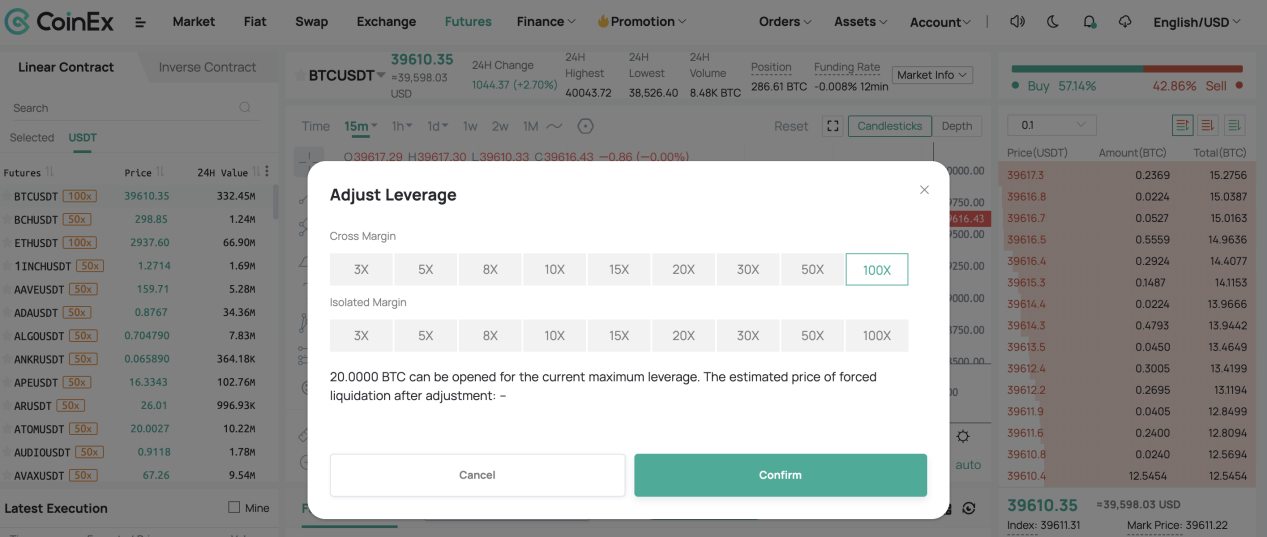

Step 4: Adjust the leverage multiple of the position, CoinEx now provides multiples of 3x-100x for you to choose;

Step 5: Adjust the margin ratio of the position. CoinEx recommends that you do it according to your own risk tolerance;

Step 6: Place an order according to the different order types provided by the CoinEx contract.

Finally, as a special product with investment value, the price of the contract is affected by many factors. The price fluctuates greatly, high leverage and high risk are its characteristics, but it is difficult for users to fully grasp in actual operation. There are still a large number of novice users. The knowledge needs to be learned, and rash entry needs to be cautious.

*The above content does not constitute investment advice

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…