Financial crises in history and the dollar index

The end of the gold standard era

The "Bretton Woods System" is that between July 1944 and 1973, most countries in the world joined the currency system with the US dollar as the international currency center and established a fixed exchange rate system pegged to the US dollar and gold , although it ended the chaotic The international financial order, but the " Triffin 's Dilemma" has occurred. Too much supply of US dollars cannot guarantee that all of them can be exchanged for gold. Converting the U.S. dollar holdings into U.S. gold reserves makes the U.S. dollar’s gold reserve stock gradually decrease, causing gold to soar and the U.S. dollar to depreciate.

In the " post Bretton Woods era ", after the issuance of the U.S. dollar, it is no longer linked to the exchange of gold , and the exchange rate between the U.S. dollar and the currencies of various countries no longer adopts a fixed exchange rate system, but instead adopts a "managed floating exchange rate system". In the Letton era , the United States no longer needed to keep pace with the economic scale of various countries in order to issue US dollars, and even had room to "actively" issue excess currency, so the issuance of US dollars was described as a wild horse, and even expanded the original global currency. The flaws of the dollar system , such as the "two oil crises", "hyperinflation" and "large exchange rate fluctuations" in the late 1970s, led to a severe recession in the world economy. At that time, France, Germany and other countries had vigorously criticized the unreasonable status of the US dollar as the leading currency, but because other countries could not find an alternative solution to the current situation, they had to accept the US dollar as the benchmark of the world monetary system. The benchmark is still in use today

US dollar index

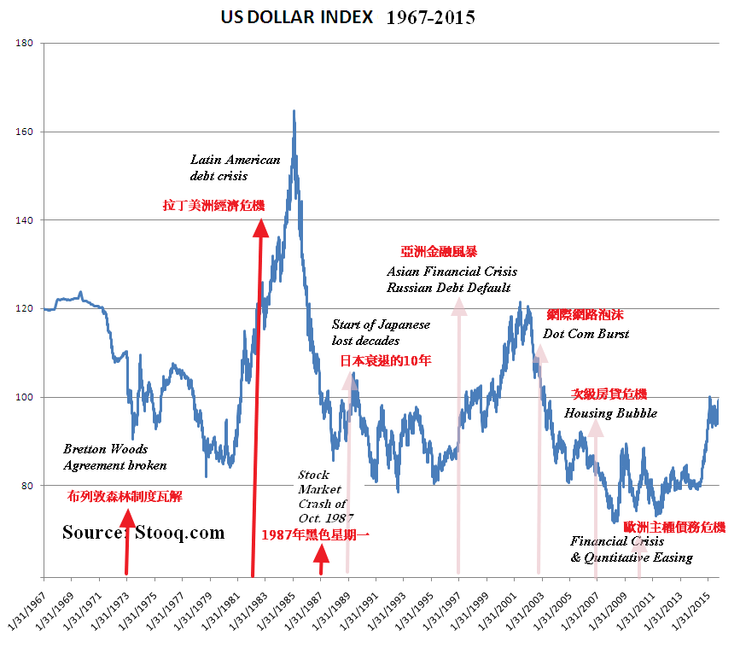

When two items with unequal liquidity adopt a fixed exchange rate system, when confidence is shaken, a run will occur and destroy the financial system. Therefore, after the US dollar index is decoupled from gold, it has laid the beginning of the era of the great dollar. After that, as long as a financial crisis occurs, it will affect the US dollar index. fluctuations, the two are entangled in a community of destiny

The U.S. dollar index is the exchange rate of the U.S. dollar against the euro, the Japanese yen, the British pound, the Canadian dollar, the Swedish krona , and the Swiss franc.

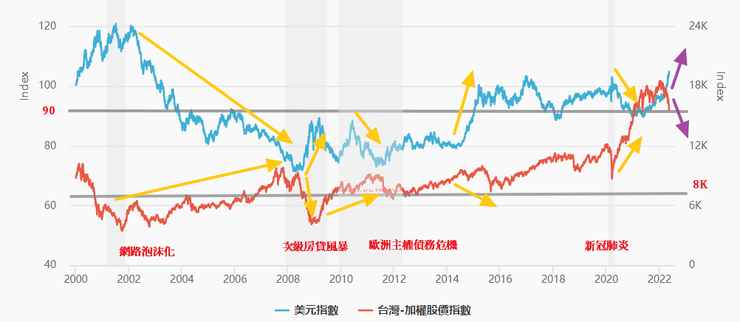

As long as hot money flows back to the United States, Taiwan, an emerging market, will be affected. The US dollar index will rise and the exchange rate of the Taiwan dollar will depreciate . No other currency system can replace this cycle of US dollar cycles. The duration of each economic crisis is different, and the power of shadow hair is also different. It is not the same, but long-term QE is a common practice in the era of the great dollar. QT is a necessary side effect, but it is also a shock to the financial market. Taiwan and the US dollar index are now inversely linked. The degree depends on the original level of QE. QT Unexploded ordnance is about to start

Your love/message/subscription is the best support

https://vocus.cc/article/6281a29afd8978000135e39e

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…