CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx|The bigger the position, the higher the maintenance margin rate? Why?

In contract trading, the most common term that users come into contact with is margin. After all, margin is closely related to the size of your position and whether it is liquidated or not. The two most important concepts of margin are the initial margin and the maintenance margin. The initial margin refers to the margin required to open a position, and the maintenance margin refers to the minimum margin level required to maintain the current position.

The maintenance margin rate is mainly used by the system to determine whether to trigger the forced liquidation mechanism. When the user's margin rate is less than the maintenance margin rate required for the user's current position + the liquidation fee rate, the system will automatically trigger the forced liquidation, which is what we call Say burst. In the isolated position mode, margin rate = (initial margin + additional margin - reduced margin + unrealized profit and loss) / opening value; in cross-position mode, margin rate = (available margin + initial margin + additional margin - reduced margin + unrealized profit and loss) / open position value.

We can use the formula to calculate the margin rate at any time, so how to check the maintenance margin rate?

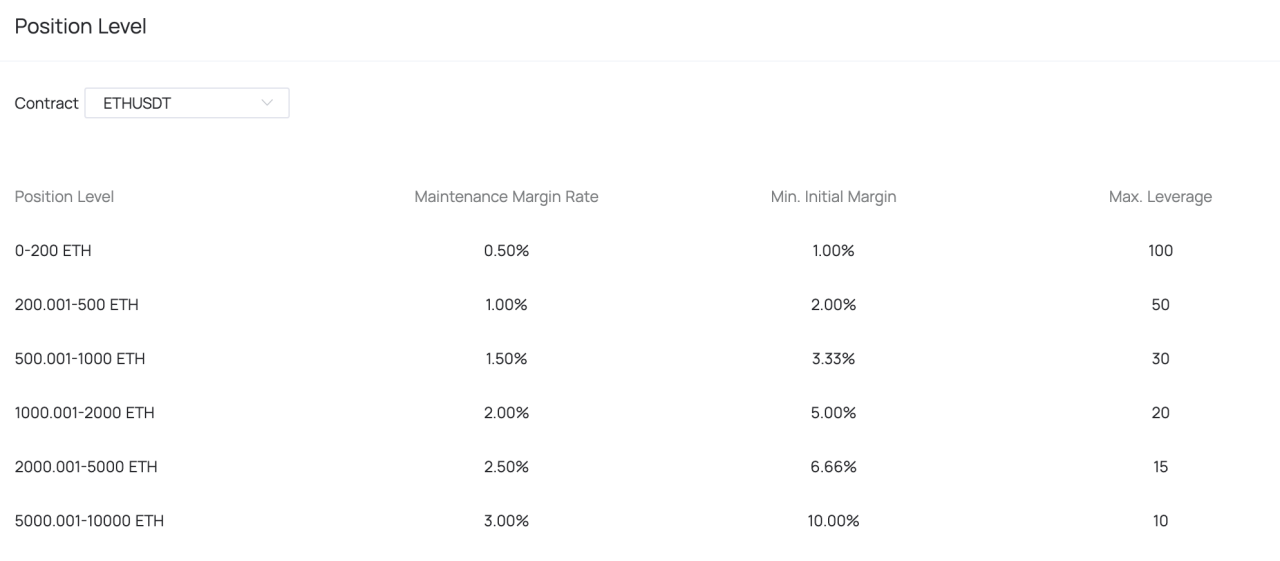

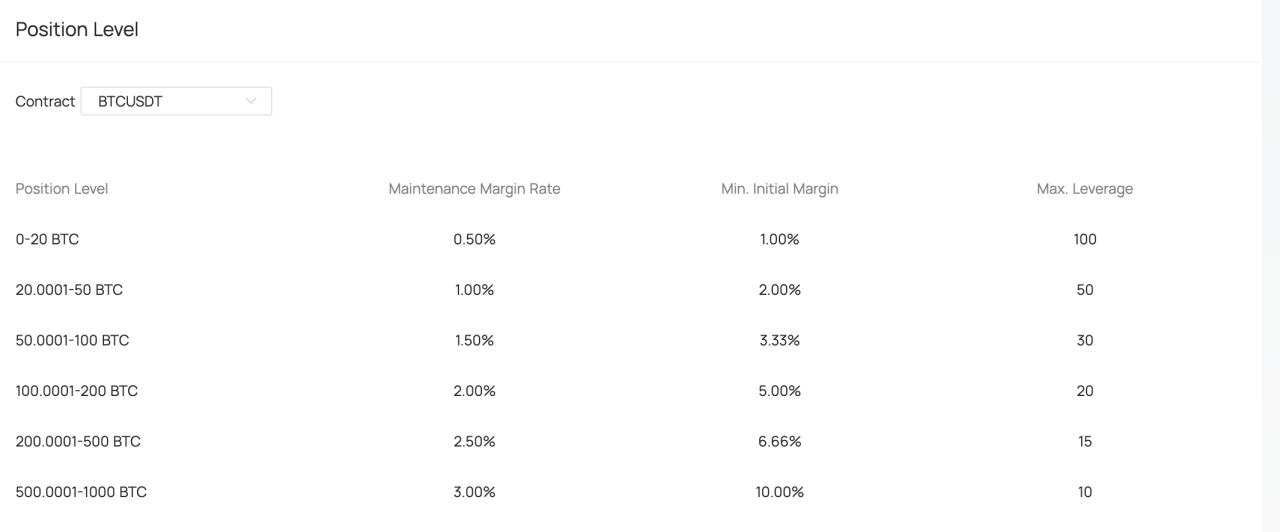

In CoinEx's contract market information, we can check the current maintenance margin rate of each pair of contracts on the platform at any time.

We will find that the maintenance margin rate given by the platform is different according to different positions. This is because CoinEx adopts a system of tiered maintenance margin rates. That is to say, the larger the user's position, the higher the maintenance margin rate of the user, and the lower the maximum leverage that can be selected.

The main purpose of this design is to prevent a relatively large impact on market liquidity when large positions are forced to close. Because if a user with a large position is liquidated, it is equivalent to a large order on the market. At this time, it may occur that the order cannot be liquidated at the liquidation price because the market liquidity cannot meet the large order. settlement situation.

If this large position is finally traded at a price that is much lower than the liquidation price, the position loss may exceed the previously invested margin, that is, there will be a relatively large loss of position penetration. Although CoinEx provides insurance funds for advance payment, the loss of large positions under high leverage may exceed the expected value. Once the contract insurance fund is not enough to cover the loss of positions, the liquidated position will be automatically reduced by the system (ADL), in which case other users may experience an automatic reduction event.

In order to better protect the interests of users and try to avoid situations where users with large positions are forced out and other users experience automatic reduction of positions, CoinEx designs different maintenance margin rates, minimum initial margin rates, and maximum leverage multiples according to different positions. Limiting the maximum openable leverage for huge positions and increasing the maintenance margin ratio will greatly increase the margin requirements for huge positions, so as to ensure that the margin can cover the loss of the position as much as possible in the event of a forced liquidation event.

For example, when the value of your BTCUSDT contract position is only 10 BTC, your position scale is 0-20 BTC, and you can open a contract leverage of up to 100 times, and the maintenance margin rate is only 0.50%; and when you open a BTCUSDT contract position value When reaching 200BTC, you can only open a maximum leverage of 20 times, and the maintenance margin rate also needs to reach 2.00%.

In CoinEx's tiered maintenance margin rate mechanism, the value of each contract's position in each direction is calculated separately. When investors hold two-way positions, the maximum value in the long and short direction will be used as the measure of the position level. For example, if a user holds a long position of 10 BTC and a short position of 30 BTC in the BTCUSDT contract, the position will be based on the maximum value of 30 BTC. Calculated, the gear range is 20.0001-50 BTC, and the maintenance margin rate is 1.00%.

The tiered maintenance margin rate system is a risk management mechanism that can effectively prevent huge losses from over-positioning. This mechanism can greatly reduce the triggering of the automatic liquidation mechanism and better safeguard the interests of each user. The maintenance margin rate of different contracts will also be different. Investors can check the relevant data in the market information of CoinEx contracts before opening a position.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…