CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx|What kind of opportunities does the funding rate reveal?

Perpetual contracts are a very unique type of product in the cryptocurrency exchange market, which are futures that do not expire. In the delivery contract, because the contract will be delivered on a regular basis, even if there is a large spread between the contract price and the spot price, on the delivery day, the spot price will eventually return.

Since there is no delivery date for perpetual contracts, users can always hold them. If the correction mechanism is not introduced, the deviation between the contract price and the spot price may continue to exist or even increase, resulting in a price decoupling. Therefore, the perpetual contract will use the capital cost mechanism to make the contract market price and the spot price tend to be consistent, thereby anchoring the spot price.

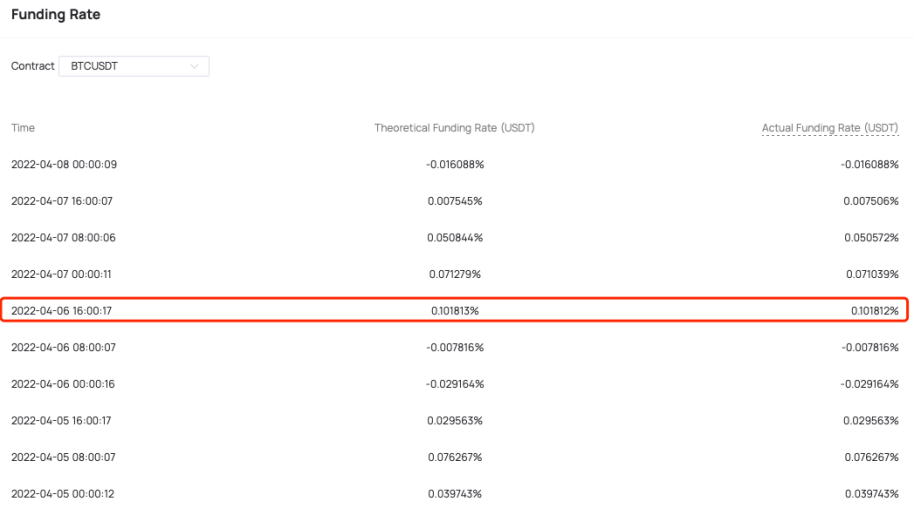

Funding fee is a fee paid or charged every 8 hours. When the funding rate is positive, long positions will pay the funding fee and short positions will receive the funding fee. If the rate is negative, the short position will pay the funding fee to the long position. warehouse. When charging the funding, the system will select the funding rate calculated one minute before the last settlement time for charging; for example, when the system settles at 16:00, the funding rate calculated at 07:59 will be charged. Funding fees are only charged between users and users, and the platform will not charge them.

The formula for calculating the funding fee is as follows (take CoinEx as an example, other exchanges may have different calculation methods):

Funding Fee = Position Value * Funding Rate

Funding rate=Clamp(MA(((depth-weighted bid price + depth-weighted ask price)/2-spot index price)/spot index price- Interest), a, b)

*Interest is currently 0, a=-0.375%, b=0.375%

*Depth-Weighted Bid = Volume is the weighted average price of a certain number of buy orders, and depth-weighted Ask = Volume is the weighted average of a certain number of Sell orders.

* Clamp(A, B, C): When A is within the range of B and C, take A; otherwise, take B as the lower limit and C as the upper limit (B < C)

So in fact, it can be seen that when the funding rate is positive, it means that the market is generally bullish. When the funding rate is negative, it means that the market is generally bearish.

So what opportunities does the funding rate reveal? First of all, the value of the funding rate can be used as an indicator to refer to the long-short trend. Of course, it can only be used as a reference. After all, it is difficult to have a comprehensive judgment on the market by relying on a single indicator.

Second, for arbitrageurs with a relatively large amount of capital, he can arbitrage through the capital rate of perpetual contracts. Because the funding rate for this time period is actually calculated from the data of the previous time period. Therefore, there will be a delay, so in fact, the actual funding rate for this time period can be roughly estimated based on the forecast funding rate.

Then when the funding rate is high, we can buy 1 BTC spot while shorting 1 BTC perpetual contract, then no matter whether the BTC price rises or falls, the spot can hedge the profit and loss of the contract, and we can earn long positions The funding rate paid to short sellers, for example, if the current funding rate reaches 0.1%, according to the current BTC price of 41,000USDT, a profit of 41 U can also be obtained.

Of course, at this time, we also need to pay close attention to the funding rate in the next time period. If the funding rate drops a lot, we can close the position to gain profits. If the funding rate changes from positive to negative, then we can make a profit based on the funding rate Then decide whether to carry out the reverse arbitrage operation.

For users who play contracts, they must learn to observe market data. Funding rate is a very important part of it. When we have a sufficient judgment on the market, and then seize the opportunity to make a move, we can better grasp the market sentiment and obtain Deserved income.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…