ACY證券總部位於澳洲雪梨,是一家擁有多國金融服務執照的多資產類別券商。 提供上千種國際流通性最大產品的交易服務,包含股票、外匯、大宗商品、指數和數字貨幣。 ACY證券始終秉承專業、誠信、公正的運營理念,為全球投資者進行資產委託帳戶管理等。

[ACY Securities] Consumer panic is rising, and gold is going to start a big rally?

The financial market on Friday was a thunderous one. The dollar fell back to around 92.5 again. The prices of major commodities reversed abruptly and maintained the situation in early trading today. These fluctuations come from the University of Michigan consumer confidence index released in the United States last Friday. The index was at 70.2, well below the expected 81.2, and even below the level at the beginning of the epidemic, hitting a 10-year low. After the release of the data, the dollar fell and gold rose sharply, both breaking through key recent technical levels. At the same time, the Dow experienced a correction, and the Nasdaq rose instead, recovering the previous gain gap.

The University of Michigan Consumer Confidence Index has been an important economic statistic for measuring future consumption levels. Although the data contains subjective components of consumers, it is an important leading indicator because it can reflect the expectations of the final consumer. However , the decline in the data this time is not unusual. It more reflects the disappointment that the epidemic cannot be effectively controlled, and it is not enough to indicate that the economy will decline again. This is exactly the same as the data slump 10 years ago. In August 2011, which was also a period of economic recovery, the consumer confidence index hit the bottom for the second time under the influence of the withdrawal of quantitative easing. However, judging from the performance of the gold price at that time, as the economy was still recovering steadily, the dollar bottomed out and rebounded, driving the gold price to peak and fall. On the whole, although this index has given the gold price a strong upward impulse, it is still only a short-term influence, and this wave of rise has given up space for short-term operations.

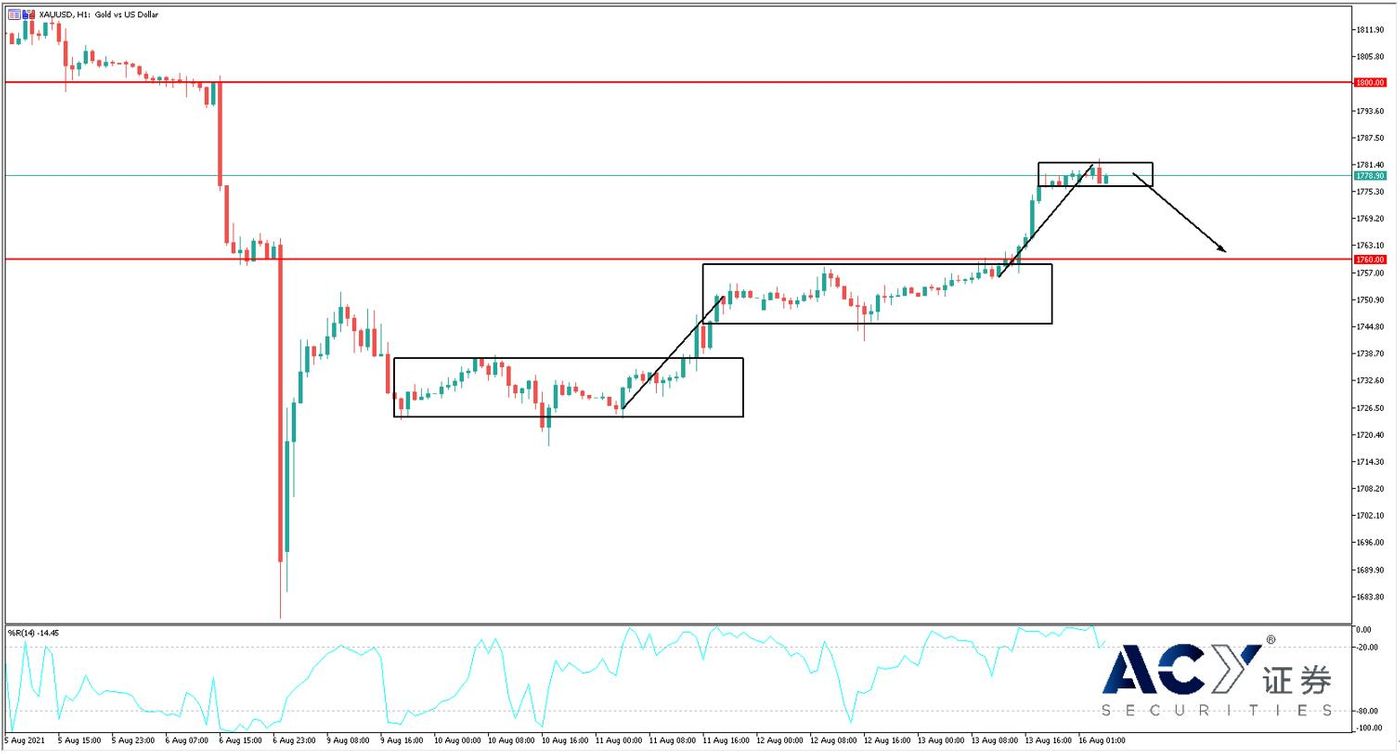

Judging from the golden hour chart, affected by the consumer confidence index, the price of gold quickly broke through the blockade of 1760, and stabilized at the 1780 mark, closing out the price quiet zone. From a morphological point of view, the K-line shows a continuous pattern of rising, leveling, and rising, and the increase in each round of news is around $25, indicating that the upper technical side still maintains stable pressure. In terms of indicators, the Williams indicator has touched the overbought line, but it has not broken down yet, and the bullish power may not be exhausted. On the whole, the trading strategy is mainly short-term and short-term rallies, and the short-term entry needs to wait for the end of the upward movement. It can cooperate with the K-line long entity to break through the current price quiet zone, and the short signal of the Williams indicator returning to the central area. The resistance above the current price is the strong integer resistance of 1800, while the support below depends on the band structure of 1760 and 1740.

In addition to gold, some base metals have also seen peaking signals recently. From the four-hour chart of nickel metal, as an important material for stainless steel, nickel prices have also skyrocketed in the past year. However, at the end of February and June this year, there were sharp corrections when it was close to the 20,000 mark. In the near future, it has also been suppressed by the high-point supply area, forming a high-level quiet zone, and there is strong head pressure on the technical side. Considering the domestic steel production limit and the possible transformation of electric vehicle batteries, the growth rate of global demand for nickel may have peaked. On the whole, the trading strategy is mainly based on short-term short-term short-term orders followed by breakthroughs. Once the K-line entity breaks through the 19500 mark, and the alligator line bites and starts to turn, it is a good time to enter the market. The upper resistance is in the supply area of the former high point of 19800, while the lower support depends on the trend line near the integer mark of 19000.

Focus on data today

20:30 US New York Fed Manufacturing Index

The content of this article is provided by third parties. ACY Securities does not make any representations or warranties for the accuracy and completeness of the content in this article; ACY Securities does not assume any responsibility for investment losses caused by third-party suggestions, forecasts or other information. The content of this article does not constitute any investment advice and is not related to personal investment objectives, financial situation or needs. If in any doubt, please seek independent professional financial or tax advice.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…