CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx Research Institute | Paying Lego: Inventory of Streaming Payment Project (Part 2)

This article will continue to the previous article and continue to count the streaming payment project.

3. Streamflow

Streamflow is a suite of products that enables organizations and individuals to distribute funds in a simple and straightforward manner. It is currently deployed on the Solana network, and supported tokens include USDT, prtSOL, and several other SPL-type tokens.

Streamflow helps users simplify the process, save time and money by building protocols, SDKs, and applications to solve the problems users encounter when distributing funds, such as Vesting, payroll, and multi-signature vaults. The main products of Streamflow include:

l Token release: an open-source, verifiable, programmable token unlocking release protocol, which can set the start and end time (including lock-up time), TGE ratio and release frequency and other parameters involved in common token unlocking and release;

l Streaming payment: Continuously released payments in the form of time-locked escrow accounts, see below for specific steps;

l Bulk payments: team payroll or reward distribution for crypto users, including simple one-to-many payments;

l Multi-signature fund pool: Create a fund pool that requires M/N signatures.

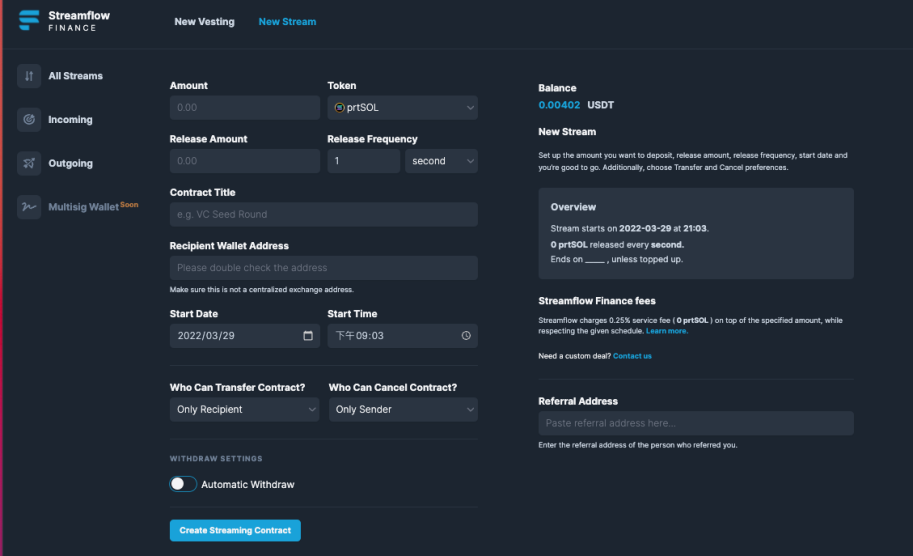

In the operation of streaming payment, the sender can input and select a series of information on the front-end interface, including the type of token, the total amount of streaming payment, the recipient's address, and the frequency (per second/hour/day/week/month/year) , agreement title, start date and time, who has permission to transfer the agreement (sender, receiver, both, neither), who has permission to cancel the agreement (sender, receiver, both both, neither), and whether to automatically extract.

(Source: Streamflow official website)

Streamflow’s investment lineup is also quite strong, including Jump Crypto, Solana Ventures, GVB, and Amber, among others.

4. Zebec

Zebec's full name is Zebec Protocol, which is a programmable stream payment protocol and a multi-currency fund management tool deployed on Solana. The automated flow of money enabled by Zebec enables businesses, employees and consumers to redefine how they pay, invest and purchase products or services.

Zebec Pay is Zebec's first app, an efficient and low-cost payroll solution that enables employees to get paid every second and use it immediately. Currently, tokens supported on the Solana network on Zebec Pay include SOL, ZBC, USDC and USDT. More than just a streaming payment tool, Zebec Pay gives corporate employees access to exceptional crypto-native financial services, including:

l Automated Dollar Cost Averaging: Zebec enables instant, second-by-second dollar cost averaging investing. Users can automatically convert a certain percentage of their salary into cryptocurrency to realize salary management.

l Investments & Yield-Farming: Users can fully control the use and distribution of funds through easy-to-program smart contracts to automatically invest in cryptocurrencies or invest in DeFi applications to earn income.

l Encrypted IRA and 401k accounts: Users can easily distribute part of their salary to compliant encrypted IRA and 401k accounts.

l Free fiat entry and exit: Users can exchange their cryptocurrencies for USD and transfer their money to regular bank accounts without paying any fees.

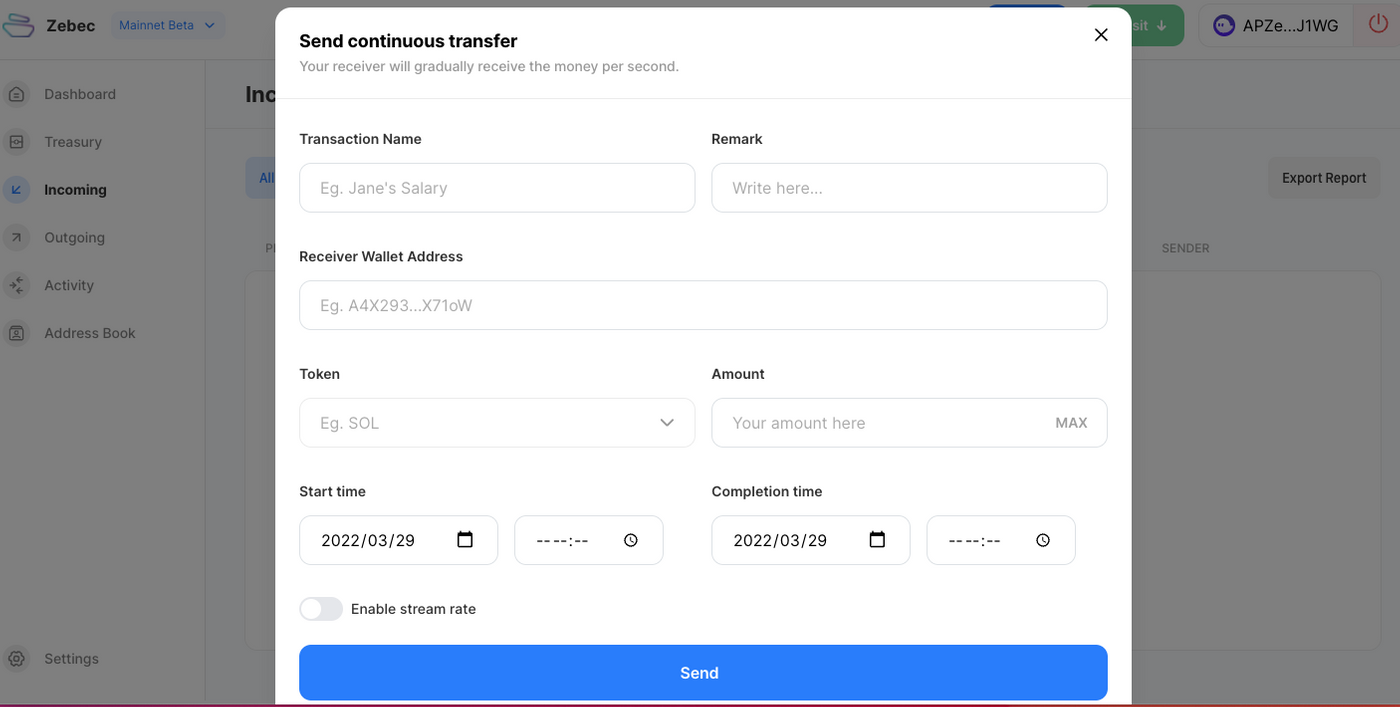

Operationally, the sender needs to deposit tokens into the Zebec protocol before creating a streaming payment. When creating a streaming payment, the information that the user needs to fill in or select includes: transaction name, remarks, recipient address, token type, total number, start time and end time. If it is a fixed flow rate method, you do not need to fill in the total number and completion time, you only need to select the flow rate (such as how many tokens per week/month/day). After the flow is created, the user can also choose to pause or terminate the flow.

(Source: Zebec official website)

Zebec is the only streaming payment protocol that has issued tokens. The token is ZBC, with a total issuance of 10 billion. On March 16, Zebec raised $28 million, including $21 million in private investors including Circle, Coinbase, Solana Ventures, Lightspeed Venture Partners and Alameda Research, and $7 million in a public sale in partnership with Republic.

Summarize

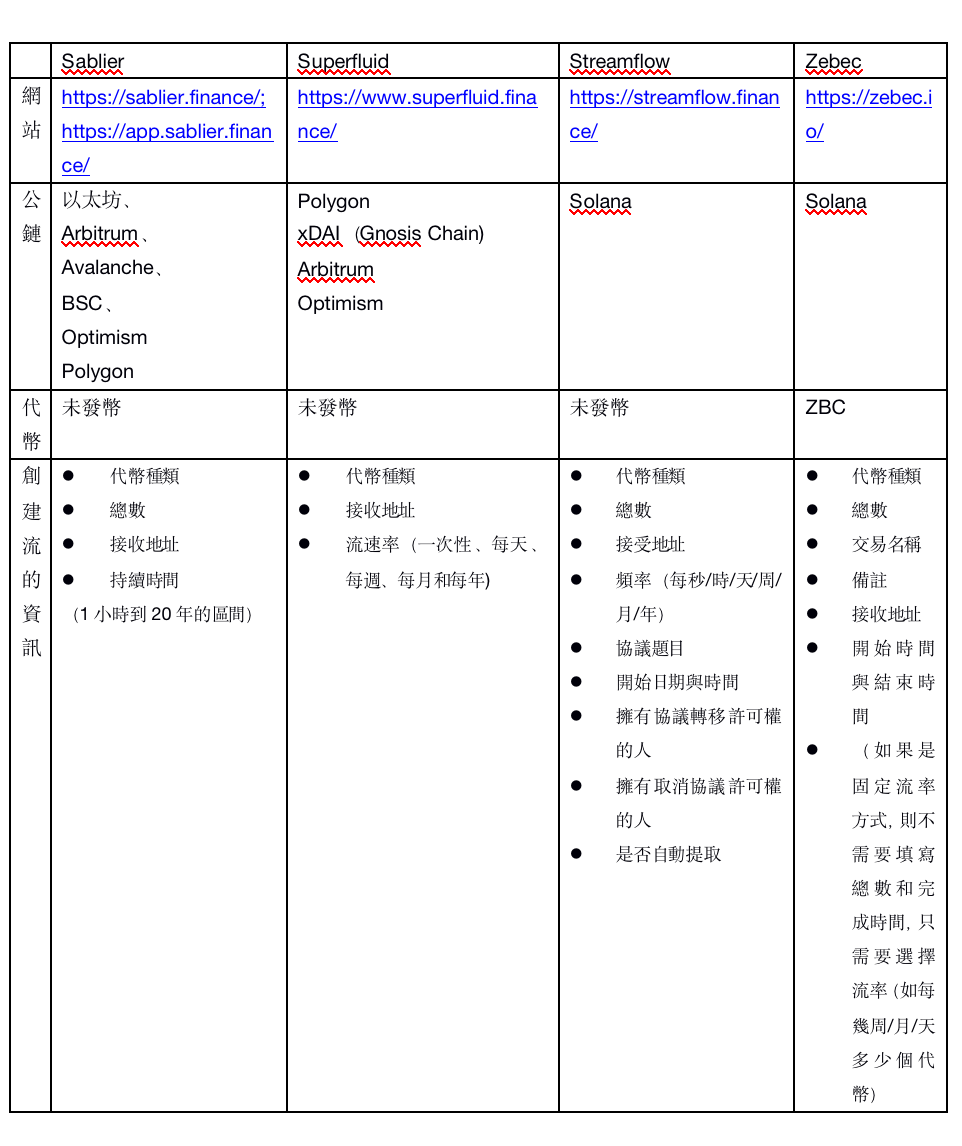

Although the core businesses of the above four projects are all streaming payments, there are also some differences in product design. From the point of view of supported networks, Sablier supports the most networks, followed by Superfield, but these two are mainly EVM compatible networks, while Streamflow and Zebec both support non-EVM Solana. From the perspective of the type of flow protocol, Sablier supports fixed-amount flow, while Superfluid supports fixed-rate flow, and the input information required to create a flow payment is relatively simple. However, Streamflow and Zebec have more information on options and customization when creating streaming payments.

The author believes that each of these four projects has its own merits. Sablier's visual interface is exquisite, and the data presentation is concise and clear. The development of Superfluid is more community-based, and more application scenarios are explored by the community. Its framework design allows developers to expand more functions. Streamflow makes the protocol more visible, and the corresponding operation is converted into a text during the creation of the stream payment. The main feature of Zebec is that it provides solutions for employee compensation of cryptocurrency organizations. In addition to streaming payment, it also provides streaming investment and financial management of wages, compliance support for encrypted IRA and 401k accounts, and legal currency import and export.

Below is a summary of some information on the four projects:

4. Streaming payment application scenarios

Maybe streaming payments won't be a single hotspot, but it is an important tool in the Web 3.0 process, and even an indispensable infrastructure. Streaming payment plays a very important role in the realization of micro-innovations in Airdrop, IDO and fund management methods, and the implementation of roadmaps for projects such as DeFi, NFT, DAO and Metaverse.

The following is an introduction to some application scenarios, and there are more scenarios that are worth imagining and exploring together.

1. Immediate payroll

Through the streaming payment protocol, whether it is an employee of an entity company, a provider of professional services, or a contributor to a DAO organization, etc., they can receive salaries in real time, and pay salaries using the streaming payment protocol, and are not limited by space and time. In addition to reducing labor costs, it also reduces financial costs. You can no longer waste costs on accounting, invoicing, and timestamps. You only need to pay gas when creating and terminating streams, and you can achieve better capital flow. For instant payroll, a more specific scenario can be that an international company uses a fixed flow rate to pay employees all over the world instantly (but compliance factors need to be considered); in addition, students in short-term training courses can use the flow to pay on a daily basis. Pay for the class hours frequently, rather than settle it all at once at the beginning; finally, the metaverse landowner pays the virtual world designer MANA and so on with a fixed total flow payment method.

2. Token Unlock and Airdrop

Usually private and public investors of the project can invest in tokens at a lower price, so for such investors, the project will set a lock-up plan, such as setting a certain percentage of TGE, and then lock it for half a year to 1 year, divided into 1 year Monthly release or daily release for 2 years. This poses certain challenges to the operational management of the project or to the trust of investors. The use of streaming payment can solve the above problems. Using the streaming payment tool, the project party does not need to write a separate smart contract, just set the release ratio, lock time and other simple parameters on the front-end of the streaming payment tool platform as described above to start the real-time vesting of tokens. And investors don't have to worry about the project party not fulfilling the agreement, because once the sender is set when the flow is created, the agreement cannot be stopped, and the project party has no permission to touch the funds locked in the agreement.

The same is true for airdrops. At present, most airdrops are in a one-time distribution mode. In this case, the tokens in the hands of users usually form a kind of selling pressure. The existence of the streaming payment protocol not only allows the project party to distribute airdrop rewards in a regular and immediate manner, but also reduces the existence of selling pressure.

3. Fund Management

Zebec's automatic average dollar cost and investment function, as described above, can enable employees to convert a certain percentage of their salary to cryptocurrency investment as planned, and can implement a fixed investment strategy that reduces the impact of short-term fluctuations. However, the specific technical implementation requires the streaming payment protocol and the DeFi protocol to form Lego. In operation, users can automatically buy a certain token on a regular basis by planning the amount and frequency of fixed investment, such as buying 1000U worth of Ethereum every Wednesday, thus saving time for capital management.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…