CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx Research Institute: Decentralized derivatives are still a blue ocean market

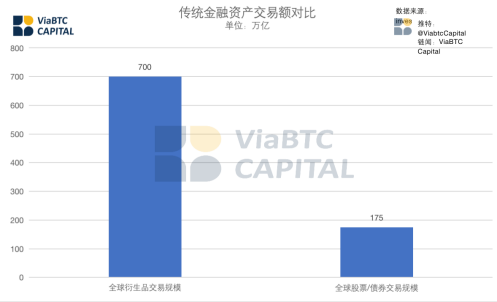

Warren Buffett describes derivatives as "financial weapons of mass destruction", from the original Dutch tulip futures to the various derivatives of the Chicago Stock Exchange, from a paper contract signed by a farmer's rice to the complex over-the-counter exotic options (Exotic Options) trading, derivatives have played a pivotal role in the financial world since its inception. According to the statistics of investing, the size of the derivatives market is exploding, and now there are more than 700 trillion US dollars worth of derivatives transactions in nominal value every year. What is even more amazing is that this number is the sum of the GDP of all countries in the world in the past 20 years. In 2020, the trading market size of stocks is 56 trillion US dollars, and the bond market is 119 trillion US dollars.

Put this number into the DeFi field, and you will find that decentralized derivatives are still a blue ocean market.

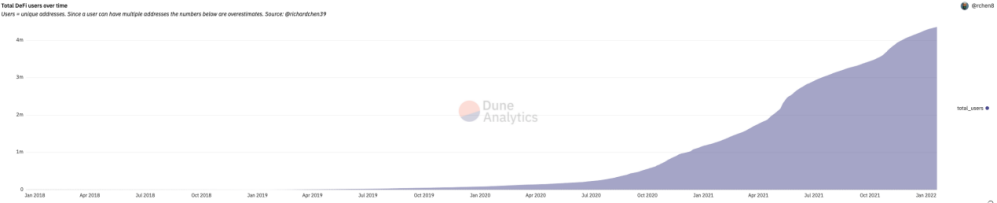

Looking back at the development of the DeFi i market, the number of DeFi users has grown exponentially since the beginning of 2020. By 2021, the year of DeFi that everyone is familiar with, a large number of high-quality projects have been launched, and the good product experience and the development of AMM have attracted countless participants. From Dune's data analysis, it can be seen that the growth momentum of DeFi users will continue until 2022, and it seems that there is no meaning to stop.

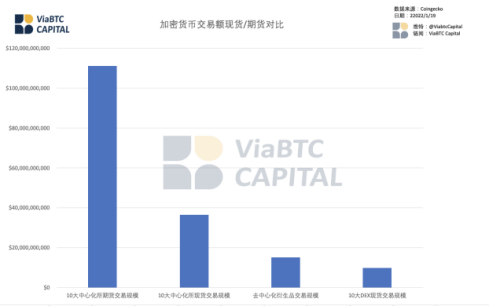

According to Coingecko’s statistics, the top 10 centralized exchanges’ spot trading volume in the past 24 hours was $36,586,809,509, while futures trading volume was $111,156,878,961. During the same period, the 24-hour trading volume of the top ten DEXs was $9,881,939,284, while the trading volume of the decentralized derivatives trading platform led by dydx was about $15,202,983,513.85.

In the traditional financial field, the trading volume of derivatives/spot is about 4X, and the ratio of centralized exchanges in the cryptocurrency field is about 3X based on sample data, while the ratio of decentralized exchanges is even lower, only 1.5X.

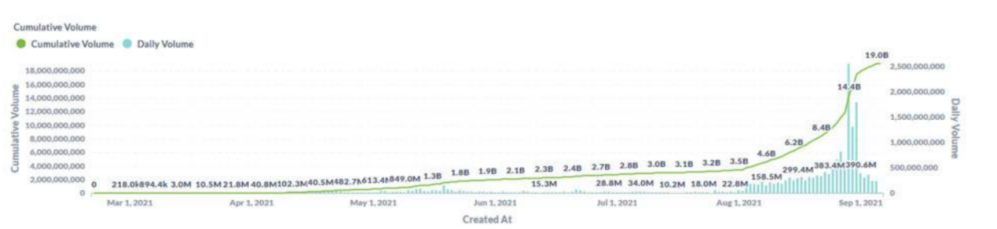

From the data comparison, the growth of derivatives is at least doubled. The increase of DeFi users and the urgently developed decentralized derivatives market are still the future development direction of DeFi. Indeed, the decentralized derivatives market in 2022 will also see substantial growth, especially with the launch of dydx products as a watershed, the speed and magnitude of growth have improved qualitatively. According to the official website data, since the opening of trading and mining in August 2021, a trading volume of 9.8 billion US dollars has been created. dydx carries the expectations of the explosive growth of futures DEX and even the entire derivatives decentralized trading market. Professional market makers conduct market making, and LPs provide part of the market making funds.

In addition to dydx, Perpetual is also an important challenger. Unlike dydx, PERP uses the pricing method of vAMM and provides perpetual contract products. A total of two generations of PERP products have been launched. In V1, PERP separates pricing and settlement and removes market makers, realizing a simple market structure of direct games between long and short parties; in V2 version, PERP is directly set up on Uniswap V3, and market making is introduced. It uses the Uniswap V3-style aggregated liquidity method to make the market, and realizes the mechanism of creating a market without permission.

From the data of the blockcrypto, the PERP protocol has been in the leading position in 2021, but since dydx launched transaction mining in August, dydx has firmly grasped the lead in transaction volume and has continued until 2022.

Both dydx and Perpetual are doing the futures market. There are more derivatives categories in traditional finance that can be tapped and developed. The entire decentralized derivatives market has ushered in a blowout development of potential projects, including derivatives strategy, Greek letter strategy , exotic options and other alternative investments. Next, we will introduce a few more distinctive but not yet issued derivatives projects:

1. Volare:

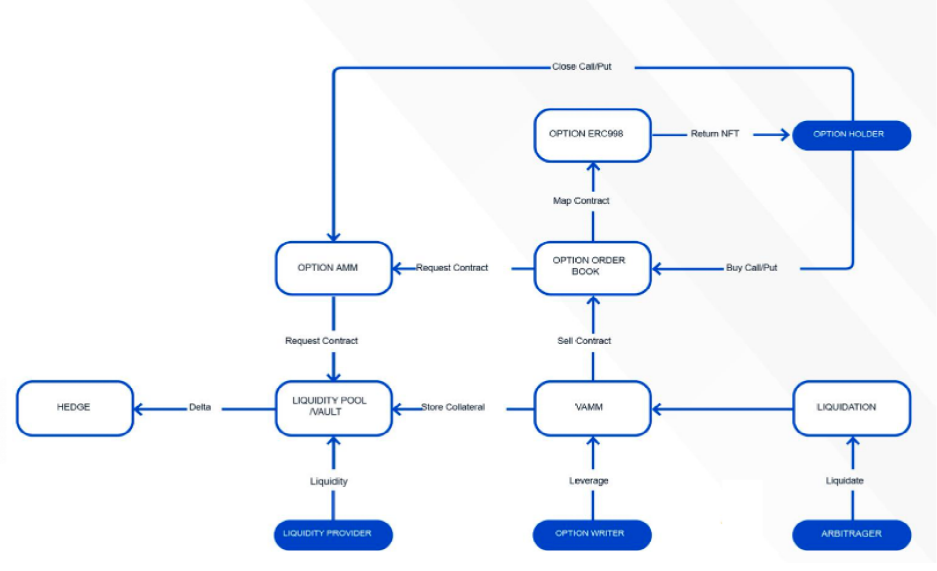

Volare is an exotic options derivatives project built on the L2 layer. The project team is a group of quantitative traders from Wall Street who are deeply involved in derivatives pricing and trading. They bring some complex and high-quality derivative products from traditional finance to blockchain finance. For example, they will produce a series of volatility products, including volatility futures, volatility index VIX, volatility algorithm tool suite, etc., so that traders can build their own personalized strategies. Traditional options strategies are also the focus of their products. Classic strategies include straddle, strangle, call/put spread, ratio spread and calendar spread, etc. At the same time, the pricing function is more rationalized through its own data analysis and vAMM model. Its features also include the use of implied volatility to calculate the mortgage rate, and the order book model provides an experience similar to that of a centralized exchange. At the same time, there will be built-in Computing tools to provide second-level price data to reduce the impact of latency, using NFT technology to make options available for trading, the project is built on Arbitrum to reduce ETH fees.

Its platform token is Volare, which has not yet been issued, but there are good mechanisms such as destruction, repurchase and pledge fee sharing to ensure the stability of the token price. Volare has completed the seed round of financing, led by DCG, and the participants include Genesis, QCP, ViaBTC Capital, etc.; its core advantage is the exotic option product, which fills this vacancy in the DeFi field. The future is unknown, but its occupation It is an important branch of this particular track, contributing to DeFi derivatives and a key step in decentralized finance.

2. Friktion:

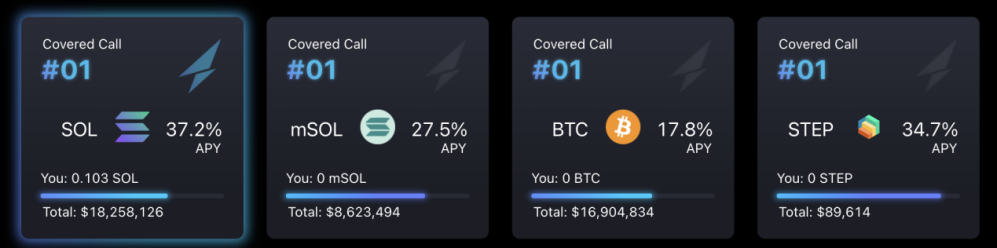

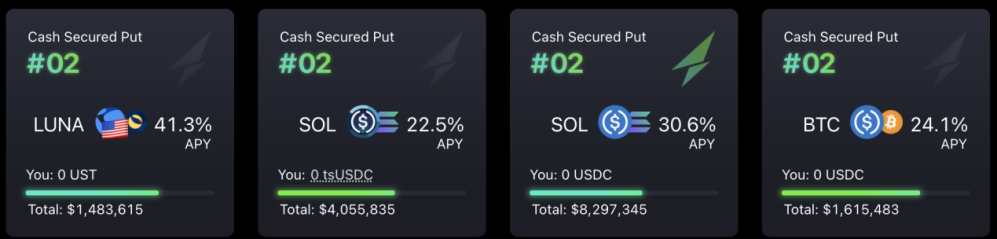

Friktion is a full-stack portfolio risk management solution built on Solana. It provides permission-free risk management strategies and risk-adjusted benefits driven by individuals, DAOs, and traditional financial institutions. Investors and LPs with lower risk appetite can both serve as liquidity providers of the strategy pool. They provide liquidity by providing their own assets in exchange for the fee share of investors with higher risk appetite or institutional hedging clients. Quantitative investors can choose the corresponding pool to arbitrage or hedge risks according to their established strategies. Now Friktion network provides 2 main strategies: covered call and cash secured put, mainly covering LUNA/BTC/ETH/SOL/mSOL and other trading pairs, TVL is now close to 100 million US dollars, APY is from the lowest 17% of BTC- The top 90% for MNGOs varies. Details can be found at:

https://docs.friktion.fi/product-overview/supported-assets

The Friktion project announced a $5.5 million financing in early 2022, with participation from Jump Capital, DeFiance Capital, Pillar, Libertus Capital, Delphi Ventures, Sino Global Capital, Tribe Capital, Castle Island Ventures, Dialetic, Petrock Capital, and Solana Capital .

3. Aperture:

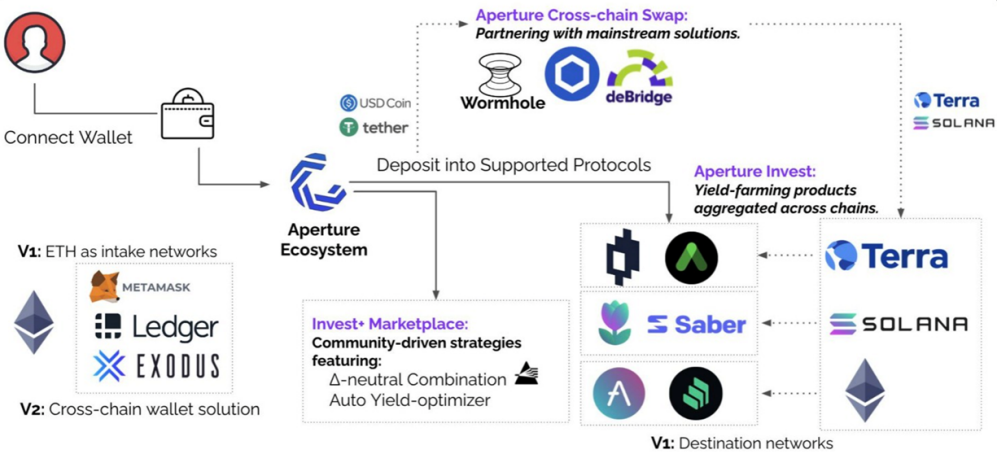

Aperture is a cross-chain investment strategy platform. Users can invest on Aperture, and Aperture will find the best cross-chain solution to help users cross-chain from one chain to another during investment transactions, realizing one-click cross-chain investment. Using "one-click cross-chain investment", users can complete currency exchange and investment between different chains without operating multiple wallets. Aperture first supports the investment of Ethereum assets, and will support other mainstream EVM compatible chains, Solana and Polygon and other public chains in succession.

The project is endorsed by well-known overseas institutions such as ParaFi Capital, Arrington Capital, Divergence Ventures and ViaBTC Capital, and has also received personal investment from the founder and CEO of Terra and partners of Dragonfly. In the early stage of the project, the main focus was on Terra's Mirror ecosystem, and the products are now mainly based on Delta-Neutral's strategy to gain benefits from quantitative hedging strategies in Terra's ecosystem. Its core team is mainly from large factories in the Bay Area, with technical background and a good academic background and development ability. Presumably, under the conditions of the increasingly vigorous development of Terra ecology, it will certainly have a good performance.

In the development process of DeFi, derivatives have become an indispensable and important part. Today, when decentralized derivatives have not been widely used and traditional financial institutions are constantly pouring in, we still have great expectations for the outbreak of these projects, expect the derivatives market to flourish, and look forward to DeFi ushering in the next spring.

*No Financial Advice

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…