CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx Research Institute | Devotees in the field of Arbitrum-Layer2

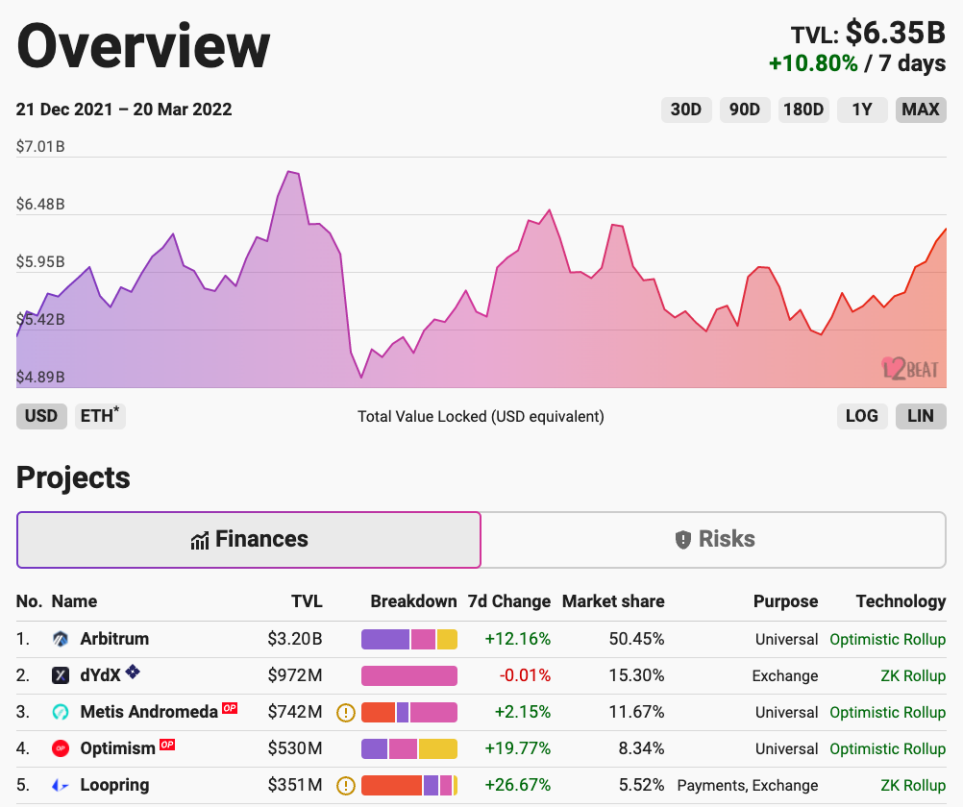

The Arbitrum network has been online for more than half a year. Although it was grabbed by various local dog projects at the beginning of its launch, the development of Arbitrum has not been shaken by these local dog projects. As of March 21, according to L2beat (Figure 1), Arbitrum's TVL reached about $3.2 billion, and it is far ahead of many Layer 2 projects. The total TVL of all Layer 2 projects is about $6.35 billion, and Arbitrum's TVL accounts for 50%, which is 3.2 times that of the second-placed dYdX.

Figure 1: L2beat layer2 TVL leaderboard

Source: https://l2beat.com/#projects

Data as of March 21

Judging from the above data, Arbitrum is still favored by various funds and occupies a very important position in the expansion of Ethereum. And Offchain labs announced the launch of Anytrust Chains on March 2, adding a touch of imagination to the Layer2 track. Therefore, this article will be divided into two parts to introduce Arbitrum. The last part will make a brief review of Arbitrum, analyze its competitiveness from the user's point of view, and compare similar projects. The next part will introduce the details of Arbitrum's native ecology and analyze the future development prospects.

Introduction to Arbitrum

Arbitrum is a scaling solution for Ethereum, created by Offchain labs, the team raised $120 million in Series B funding in 2019, with investors including Pantera Capital, Polychain Capital, Coinbase and many other leading investment institutions.

Arbitrum is cheap and fast, and transmits all transaction information back to the Ethereum main chain. For a simple comparison, Ethereum can process about 14 transactions per second, and the transaction gas fee varies according to the degree of network congestion, and the gas fee even soars to hundreds of dollars during congestion. While Arbitrum has 40,000 TPS, the gas fee is about $0.6 per transaction. And Arbitrum fully supports the Ethereum Virtual Machine (EVM), which means developers can directly integrate their Dapps with Arbitrum, reducing redevelopment time.

The working principle of Arbitrum is actually easy to understand. In short, Arbitrum packages many transactions or things together, settles them on a proprietary sidechain, and then reports the transaction data to the Ethereum main chain. Arbitrum employs a technique called Optimistic Rollup, which compresses the data of blockchain transactions and rolls up (aggregates) them into a single transaction. The advantage of this is that the blockchain only needs to process a single transaction without having to confirm the single transaction contained in the Rollup, saving not only time but also transaction gas fees.

Arbitrum's security guarantees are enforced by validators. The premise of Optimistic Rollup assumes that all transaction data is correct, but if a validator suspects fraud, the transaction can be disputed through a dispute resolution mechanism. Therefore, Optimistic Rollup has a challenge period. If the verifier finds suspicious transactions, the challenged transactions can be recovered during this period after the challenge is successful. Because of this setting, it only takes about 10 minutes to transfer funds from the Ethereum mainnet to Arbitrum, and it takes about a week to transfer funds from Arbitrum back to the Ethereum mainnet.

Competitiveness of Arbitrum

Considering the competitiveness of Arbitrum, it may feel obscure compared to analyzing the technical differences between different Layer 2 projects. We might as well start from the user's point of view, what do users really need? One is a good user experience, and the other is to ensure the security of assets. The following article will analyze these two aspects.

From the perspective of user experience, users pay more attention to the speed of the transaction and the level of each gas fee during the transaction process. From this perspective, Arbitrum's competitors are not only Layer 2 projects, but also high-performance Layer 1 main chains such as Solana, AVAX, and BSC. They also have the characteristics of high TPS and low handling fees, and cross-chain assets are fast, and there is no need to wait for a long time to exit.

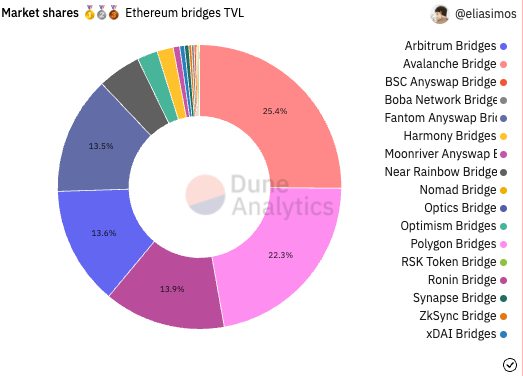

In 2021, with the successive outbreak of Layer 1 and Layer 2 projects, Ethereum assets will gradually overflow. Judging from the market share outflow from Ethereum, AVAX currently ranks first in market share, followed by Polygon and Ronin, and Arbitrum ranks fourth.

Figure 2: Ethereum’s market share of outgoing cross-chain bridges

Source: Dune Analytics @eliasimos

Data Deadline: March 22 Judging by the above rankings, Arbitrum is not the best choice. One of the reasons is that the gas fee on Arbtrium is not dominant in AVAX, Polygon, Solana and other Layer 1 projects with gas fees at the $0.00X level. However, the Arbitrum team said that in the future, the gas fee will be reduced by increasing the speed limit and increasing the network capacity, and will gradually reduce the fee as the transaction volume on the Arbitrum network increases. Second, Arbitrum does face the limitation of a cross-chain cycle. For users with high capital flexibility needs, waiting for a week to transfer out is a big concern. But at present, many cross-chain bridges that support Arbitrum have solved this problem. For example, the Hop protocol uses intermediate assets and AMM mechanism to cross-chain, which can reduce the waiting time of Arbitrum’s second-layer assets.

Still, Arbitrum has its advantages. One of the biggest attractions is that the EVM is fully compatible. For developers, it is possible to quickly compatible applications on Ethereum to Arbitrum, keeping the code unchanged, and the migration cost is low. For users, it is possible to use the native protocol on Ethereum at a lower cost, which is a good boon for loyal users who criticize Ethereum for being too expensive. There are currently over 150 Ethereum-native projects running on Arbitrum one, including leading protocols or Dapps for various infrastructures. And on March 2, 2022, Offchain labs announced the launch of Anytrust chain, which will run with Arbitrum one to further optimize and adapt to the game and NFT fields. At that time, Arbitrum can not only radiate DeFi protocols, but also NFT, GameFi, etc. Projects are included.

In terms of asset security, we need to pay attention to two points, one is the network protocol security, and the other is the risk of being attacked by hackers across the chain.

Network protocol security: Arbitrum, as the side chain of Ethereum, has the same security as Ethereum, so the security of Arbitrum has a high guarantee.

Cross-chain risk: It is not difficult to see that security problems have occurred when major high-performance Layer 1 cross-chain Ethereum assets. For example, the cross-chain bridge project Wormhole on Solana was attacked, and the cross-chain bridge of THORchain suffered three consecutive malicious attacks. Lost nearly more than $16 million. When assets are crossed from Ethereum to other Layer1 or sidechains, they are at risk of being hacked. When the assets of Ethereum are cross-chained to Arbitrum, because of the mechanism of Rollup and review period, the risk of being successfully attacked by hackers can be greatly reduced.

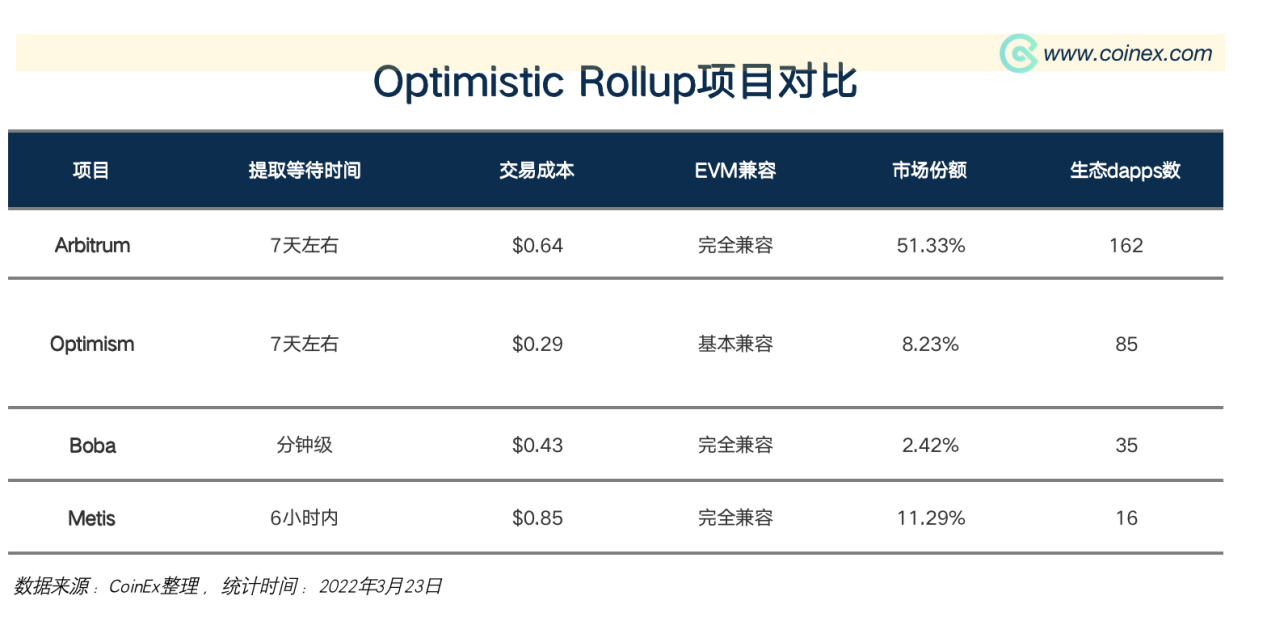

Here we can't ignore other Layer2 projects that also use Optimistic Rollup technology. Projects currently using the technology include Optimism, Metis Andromeda and Boba Network. Metis and Boba are a fork of Optimistic, optimized for blockchain scaling performance and gas fees.

Table 1: Comparison of Optimistic Rollup Projects

As can be seen from the above figure, Arbitrum's fees are still higher than several other projects that are also Optimistic Rollup. The biggest difference between Optimism and Arbitrum is compatibility. Therefore, although the launch time is not long, the market share and the number of ecological Dapps are very different. In addition to this, Boba and Metis are also optimized for withdrawals, instead of waiting a week or so, assets can be transferred out in minutes or hours. The advantage of Arbitrum lies in its rich ecology, and such a high market share also benefits from the expansion of its ecology.

Arbitrum Ecology

As mentioned above, since Arbitrum is highly compatible with Ethereum EVM, large-scale infrastructure projects on Ethereum have been deployed to Arbitrum at the beginning of its launch, allowing users to play on Ethereum with low fees and high-speed experience. projects, such as Uniswap, Sushiswap, Balancer and other Dex, Curve Finance, Abracadabra Money and other stable currency protocols, Ren, Multichain, Synapse and other cross-chain bridge projects have supported the Arbitrum network. This is a key step in Arbitrum's ability to quickly grab market share. It provides users who are accustomed to using the Ethereum protocol with a smoother transaction experience and lower handling fees.

In this part of this article, we will not repeat the native protocol of Ethereum, but will focus on the high-quality native protocol on Arbitrum. The following will introduce several ecological projects worth noting on Arbitrum.

Dopex

Dopex is a decentralized options platform that provides liquidity to option traders through an option pool, and enhances the interests of both buyers and sellers of options contracts through a rebate (rebate) system and arbitrage functions. The protocol was created by an anonymous team of 18, with @tztokchad and @witherblock at its core, with investments from DeFi KOLs Tetranode and DeFiGod1.

The core function of Dopex is to provide a single-currency collateralized option library (SSOV), which allows users to lock up tokens for a specified period of time and earn income on their collateralized assets. A user deposits an asset into a contract, and the system sells the user's deposit to the buyer as a call option, which is exercised at a fixed price at the expiration of each period of their choice. Simply put, users deposit assets to sell a call or put option, and correspondingly, there will be buyers who buy call or put options for hedging.

Similar to the logic of traditional options, for an option pool where a user deposits a call option, if the price of the underlying asset rises, the single-currency pledged option pledger can retain its dollar value, that is, the buyer exercises the option and the seller sells it at the exercise price. Token; if the price of the underlying asset falls, i.e. the buyer chooses not to exercise the right, the seller can still retain the value of their token. In both cases, stakers can earn option returns and DPX rewards. Options will be charged in proportion to liquidity, while DPX rewards will be issued in proportion to strike prices close to at-the-money.

A dual-token economic model is adopted in Dopex, with DPX as a governance token and a protocol fee token, and fees charged in protocol pool purchases, swaps, transaction pool fines, and policy vaults are denominated in DPX, and 15% of all fees charged will be Proportionately distributed to DPX holders after each epoch (epoch). rDPX is used as a Rebate token. In order to eliminate the risk of loss caused by extreme bands, option holders can receive rDPX tokens for compensation in each epoch. rDPX can be used to mint synthetic assets, or as collateral to further expand asset exposure.

Sperax

Sperax is a decentralized stablecoin protocol that utilizes both staking and algorithms. Its stablecoin USDs is backed by external assets + its governance token SPA. Mint USDs by burning the SPA and adding some collateral. USDs are held stable through collateral and algorithmic stability (arbitrage).

The background of investment institutions and teams is luxurious. Sperax completed a $6 million financing at a valuation of $200 million. Institutions such as Amber Group, Alameda Research, Jump Capital and well-known DJ Steve Aoki invested by purchasing Token SPA. The team includes former Terra core researcher Nicolas Andreoulis, and Harvard professor Marco Di Maggio.

Unique to Sperax is the dynamic transition between algorithmic and collateralized stability. The ratio of money supply to collateral in the algorithm is determined through an on-chain mechanism. If the price is above the peg, the money supply will be algorithmically stable, and if the price is below the peg, the reliance on external collateral increases. The main difference between USDs and other decentralized stablecoins is the automatic earning feature, which is built into the stablecoin and earns interest through the DeFi aggregator on Sperax.

GMX

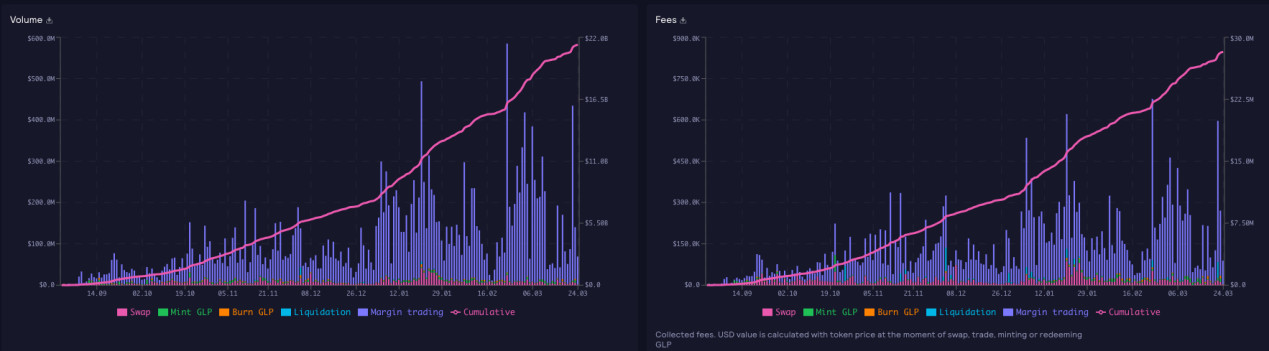

GMX is a decentralized perpetual contract trading platform on Arbitrum, which can trade ETH, BTC, LINK and other currencies with up to 30 times leverage. GXM focuses on low swap fees and zero-slippage transactions. It is currently deployed on Arbitrum and AVAX. AUM has reached 380 million US dollars. TVL ranks third among all Arbitrum ecological projects and has become the leader in Arbitrum's decentralized perpetual contract projects. By.

In order to ensure zero slippage in transactions, GMX does not use a pool composed of trading pairs, but instead, liquidity providers pledge ETH, BTC and other assets to the GLP pool, and a multi-asset GLP pool executes Swap and leveraged transactions. The GLP pool capacity is larger than the transaction pair pool capacity, and the transaction price is fed by the average price of Chainlink oracles and other DEXs, which can minimize the impact of slippage.

Its token economy also adopts a dual-token economic model. GMX is the platform governance token, which can be used for pledge, and holders can get 30% of the platform's income. GLP is the certificate that liquidity providers get when they deposit assets into the GLP pool, and the price of GLP is derived from the total value of assets in the GLP pool/the supply of GLP. GLP holders can get 70% of the platform revenue and can be fully converted into esGMX after one year. Quickly capture liquidity through token incentives, and its transaction volume and protocol revenue are also rising.

Figure 3: GMX transaction volume and fees

Source: https://stats.gmx.io/

Deadline: March 24, 2022

In general, the current Arbitrum ecological projects focus more on infrastructure such as wallets and cross-chain bridges. The second is DeFi, especially the derivatives segment. Arbitrum's unique high-performance conditions provide fertile soil for derivatives projects, and also provide a ray of life for those projects that have been criticized for insufficient liquidity and high handling fees. Finally, Arbitrum's ecosystem in the NFT and GameFi market segments is relatively small. Currently, there are only three NFT market projects, and the transaction volume is small. NFT and GameFi have higher performance requirements for a side chain, some due programs need to further reduce costs, or extract NFT faster, as well as high-load capacity and transaction requirements in games. Therefore, Arbitrum will launch Anytrust chain in the future to adapt to the development of NFT and GameFi.

Future development prospects

In today's Layer1/Layer2 differentiated competitive landscape, where does Arbitrum go? When will the market explosion that belongs to Arbitrum be reached?

In fact, Arbitrum took a different path. As the side chain of Ethereum, Arbitrum is mainly to solve the scalability problem of Ethereum. The team has always maintained this original intention and continuously improved its performance technically.

Regarding whether Arbitrum will issue a token, at the beginning of Arbitrum’s launch, the community believed that Arbitrum would follow the same route of airdropping native tokens to early users as other Layer 2 solutions. However, Off-chain labs have confirmed that they do not plan to offer any such native tokens.

Figure 4: Arbitrum twitter says it does not provide native tokens

Source: twitter @arbitrum

When the announcement was made, the TVL growth rate of the Arbitrum network slowed significantly, and it even lost about 50% of its TVL after that. But looking at it now, this 50% TVL is just the beginning, abandoning impetuous speculative capital and devote myself to practice. They are not in a hurry to release native tokens to gain vested interests. Instead, they have injected a shot in the arm for the development of Arbitrum, deeply cultivating technology and developing ecology, and then expanding their influence.

Judging from the latest plans released by Offchain labs, they will continue to upgrade the Arbitrum protocol. First upgrade Arbitrum One to Arbitrum Nitro, and then launch Anytrust chains to develop the NFT and GameFi markets.

In the future, Arbitrum may not only play the role of leading Ethereum's Layer 2, but may even extend Rollup to other Layer 1 projects to open up a larger pattern of public chain integration and development.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…