CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx|Understand the three prices of contract transactions in one article

CoinEx|Understand the three prices of contract transactions in one article

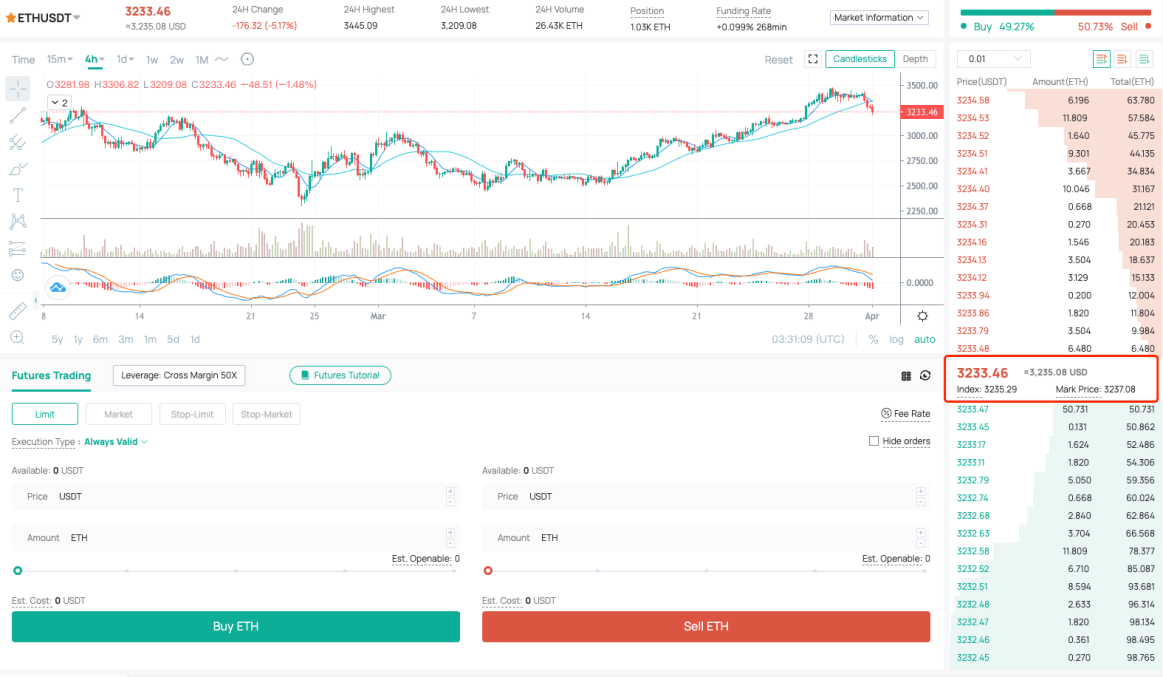

When we are conducting contract transactions, we will find that the page of contract trading is somewhat different from that of spot trading. There are three prices in the middle of the trading market, namely the latest transaction price, the index price and the marked price. In the contract, these three prices have different functions, and it can be seen that there will be some numerical differences, so this article will introduce to you, what kind of connections and differences these three prices have.

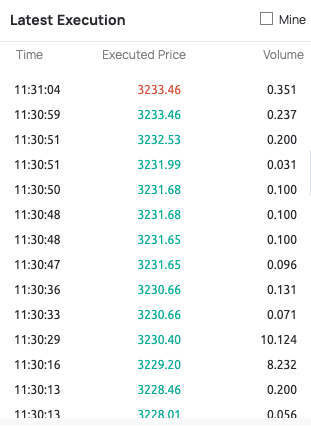

Latest transaction price

The latest transaction price refers to the latest transaction price in the current market. In the latest transaction list on the transaction page, the price of the last transaction is the source of the latest transaction price. Through the latest transaction price, you can see the transaction status of the current market.

index price

The index price is a mechanism introduced by cryptocurrency exchanges to prevent market price anomalies on a single platform. Index prices on exchanges are usually weighted based on spot prices on multiple exchanges. The main feature of the index price is that it uses the spot price of multiple exchanges instead of the spot price of a single exchange as the basis for the contract price, and it is much more difficult to manipulate multiple market prices than a single market, so the index price can be used. A more fair reflection of the real market price can better serve as an important reference when investing.

In the CoinEx exchange, the index price selects a number of mainstream exchanges as the index weight components, and the price is updated every 5 seconds. If the weight exchange does not have a trading pair of the pricing currency, CoinEx will exchange the exchange rate for the pricing supported by the index price. If there is a system maintenance on the currency and weight exchange or the latest transaction price and volume are not updated within 15 minutes, CoinEx will temporarily remove the weight of the exchange, and the other exchanges will share the weight.

mark price

The mark price is based on the index price, plus the funding fee. In CoinEx, the mark price is calculated as follows:

Mark Price = Index Price * (1 + Funding Basis Rate), Funding Basis Rate = Funding Rate at the Last Settlement Time Point * (Time to Next Funding Payment / Funding Rate Interval)

The mark price is a more reasonable estimate of the perpetual contract price. In the traditional futures market, the latest transaction price is mainly used to calculate the profit and loss and as the basis for liquidation, but most of the reference prices for forced liquidation of perpetual contracts in the crypto market will not be based on the latest transaction price, but the marked price. This is because if the liquidity of the exchange market is insufficient or the price fluctuates violently due to malicious manipulation, once the liquidation is determined according to the latest transaction price, the user's position will easily be liquidated unnecessarily.

Therefore, it is more reasonable to use the marked price as the basis for contract liquidation, which can protect the rights and interests of users, reduce unnecessary capital losses, and improve the stability of the contract market.

This is the main difference between the three prices of contract transactions. Everyone must distinguish the different effects of different prices when experiencing contracts, so as to make better investment decisions.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…