3C開箱,投資總經加密貨幣等主題都會寫,合作邀約:repoker070@gmail.com https://bit.ly/m/yuchen 若是你覺得寫得還不錯,也可以買杯咖啡給我 https://www.buymeacoffee.com/a3556959w

What I have learned in the past year of entering cryptocurrency (middle)

I've been seeing a doctor recently, and I've made a mess, and it's easy to get lazy in writing. This bad habit really needs to be changed.

This article follows the above: https://reurl.cc/Qjpnq0, if you haven't seen it, you can go to it first

Before I entered cryptocurrency, I had about four years of investment experience. In order to learn the operation of the capital market, I combined a double major in economics, learning theory and combining practice. I personally highly recommend this way to learn , the experiences of both sides can be compared with each other and help memory.

In the process of exploration, I gradually think of myself as a long-termist. I like to use my lousy elementary accounting to read the financial statements of listed companies, and use the indicators and models that have been rotten to buy what I think A good or undervalued company, because I believe that profit is the core of the company. Gordon's discounted cash model and simple yield calculation allow me to easily recognize that if I buy these at a low price For stock assets, basically in the long run, you don’t need to worry about losing money. Trading on the left side becomes an option that doesn’t require thinking. Only by buying from the left side can you easily earn the entire gain. At the same time, I also earn very good returns in the stock market, so I naturally rely on this method to continue investing.

The opportunity that made me willing to make up my mind to enter the cryptocurrency market is precisely related to this. As mentioned in an earlier article, I bought BTC in 2017, and when I was studying the theoretical basis behind it, I thought " "Decentralization" is a reasonable concept, I may not agree with it, but it may indeed change the world, so I invested in batches to buy BTC whose average price was already super high at that time, and quickly ran to 13K with BTC When the price point is above 15K, then the bear market of cryptocurrencies comes. Although the stock market fluctuates in the cycle of raising interest rates in 2018-19, the economic machine is running very well, and I still maintain a good rate of return, Except my BTC. And BTC is not a company, it cannot bring me profit, just like gold, it may not be of any use there. So at the end of 18 I sold it at a very poor price.

The time has come to the end of 2020. After I carefully studied CEFI and DEFI, I think this does provide value to users. If I think that stock exchanges provide users with a system and a pending order book, they will earn a lot of handling fees. is a valuable behavior. Then UNISWAP provides a UI interface for users to trade on AMM by themselves, which is also a valuable behavior. (It is hard to say how much the valuation price is, but it is indeed profitable.) On the other hand, AAVE in the lending market has the same logic. If the services provided by banks are valuable, then AAVE’s services are not castles in the air, but practical. able to serve users.

After thinking about it for a few days, I thought that even if I missed the DEFI craze in 2020, I would still be an early user if I joined in 2021, so I can still have a lot of cognitive dividends to eat. Looking back at the market in 2021, it is currently inferred. Fair enough.

The first lesson I learned:

After joining, there will be problems, how to buy, what to buy is a university question. If you don’t have an idea, just use the old method first, analyze the fundamentals first, and make a good PANCAKEBUNNY machine gun pool track. For every 1BNB you earn, 5BUNNY will be issued (the output ratio when I put in), which is a real money-making project.

1. After that, there may be a reduction in production. After all, there are precedents.

2. TVL is still growing, and there is no sign of slowing down.

You can't buy BUNNY with the price of 0.2BNB, because the track is growing very fast, 380U bought it!!!

Maybe some people thought the same at that time. After buying, BUNNY rose wildly, and the plan was passed.

Do you want to sell? Don’t sell! Only fools sell. Fundamental investors only cash out when they need money, let the profits run for a while, TVL has not decreased, and they have voted to reduce production to become 1BNB and 3BUNNY. , and swelled again, and assets rose every day.

In the end, a flash loan every two days taught me how to be a man in minutes.

Unplanned new things made me lose money, but I'm not particularly sad, I have position management, although it hurts to death, I can finally accept it,

The point is that I have learned: smart contracts have profit and loss, and there is a hole to get money directly.

Second lesson:

IRON is a project forked from FRAX. At that time, contracts were deployed in BSC and POLYGON, and the algorithm and partial mortgage were achieved through the mechanism. At that time, I was familiar with the white paper and mortgage algorithm. Such a fragrant mine, OK pull, don't There is nothing wrong with being run. From the data on the chain, there are not many whales coming in, and whales generally sell slowly (reducing slippage). System risk is not very big, rushed!

On the day of 6/17, the project party did not know whether it was bitten by an eel or what, and inexplicably cut off his limbs, and he did not sell it slowly, but directly sold it. After I stopped for a while, I thought it was all right, so I went to bed, but they continued to toss again. Later, the UNPEG was directly run and exploded. The IRON stablecoin was only 0.5U at one time, and the corpse was also eaten by the bricks, the abominable vulture. So the whole project exploded directly.

This shit project party did three shitty things behind the scenes

1. The project party’s Twitter directly steals the smell and users don’t read the white paper, so the run and stampede really deserves it (later deleted)

2. The actual mortgage rate of the national treasury is 1RON=0.748USDC. The first announcement will be followed, and it will be redeemed according to the proportion, so it is okay. After about six hours, the announcement was changed to 1:0.7. The group fryers thought that 0.48 was going to be eaten. A bunch of people panicked and sold them directly on QUICK. Later, the announcement was changed back to 0.74, but they have already received a bunch of IRON at a low price, and they are directly arbitrage.

2. Before the launch of IRON V2, I quickly called on Twitter to call on users to redeem IRON (1:0.748), several articles in a row. After the launch of IRONV2, the stablecoin contract address has not changed at all, and it can be redeemed at 1:1. The point is that the project party is secretly eating goods in QUICK.

The second thing I learned: Originally I hated regulators in the stock market, and overall they are very easy to be a player and referee, and they go up and down with the institutions they are trying to regulate. The same is true for the SEC and the FSC. But in the IRON incident, I saw that in the unregulated world line, most retail investors can only be reduced to fish and meat and be slaughtered by others. Fake news is flying all over the sky and no one can control it, everyone just prays not to RUG PULL and thank God.

The regulations restricting the competent authorities even if they release water should not be too exaggerated. The listed companies are definitely one-of-a-kind companies. Corporate governance and regulatory restrictions are much safer than the savage anonymous team.

Lesson Three:

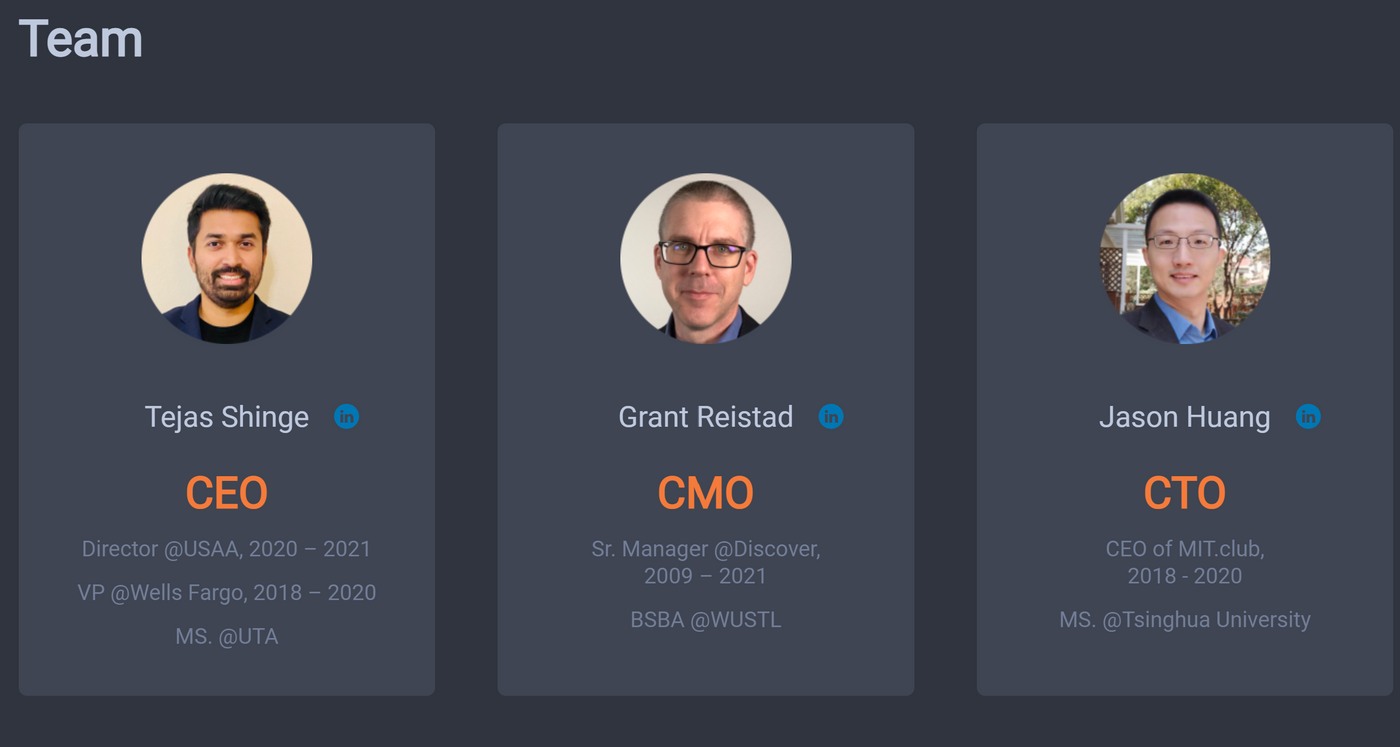

VEE is about to be deployed on an emerging AVAX public chain, luxury VC, slow fog audit, team real name, avalanche official platform, FORK carrying fat code

Everything seemed so stable and stable. One week after the launch, the oracle was dried up and 800M USD was stolen from the pool.

Up to now, the whole project is still lying on the ground and can't get up.

I have learned: CHAINLINK YYDS, the truth is expensive. Never feel stable, no RUG does not mean no accident, just refer to the authoritative organization

Of course there are other things like parrots that don't, and I learned a lot. You can't do anything about SOFT DAO. DAO has no company law, shareholders' meeting and board of directors' articles of association, and everything is not mandatory. Without RUG, you are an angel.

As a whole, in the cryptocurrency market, what can be quantified can only be used as a reference. The influence of the core team is placed infinitely, and what is qualitative is the core competitiveness. Don't you see FRAX being a duck to water recently, it can be said to be mixed It's not a little bit better than IRON, but the same mathematical model can run out of two emotions.

As a long-termist, in this impetuous market, it is relatively difficult to adjust, and stories of Dogecoin Shiba Inu's riches emerge one after another. But I still believe that under the test of time, many things will surface, such as AAVE and CURVE and other projects, and CHAINLINK has also been verified to cross the bull and bear, maybe when everyone is very impetuous, think, how Finding the next logic to cross the bull and bear will be a different experience than chasing the high and killing the low.

For example, I think GAME>FI in GAMEFI, fun is the core competitiveness of a game. If Maple Valley and World of Warcraft can be directly linked, no one can beat this wave of GAMEFI, and they will definitely lose their armor and discard their armor. .

What about the public chain? What about DEFI?

In the cryptocurrency market, for the time being, I will be cautious about trading on the left side and focus on the right side. After all, it is the norm to look away. I wish you all the best of luck next year. If there is another episode, I may have to sort out my investment direction for next year.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…