CoinEx成立於2017年12月,是一家面向全球的專業數字資產交易服務商。聚集創新數字資產為核心,多年來良好的專案服務水準及優質資產篩選能力,為全球用戶提供全面且優質的投資選擇。 CoinEx中文繁體群:https://t.me/CoinExGlobalChinese

CoinEx|A must-see for newcomers: What are the risks of contract trading?

Regarding contract trading, most investors value its high leverage and high returns, but at the same time, it also means high risk. Unknown risks also discourage new investors and lack of grasp of market conditions. The so-called contract risk refers to the uncertainty of trading contracts, which may lead to the risk of loss of income or even loss of principal. Therefore, newcomers must fully understand the risks of contract transactions, and open contract transactions under the risk of being able to undertake contract transactions.

Contract transactions may involve the following risks:

1. The risk of price fluctuations. As a special product with investment value, the price of contract trading is affected by many factors, and the price fluctuates greatly. It is difficult for investors to fully grasp the market trend in actual operation, so there is the possibility of investment mistakes. If the risk cannot be reduced, It may suffer greater losses, and investors must bear the losses alone.

You can see the market fluctuations shown in the figure below. From 10:00-11:00 on March 16, 2022, the price of Bitcoin fluctuated greatly, and there were sharp rises and falls in a short period of time, which is difficult for investors to accurately Anticipatory.

2. Risk of forced liquidation. Investors need to know that contract trading is characterized by high leverage, which may lead to quick profits or losses. If the direction of the transaction is opposite to the fluctuation of the market, it will cause a larger loss. According to the degree of loss, investors need to increase the digital currency margin or reduce their positions, otherwise their positions may be forced to liquidate, and investors must bear all the losses caused thereby.

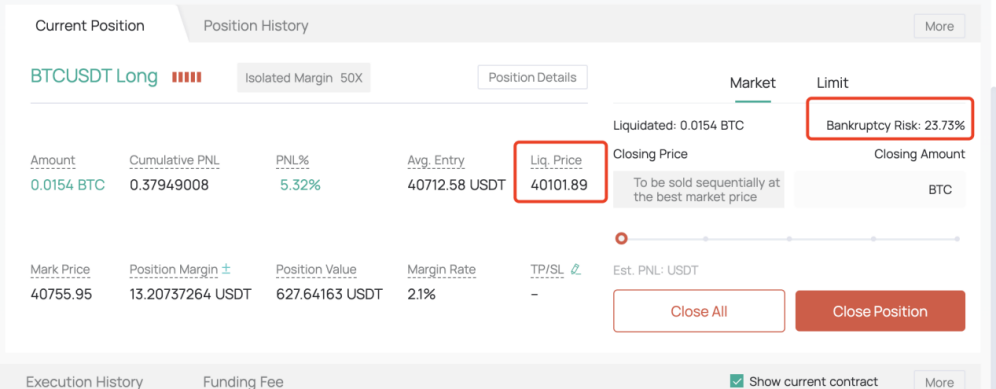

For contract transactions on the CoinEx exchange, there are the liquidation price and liquidation risk percentage of the well-marked position. Investors can refer to these two values to have a certain understanding of the liquidation risk of their own positions, and adjust their positions according to the risks. .

3. Transaction risks. In the contract trading system of the exchange, the order submitted by the investor is irrevocable once the transaction is completed. At the same time, the exchange does not guarantee profit to investors, and does not share benefits or risks with investors.

4. Policy risks. Digital currency contract transactions may face policy regulatory risks in a certain area. Investors need to understand the policy and regulatory background of the trading area before trading, and make trading judgments cautiously.

5. Risks caused by force majeure factors. Due to some factors beyond the control of the exchange, such as earthquakes, floods, fires and other force majeure factors or computer system, communication system failures, etc., investors' orders may not be executed or not fully executed, and investors need to bear the resulting losses. .

6. Other risks. When investors use high leverage to open contracts, it may bring greater risks to the investors themselves and the market. Generally speaking, trading platforms will take measures against this. For example, in order to maintain market stability, CoinEx will monitor positions that use excessive leverage. When CoinEx judges that investor positions may have a greater impact on market stability, it will take corresponding measures, including However, it is not limited to communication, exposure of risks, forced reduction of positions, forced liquidation of positions, cancellation of orders, etc., and written explanations will be given to investors. This is also a safeguard for other investors by the CoinEx exchange, providing a stable and safe trading environment.

The above are the possible risks of contract transactions. For new investors, it is necessary to carefully judge various risks and allocate funds reasonably for contract transactions.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…