CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx | A must-see series for trading beginners: What are limit orders and market orders?

In contract trading, a limit order is a contract order that the user buys or sells in the market at the price specified by the user, while a market order is a contract order that the user executes at the current market buying or selling order price.

There are two types of orders for users to place limit orders, one is limit order and the other is planned limit order; there are also two types of orders when placing market orders: market order and planned market order. Below we will explain the four types of delegation respectively.

1. Limit order

1. What is a limit order?

Limit order means that the user buys or sells at the specified price, and the transaction can be executed when the market price fluctuates to the price set by the user. Under this type, there are 4 valid mechanisms for contract transactions, which are [Always valid], [Immediate transaction or cancellation], [All transaction or cancellation] and [Only Maker].

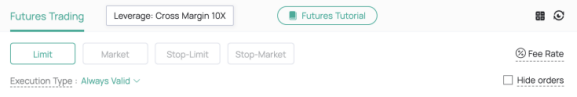

2. How to set a limit order in a contract

Taking the BTC/USDT contract market as an example, assuming that user A buys (longs) BTC at the USDT limit price, the general operation is as follows:

(1) Set the margin mode and leverage multiple, here is 10 times for the entire position;

(2) Select the [Limit Price] order type, and the default effective mechanism is [Always effective];

(3) Set [Buy Price] to 50000 and [Buy Amount] to 0.1;

(4) Confirm [Transaction Amount] and click to buy BTC.

Then, after the limit order is successful, the contract order will be sent to the market, and the order will be filled when the BTC market price fluctuates to 50000USDT.

2. Plan price limit

1. What is a planned price limit?

The planned limit price refers to the preset trigger conditions and the order price and quantity. When the latest market transaction price reaches the trigger conditions, the system will place an order at the limit price according to the pre-set order price and quantity.

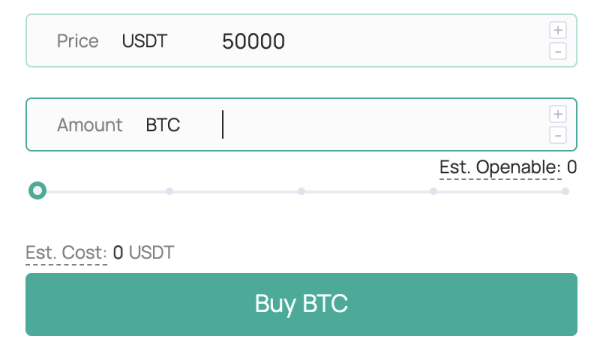

2. How to set the plan limit price

Also taking the BTC/USDT contract market as an example, if user A believes that BTC will encounter greater resistance when it rises to 53,000USDT, he can set a plan to sell at a limit price. The general steps are as follows:

(1) Set the margin mode and leverage, and select [Plan Limit];

(2) Set the [Trigger Price], which is set to 53000 here;

(3) Set the [Ask Price], which is set to 53000 here;

(4) Set [Sell Amount], which is set to 0.1 here;

(5) Click [Sell BTC].

After the order is successful, the order will not be sent to the market immediately; when the latest market price of BTC reaches 53,000USDT, the plan order will be triggered, and the system will send the pre-set order (sell 0.1 BTC at the price of 53,000USDT) to the market. into the market.

3. Market order

1. What is market order?

The market order is based on the user's order quantity, and the order is executed according to the price of the current market counterparty's buy order or sell order. time, the delegation cannot be submitted.

2. How to set up a market order

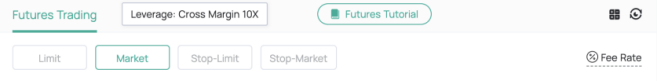

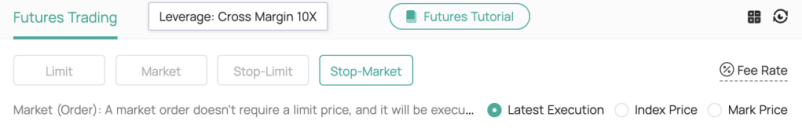

Taking the BTC/USDT contract market as an example, if user A entrusts a long BTC purchase through the market price, the general operation is as follows:

(1) Observe the current market selling depth;

(2) Select the margin mode and leverage, and select the [Market Price] order type;

(3) Set [Transaction Amount], which is set to 0.1 here;

(4) Click [Buy BTC].

After the order is successful, the order will be sent to the market and executed at the best price in the market; it is worth mentioning that if the user's buying volume is large, please pay attention to the current selling order depth to avoid large slippage due to insufficient market depth point.

4. The planned market price

1. What is the planned market price?

The planned market price refers to the preset trigger conditions and quantity. When the latest market transaction price reaches the trigger conditions, the system will place an order at the market price according to the pre-set quantity.

2. How to set the planned market price

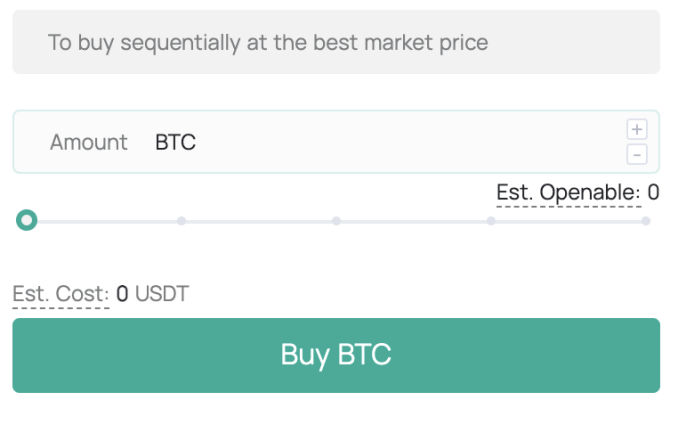

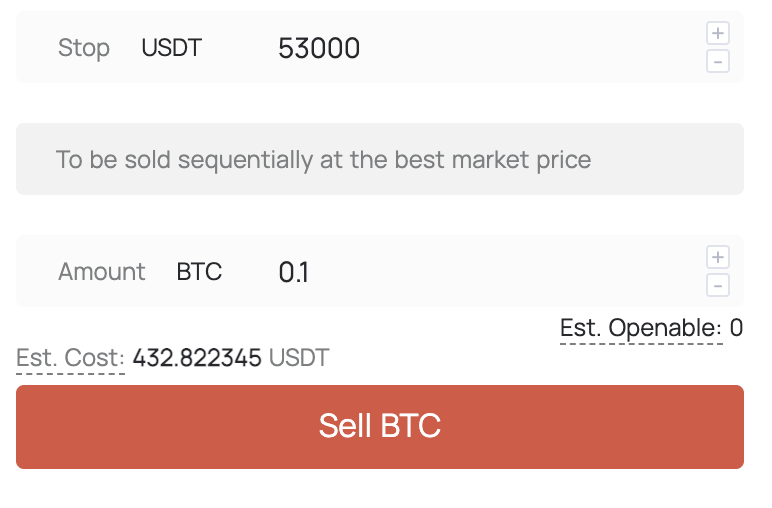

Still in the above example, assuming that user A thinks that BTC will encounter greater resistance when it rises to 53000USDT and plans to sell, then the planned market price can be set as follows:

1. Select the margin mode and leverage, and select [Planned Market Price];

2. Set the [Trigger Price], which is set to 53000 here;

3. Set [Sell Amount], here it is set to 0.1;

4. Click [Sell BTC].

After the order is successful, the order will not be sent to the market immediately. When the latest BTC price reaches 53,000USDT, the planned order will be triggered, and the system will place the pre-set order (selling 0.1BTC at the market price) in order of the best price in the market. Sell until all is sold.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…