CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

Traditional venture capital has accelerated its entry into the encryption field, and talked about the investment potential of the encryption field

In March of this year, Coindesk reported that Bridgewater Associates, which has a total asset management scale of $150 billion, plans to back a crypto investment fund to start entering the crypto space.

Bridgewater Associates Bridgewater Fund was founded in 1975. As a senior traditional venture capital institution, this high-profile entry into the encryption field seems to mean an investment signal. In fact, before this, investment institutions such as Grayscale, Sequoia Capital, a16z, Three Arrows Capital, ViaBTC Capital and other investment institutions have already started investing in the crypto market.

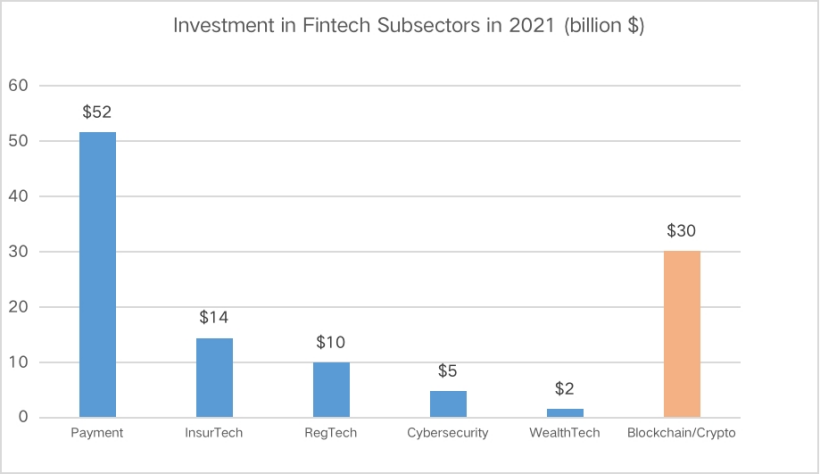

According to the "Global Insights" report, the total global investment in fintech in 2021 will reach 210 billion US dollars, and the blockchain track, one of the sub-sectors of fintech, is making rapid progress, with the total investment soaring from 5.4 billion US dollars in 2020. At $30 billion by 2021, it ranks second in total investment in the fintech sub-category, far ahead of insurtech, regtech, cybersecurity tech and wealth tech. From an investment perspective, in 2021, the crypto space has finally gained market value, and countless companies are trying to make breakthroughs in the crypto space.

Source: FinTech Trends (2H 2021), Global FinTech Investment Analysis, KPMG International (Data provided by PitchBook), *as of December 31, 2021.

Why is the crypto space so beloved by investment institutions?

In the traditional investment industry, the 2021 IPO class is up only about 1.6% in 2021, according to Bloomberg data, and the shares of 347 companies listed in the U.S. in 2020 are only up about 46% from their offering prices in 2022; according to Credit Suisse (Credit Suisse) The latest 2021 "Global Investment Return Yearbook" shows that in the 122 years since 1900, the annualized real return of the global stock market has reached 5.3%, the return of bonds has reached 2.0%, and the return of short-term treasury bills has reached 0.7%. Even the highest-returning, low-volatility U.S. (equity, bond) market has only delivered an annualized real return of 6.7% since 1900.

In the field of cryptography, GameFi's leading project AXS, which will be launched in 2021, has achieved an increase of 20,240% in just one year, followed by SOL and MATIC, which also have an increase of over 10,000%. (As shown below)

The picture comes from the data of 98KDAO

In addition to last year's AXS, STEPN, which has been on fire recently, is also one of the successful cases in the encryption field. In January this year, STEPN announced the completion of a $5 million seed round of financing. In addition to Sequoia Capital and Folius Ventures, investment institutions such as ViaBTC Capital and Solana participated in the investment. STEPN has grown steadily since its listing in late March, with a return on investment (ROI) of 29,000% to date. The success of STEPN is by no means accidental. For details, please refer to the analysis report of the project by ViaBTC Capital, one of its investors: "ViaBTC Capital | STEPN: A Gamification Model of Web 3.0 Applications" . ViaBTC Capital is a wholly-owned investment brand under ViaBTC Group, focusing on investing in Web 3.0, Layer 2 and DApp application projects combining DeFi, NFT or DAO elements. Although ViaBTC Capital was only established last year, its investment portfolio has involved multiple crypto subdivisions and has tapped many potential crypto projects, STEPN is one of them.

It is undeniable that the investment potential of the crypto market cannot be underestimated, and it may be favored by more and more investment institutions in the future.

Market Investment Potential in the Crypto Sector

In 2021, many investment institutions have begun to see the potential value and various possibilities of the blockchain, and the great harvest of the crypto market has also accelerated the emergence of many emerging investment institutions. ViaBTC Capital, which focuses on investing in the field of encryption, is a leader in emerging investment institutions. , at the beginning of its establishment, an investment fund of 50 million US dollars was set up to fully support the development of blockchain industry infrastructure and applications.

On April 6, 2022, at the Bitcoin 2022 conference in Miami, well-known investor Kevin O'Leary discussed the upcoming wave of crypto investment: "The leader of capital will pour into the industry like never before". In the future, blockchain technology is likely to be applied in various fields of the global financial economy and other industries, and it will be an irresistible trend for investment institutions to enter the field of encryption.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…