在紐約的金融業工程師,分享我的美股財報筆記 Blog: YC's Weekly Journal ( https://ycjhuo.gitlab.io/ )

A powerful tool for remittance between Taiwan and the United States, Citi Global Express (Remittance from the United States to Taiwan)

The stock market has been thriving recently. Since the middle of March last year, the market has been going up all the way, with no signs of slowing down at all. The S&P500 index, which represents the U.S. stock market, has risen 63.5% in about ten months from the lowest point of 2,304.92 (2020/03/20) to 3,768.25 last Monday (2021/01/18). This amazing rate of return has made many people eager to invest in the US stock market.

Now it is quite easy to open a securities account in the United States. You just need to find a brokerage you like and open an account directly online, and trading stocks are free of handling fees. But the only cost is how to remit money from Taiwan to the account of the US brokerage?

Based on my previous experience, Yongfeng's cross-border remittance fee is $600, and Mega is $840 (US dollar exchange rate is calculated at 30). And if you want to send money back to Taiwan from a US broker (Schwab), the fee is $25 (about $750), so the remittance fee is almost $1500.

For U.S. stock investors in Taiwan, or Taiwanese working in the United States, if there is a need to remit money back to Taiwan on a regular basis, it will be a huge burden. Is there any way to avoid this cross-border remittance fee?

Here we will introduce Citibank Global Transfers, which allows us to realize cross-border transfers between Taiwan and the United States at zero cost.

If you want to see how to remit money from Taiwan to the United States, you can refer to this article on remittance tools between Taiwan and the United States, Citi Global Express (Taiwan Remittance to the United States)

Global Transfers Account Opening

Global Money Transfer is a fee-free cross-border transfer service provided by Citibank to customers who have Citi accounts in Taiwan and the United States. Therefore, to use this service, you need to have accounts in Taiwan and the United States. Citibank in the United States does not support online account opening, so you must go to a branch to open an account in person.

Citi USA Account Selection

When opening a Citi account in the United States, there will be multiple levels to choose from. The higher the level, the more benefits you can enjoy, but the higher the monthly account management fee. U.S. bank accounts are charged monthly account management fees (but there are ways to waive them, and the higher the level of the account, the higher the waiver).

Here I recommend the Citi Basic Account Package, which is the first-level Citi account with a monthly account management fee of $25, but the account management fee can be waived as long as the account balance remains at $1500+ (or there is a salary transfer record every month, This is more difficult for people who do not work in the US)

When opening an account, Citi USA must provide a phone number and address. The system will detect whether the address belongs to a commercial area, etc., so it is uncertain whether the address of the hotel can be successfully passed.

Citi Taiwan Account Selection

In Taiwan, I choose Smart Survival. There is no account fee. If the account balance is > 50,000, 5 domestic cross-bank withdrawals will be provided free of charge.

When opening an account, remember to tell the staff that you want to open a foreign currency account together.

2021/01/18 Confirmed that Citi Taiwan can open an account online, but if you have a US tax status (that is, someone who has filled out W-9 instead of W-8BEN), you must go to a branch in person to open an account

US remittance to Taiwan settings

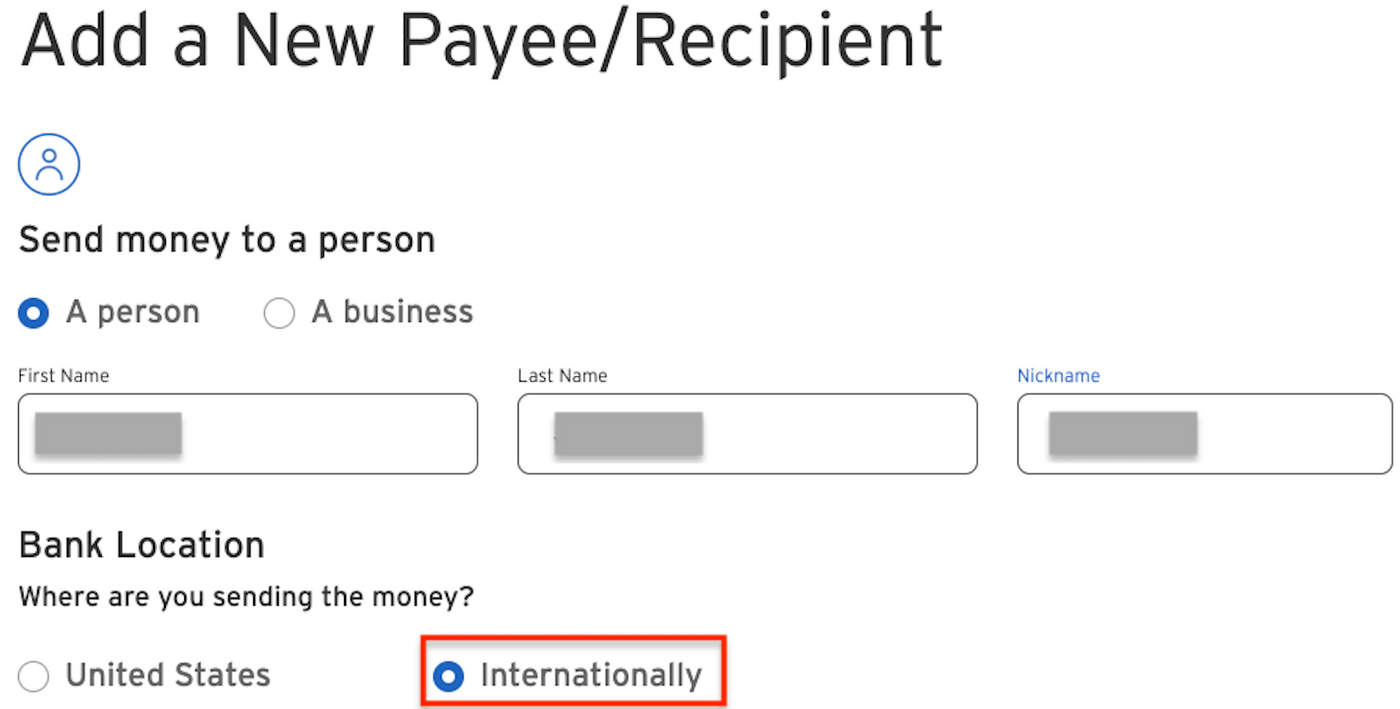

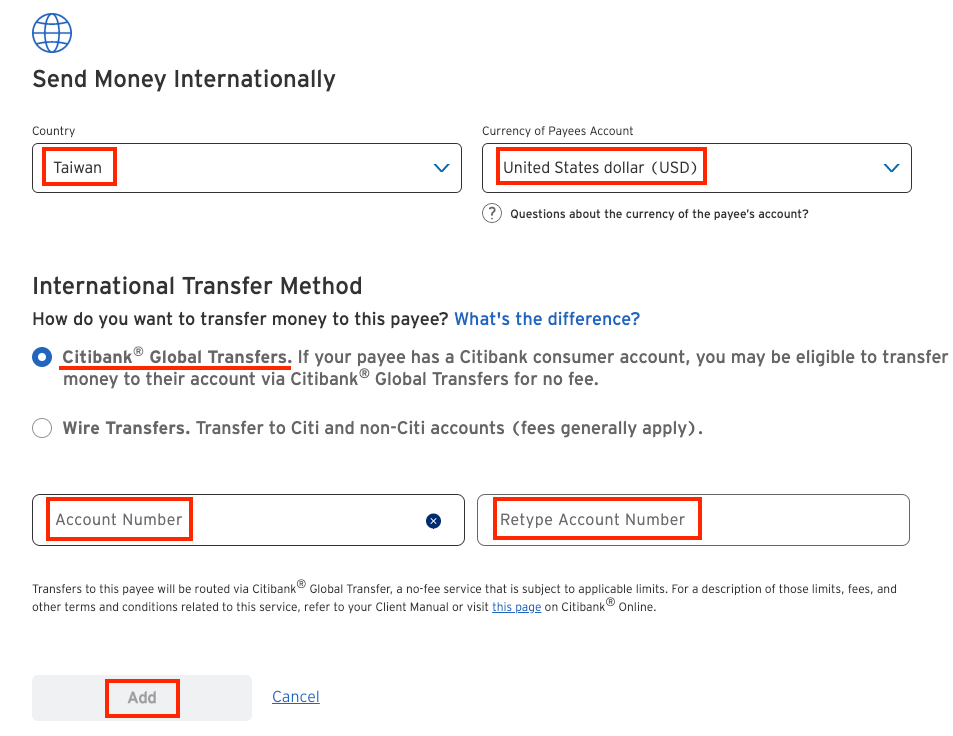

The US remittance to Taiwan can be directly operated through the online banking of Citi, to the Any External Account on the Payments & Transfer page. Then click on the PEOPLE tab of Manage Payees to start setting the payee information.

After setting, we can see the payee information just set in the Any External Account, Transfer to Others section of the Payments & Transfer page.

Send money from the United States to Taiwan

After setting up the Taiwan account information, you can send money.

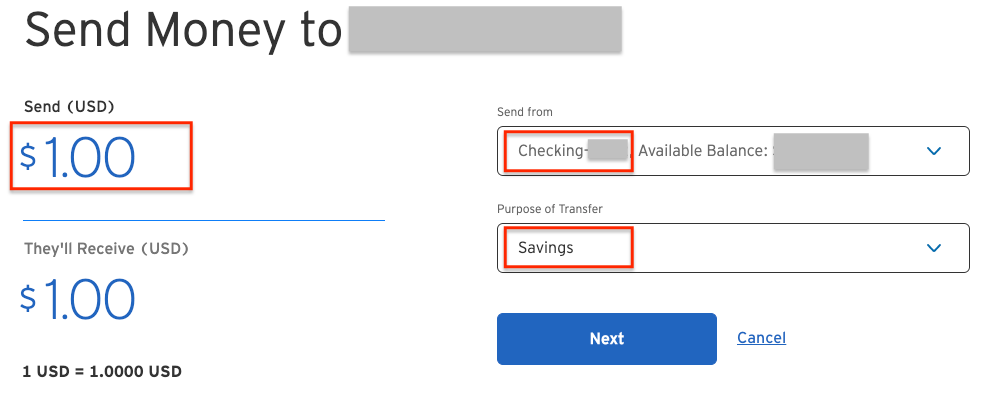

First enter the amount to be remitted, which account to remit from, and the purpose of remittance, then press Next to enter the page of remittance details.

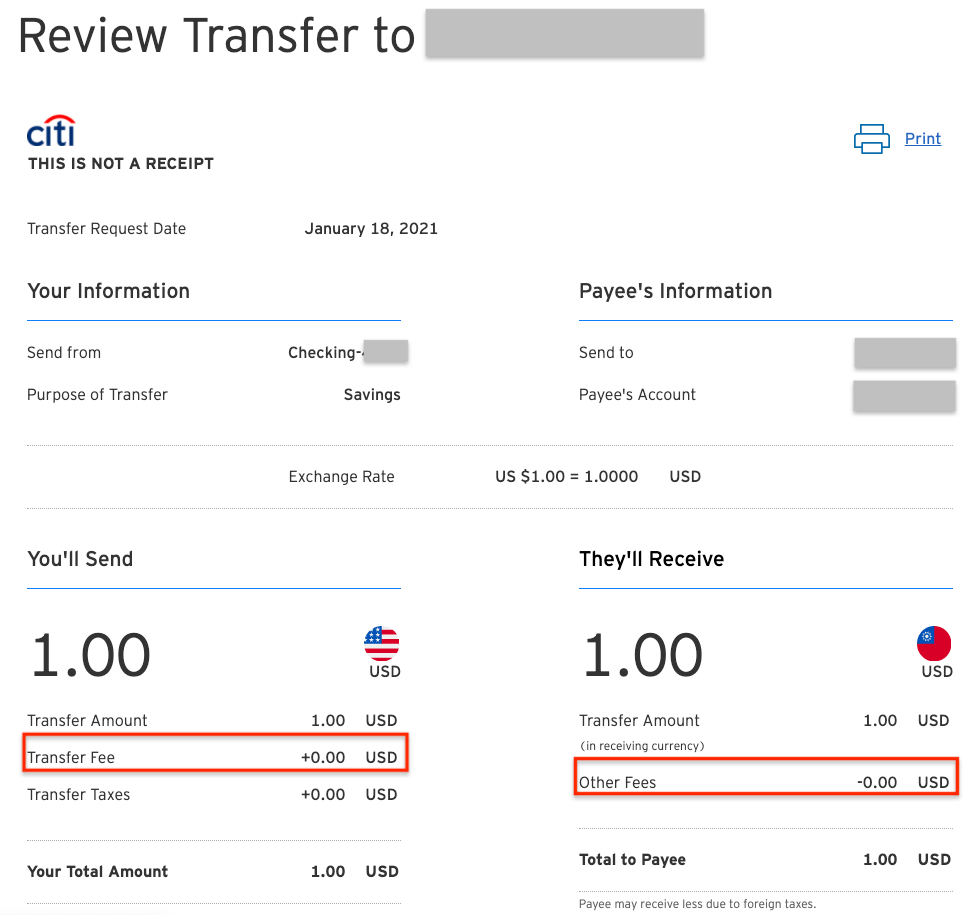

Go to the remittance details page. It can be seen that our remittance fee this time is $0. After confirming that there is no problem, press Send to complete our remittance this time.

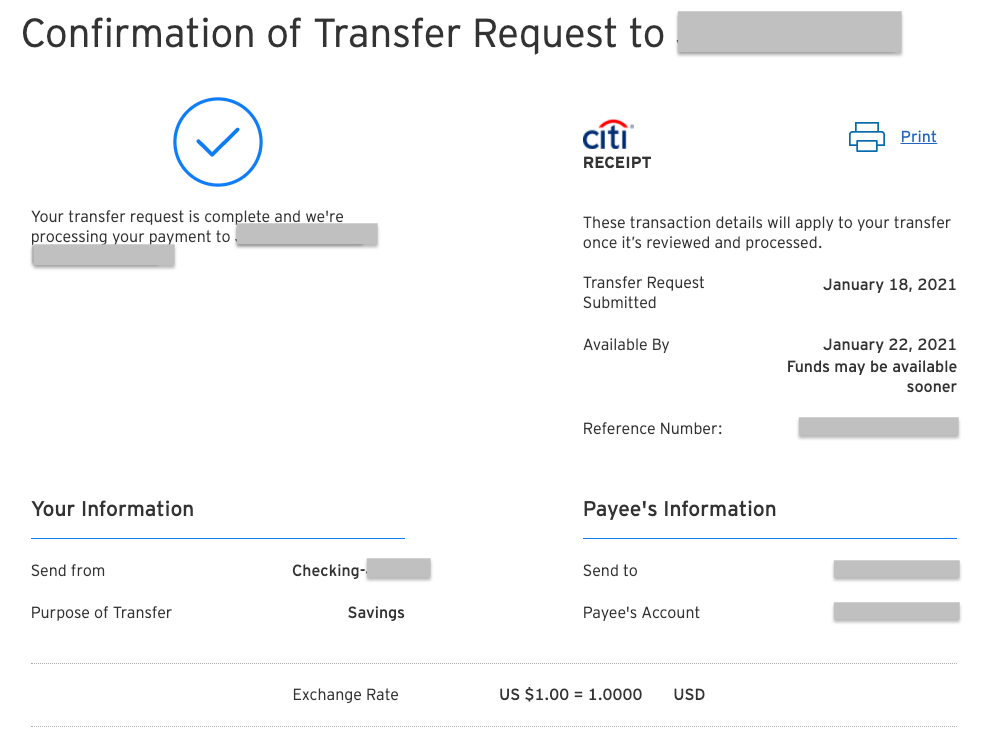

After completion, it will jump to the result page, you can see the information of our remittance and the payee, and the information that it will take about 4 days to arrive at the account.

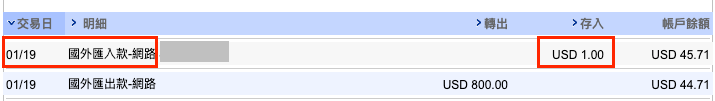

After the actual measurement, you can see the transaction in the transaction details of the foreign currency account in the Citi Taiwan account in less than 12 hours.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…