CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx Research | Paying Lego: Inventory of Streaming Payment Project (Part 1)

1. The origin of stream payment

In 1949, economist William Phillips invented MONIAC (Monetary National Income Analogue Computer) while studying at the London School of Economics (LSE). The computer, which consists of a series of transparent plastic cans and pipes, can be used to simulate the process of the UK's national economy. Phillips presents the continuous flow of money with the flow of water, which is actually the natural state of money—flowing over time.

(Source: https://www.researchgate.net/ )

In national economic activity, time is the link connecting wages, consumer spending, investment funds and government spending. Imagine "flowing money" where payments are no longer discrete but continuous, achieving a transfer frequency per second. Time determines people's net worth. In theory, instant work should be accompanied by instant salary returns, but factors such as administrative costs prevent us from achieving this effect.

Fortunately, the emergence of blockchain technology not only makes payments not limited by space (borderless payments), but also not limited by time - a payment can be made every second, forming a continuous stream. This is called "streaming payment", or instant payment. The concept of streaming payments was first proposed by Andreas Antonopoulos, the author of "Mastering Bitcoin" in 2017. In 2019, Paul Razvan Berg realized streaming payment technology through Ethereum smart contracts and founded the project Sablier.

2. The realization method of stream payment

The realization of stream payment is through smart contracts and currency programming, and defines the directional relationship between two account addresses (sender and receiver). flow to the recipient for a certain period of time.

Based on different scenarios, the rules of smart contracts can be of different types, such as:

1. Fixed amount flow

This rule applies to scenarios where the payment amount and start and end times are clearly known, such as investments. From the start time to the end time, the stream flows to the receiver every second at a certain flow rate.

Flow rate = payment amount / (end time - start time)

flow balance = flow rate * (now - start time)

2. Fixed flow rate flow

This rule applies to scenarios with no fixed end time, such as payroll. After the start time, the stream flows to the receiver at a specified flow rate per second until it equals the maximum payment amount. In addition, it does not require an end time, increasing the maximum payment amount and extending the duration of the stream.

End Time = (Maximum Payment Amount / Liquidity Rate) + Start Time

flow balance = flow rate * (now - start time)

3. Instalment flow

This rule is applicable to the fixed-amount flow with a large amount, and the number of installments can be arbitrarily set for the fixed-amount flow, which will no longer occupy the cash flow.

It's important to note that the actual amount transferred in the stream is not the real amount, and we won't see these ongoing payments on every block. What is transferred in the stream is the "stream balance": the amount of money that the sender or receiver has at a point in time on the Stream Payment Protocol. The sender and receiver can end the stream at any point in time before the end of the stream, and withdraw to obtain the stream balance at that point in time.

3. Introduction of Stream Payment Project

The author will introduce the 4 streaming payment projects currently in the market from the perspectives of the deployed network, technical framework, product functions and interaction process.

1. Sablier

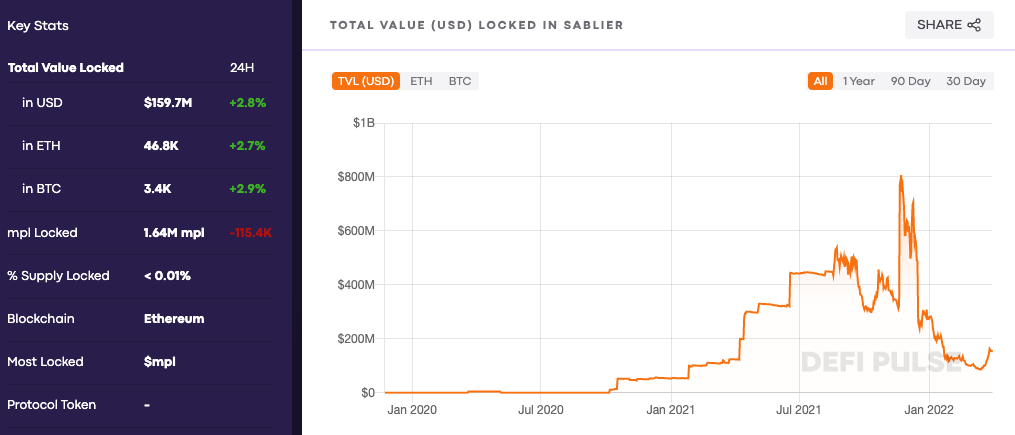

Sablier, the earliest streaming payment protocol, went live on December 14, 2019. According to the data of DeFi Pulse, as of the end of March 2022, Sablier’s total locked value (TVL) reached 158 million US dollars, and the peak period was in November 21, reaching as high as 800 million US dollars. Most of Sablier’s TVL comes from protocols that utilize Sablier for token unlocking. By using Sablier, projects can automate token unlocking and recipients can seamlessly claim tokens.

(Source: DeFi Pulse)

Currently, Sablier’s supported mainnets include Ethereum, Arbitrum, Avalanche, BSC, Optimism, and Polygon, while supported testnets include Goerli, Kovan, and Rinkeby. The tokens paid by each network are also diversified, including mainstream USD stablecoins, other legal currency stablecoins, Wrap assets, and some ecological tokens on the network.

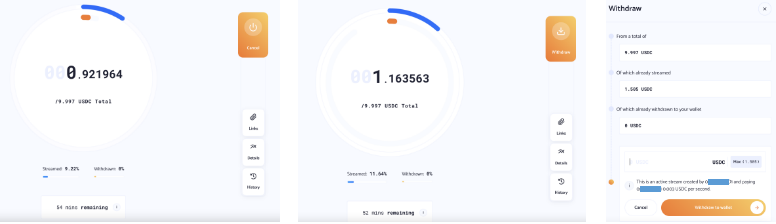

Beautiful UI and simple operation are Sablier's project features. Sablier provides an independent operation interface for both sender and receiver ( https://pay.sablier.finance/ and https://app.sablier.finance/ respectively). When the sender creates a streaming payment, the only information to choose and input is the token type, total amount, recipient address and duration (range from 1 hour to 20 years). During the process, the fees paid include network gas fees and deduction of a portion of the tokens in the stream as platform fees. After the contract is successfully created, the information sharing link will pop up on the Sablier interface; on the linked page, the sender can see the information such as the amount that has flowed out, the remaining time and the withdrawal amount of the receiver, or click the "link" to jump to the block The chain browser can view the information of the transaction, and can also click Cancel to terminate the transaction. If the flow is canceled before the specified stop time, the funds that have flowed out still belong to the recipient and the remaining deposits are returned to the sender.

The interface of the same stream of the receiver is also similar to that of the sender, the only difference is that the receiver can click the "Withdraw" button to withdraw the amount that has already flowed in. The recipient needs to perform a "withdrawal" operation for the funds to appear in the wallet balance; otherwise, the funds remain in the Sablier protocol.

(Source: Sablier's official website)

Sablier was acquired by Hifi Finance in July 2021 and has yet to issue tokens.

2.Superfluid

Superfluid has attracted much attention during the "swipe airdrop" period, and it was also one of the tasks of the Rabbit Hole. Initially, Superfluid was only listed on Polygon and xDAI Chain (Gnosis Chain), and is currently deployed on Arbitrum and Optimism. On the testnet side, Arbitrum Rinkeby, Avalanche Fuji, Goerli Testnet, Kovab Testnet, Optimism Kovab, Polygon Mumbai, Rinkeby Testnet and Ropsten Testnet are supported.

The Superfluid framework mainly has the following components:

(1) Super Agreement Framework

The Super Protocol is the cornerstone of Superfluid's ability to expand and add new features, and is at the heart of making payments LEGO. A protocol consists of a main contract and multiple protocol contracts. The protocol contract must be in the approved list, otherwise the main contract will not execute the protocol code.

More specifically, Superfulid currently has two protocols: First, the Constant Flow Agreement (CFA), the function is to allow the user's coins to flow out of the wallet; second, the Instant Distribution Agreement (IDA), The function is to let users send tokens to multiple recipients in one transaction. And only the independent use or combined use of the two protocols can realize many application scenarios. In addition, the project community is also exploring more innovative and practical protocols.

(2) Super Token Framework

The super protocol sets the "rules" for the behavior of super tokens. Super tokens include two types: Wrapper super tokens (the Wrap version of ERC20 tokens) and custom super tokens (tokens with no underlying assets on the network) . The former is encapsulated at a 1:1 ratio using the Superfluid protocol (subsequently, it can be redeemed at a 1:1 ratio at any time), and the latter is issued through the Superfluid protocol, which is also compatible with ERC777 and ERC20.

Superfulid has the following features in the token framework:

l The extended ERC777 token standard, which can respond to certain events through "Callback";

l Batch capability (Batch Capability), to achieve multiple transaction processing in the same transaction;

l Meta-Transactions, which implement transactions where one person creates and signs data off-chain and is executed by another person who pays gas fees.

(3) Super App Framework

Super App can "manage" the protocol and react to changes, this is also where developers write custom logic/behavior. More specifically, scenarios for protocol calls include:

l If the sender starts to flow tokens to the contract, CFA automatically flows another token (such as Wrapped tokens) to the receiver.

l If a project unlocks tokens, IDA will distribute the tokens to all investors.

In general, the real value of Superfluid is to effectively alleviate the two problems of key management difficulties and high gas costs, and further create a new composable and scalable value flow network, which is also the blockchain Fascinating part of the world.

In terms of stream payment operations, users need to wrap the tokens in the wallet or create custom tokens before creating stream payments. Next, the sender needs to enter or select information including: recipient address, token type, and flow rate (one-time, daily, weekly, monthly, and yearly). It should be noted that, in addition to one-time payment, streams of other rates will deduct a certain amount of margin (buffer), which will be returned when the user chooses to close the stream or deducted when the token balance is 0. The flow based on Superfield is a type of fixed flow rate. As long as the account has a token balance on the protocol, the flow will continue until the sender or receiver chooses to cancel it. The token received by the receiver is also a super token type, which needs to be displayed in the wallet address through the unwrap operation.

Superfluid is a project favored by capital. In July 2021, it announced that it has received a seed round of $9 million. Investment institutions include Multicoin Capital, Delphi Digital, and DeFiance Capital.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…