3C開箱,投資總經加密貨幣等主題都會寫,合作邀約:repoker070@gmail.com https://bit.ly/m/yuchen 若是你覺得寫得還不錯,也可以買杯咖啡給我 https://www.buymeacoffee.com/a3556959w

Deleveraging in progress

After the LUNA thunderstorm in May and the bear market torture for the next two months, with the collapse of Three Arrows Capital, which once symbolized the success of this round of bull market, the whole blockchain was shaken and felt panic, and everyone did not know Who will be the giants of thunderstorms in the future, and the sporadic package delivery situation is also uninterrupted. For example, the SLOPE wallet has a big incident in August after being spammed by my dog. After an APP update, the team secretly implanted it. The backdoor returned the user's private key to the server in a clear and unencrypted way, and the server information was unfortunately leaked, which led to the theft of a lot of user assets. The team claimed that it was also a victim, but I am Don't believe me, the server data leaked not long after the update, no matter what you think, it's all the work of an insider. In addition to this, another big news on SOLANA is that it was revealed that the SABER team played multiple roles in 11 projects on the SOLANA chain. Seeing what I wrote but pretending to be code written by another team and myself endorsed by another pseudonymous team of my own, they're SAFU), it's a joke.

Under the surface, in fact, deleveraging seems to be still in full swing, and it has not increased too much due to the temporary recovery of the market, which is actually good news.

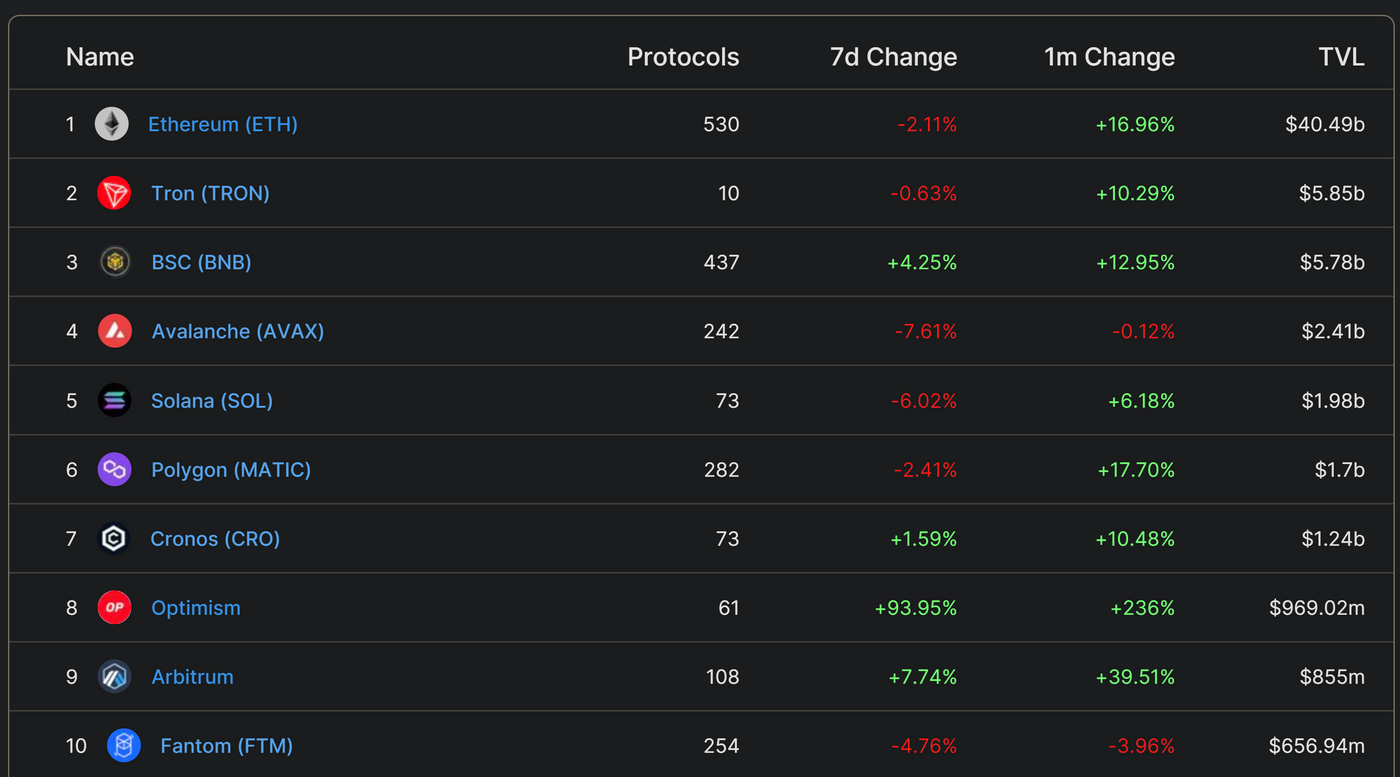

As can be seen from the above picture, the top ten chains have recovered in TVL in the last month, but the ratio is not very fast compared to their respective chain coins (except for the two chains of OP and AB, OP has just released Coin and AB follow another trend), so why is this? My personal judgment is that the stacking work of DEFI LEGO has temporarily stopped, and more is the stage of dismantling building blocks and deleveraging. In the period of rapid development of the bull market, the loan agreement can be said to be the first pioneer of irrigation. Through the revolving loan and fancy PUMP assets, under the double BUFF of currency creation and multiplier effect, TVL can be increased much faster than the currency price. The bubbles can be blown quite large. For details, please refer to the article VIRES, the largest lending platform on WAVES, to govern dictatorship!? - yuchen (@3auEcdYlzpN4vI) (matters.news) . However, there is also the risk of accelerating the collapse and the bubble bursting with it.

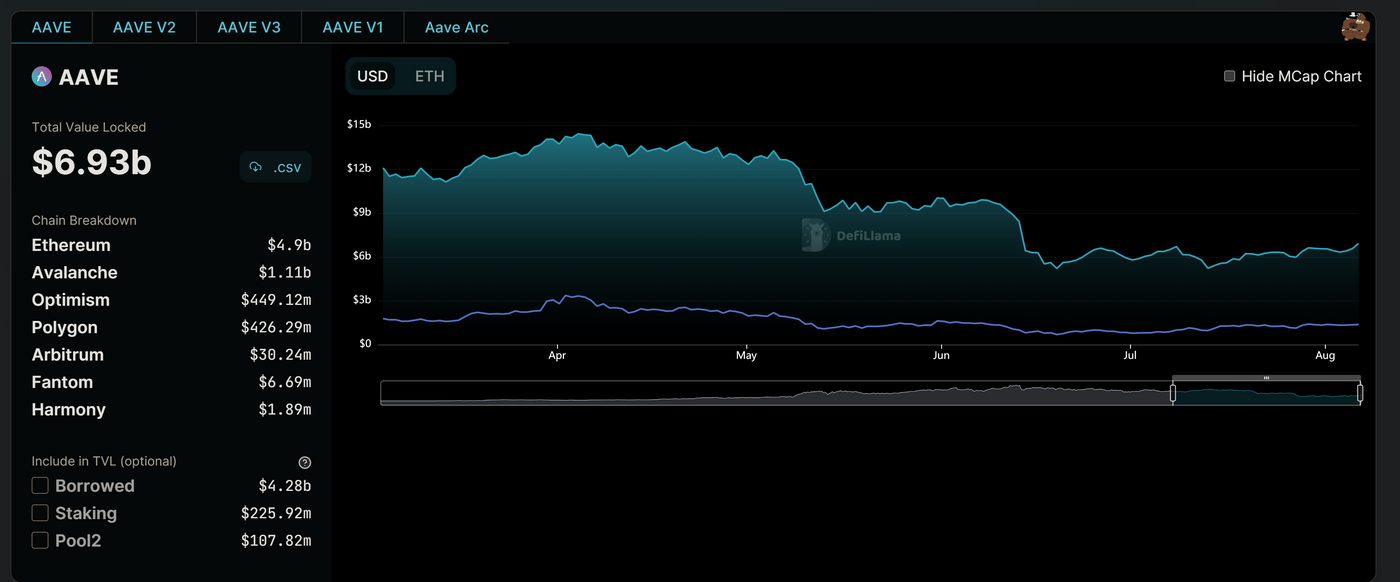

Looking back at the TVL trend of the leading lending leader AAVE at this time, we can see that after a large number of stampede and chain liquidations were triggered in May and June, even if the mainstream currencies rebounded in July and August, the recovery of TVL was quite small. Looking at the bears, many users who deposit BTC, ETH, and BNB choose to repay their money by actively reducing their leverage in order to avoid liquidation. And this is also the opposite of another thing. The reduction of leverage also symbolizes that it is more difficult to chain stepping on leverage by smashing the currency price and affecting a large number of liquidations. Data | Long-Short Ratio | Binance Futures (binance.com) )

Therefore, the overall environment should no longer be suitable for shorting. It is recommended that the air force be self-respecting and go to fry fries when they are beaten, but they will not be long for the time being, because interest rates are the gravitational force of all assets, and they are still in a cycle of interest rate hikes. At the time, the risk of choosing to go long is not low. Under low leverage, it will not quickly return to zero, but it does not mean that you will not lose money. I am currently focusing on french fries and delivery, accumulating capital and waiting for the dawn.

In addition to delivery, I will be a gangster on the Internet, and those who are interested can come in and chat https://t.me/wiwi995

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…